Cryptocurrency fund inflows hit $36 million last week

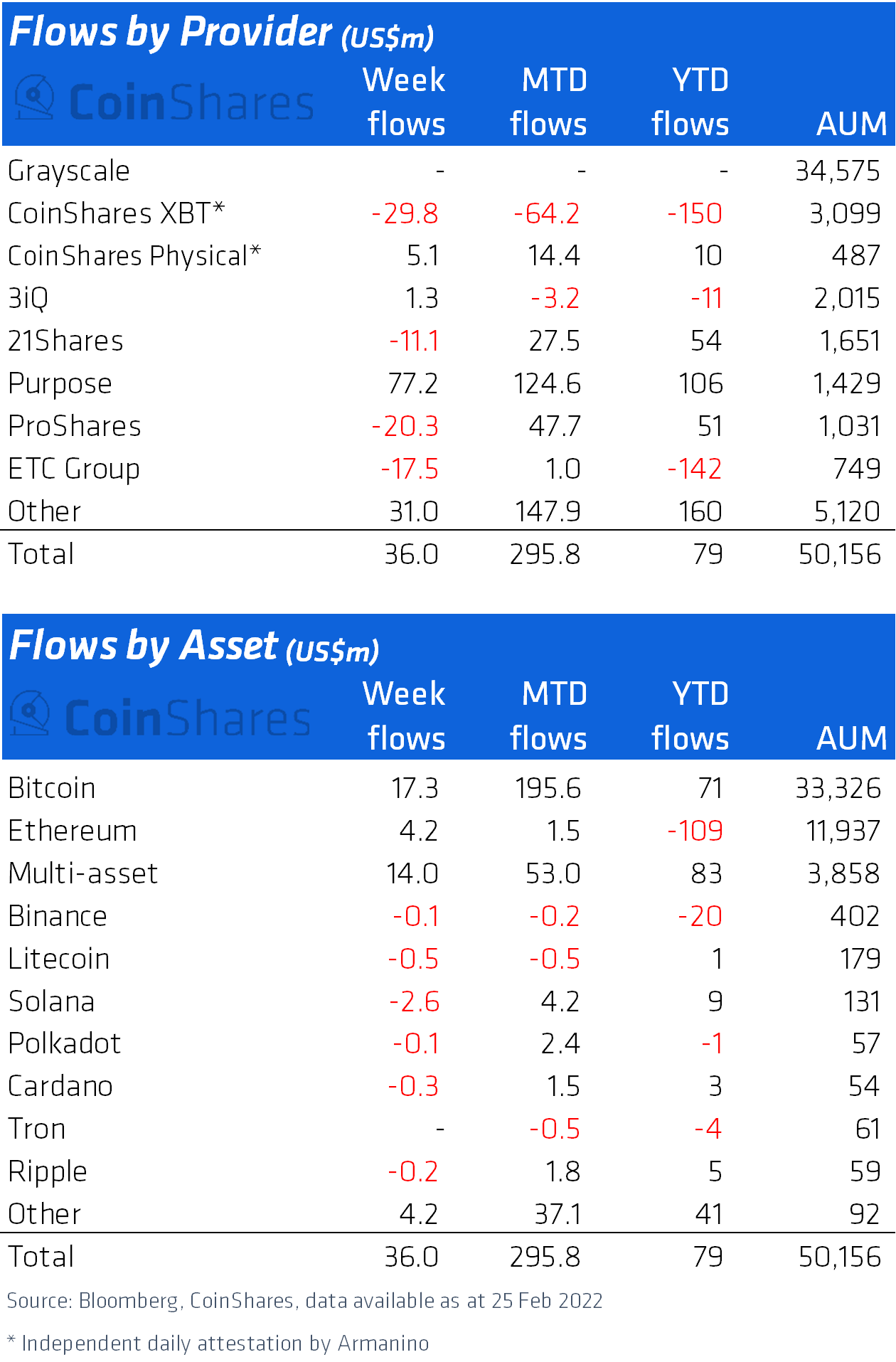

CoinShares’ weekly survey of cryptocurrency fund flows shows that total investment inflows into digital assets hit $36 million last week.

The asset manager writes that the renewed inflows suggest the recent headwinds for digital assets, such as the significant price weakness, were seen as buying opportunities for investors. However, crypto investment products remain in red on a YTD basis.

Interestingly, volumes in Bitcoin crypto exchanges that trade the RUB/USD pair have seen volumes rise by 121 percent week-on-week. Overall, the primary coin saw inflows of $17 million last week, entering its 5th consecutive week of inflows totalling $239 million.

Europe’s largest digital asset investment firm said Ethereum investment products saw minor inflows at $4.2 million. The second largest cryptocurrency in terms of market capitalisation witnessed the biggest blow so far in 2022, with YTD outflow of $109 million.

Ethereum’s market share has suffered in recent months due to Bitcoin’s dominance, and the recent combination of price drop and outflow has seen their AUM fall to $11.9 billion from a record $20 billion. As a result, Ethereum now represents 23.8 percent of the capital locked in crypto investment products.

Altcoin investments are down

Total assets under management (AuM) are now $50 billion, the lowest since early August 2021, which comes in line with the bearish trend in the broader cryptocurrency market. The figure is down by 41 percent from the $86 billion peak set back in November 2021.

Regionally, flows have been, one-sided, with the Americas seeing inflows of $95 million (notably Canada & Brazil) while European investment products saw outflows hit $59 million last week.

Breaking down the latest statistics, Coinshares said minor outflows were seen in most altcoins’ investment products. Solana and Litecoin were the worst performers with outflows of $2.6 million and $0.5 million respectively.

Tezos was the only altcoin investment product to see inflows, which totalled $4.4 million, representing 14 percent of assets under management.

Multi-asset products saw inflows of $14 million last week, with year-to-date inflows surpassing Bitcoin at $83 million. Blockchain equity funds also continued to attract new investments, having reported $8 million in inflows last week.

Digital asset investment products recorded a huge outflow of funds in the first month of the year as the broader cryptocurrency market performed poorly. Cryptocurrency funds and products had amassed inflows of $9.3 billion in 2021, significantly greater than the $6.8 billion seen in 2020, or up 36 percent year-over-year.