Cryptocurrency scams continue to spark concerns of Belgium’s FSMA

The Belgian financial regulator adds 28 names to its “black list” of fraudulent cryptocurrency entities.

Fraudulent cryptocurrency trading platforms continue to present problems for Belgian investors. In the face of previous warnings issued by the Financial Services and Markets Authority (FSMA), the regulator has kept receiving multiple complaints from investors about fraudulent offerings related to investing in cryptocurrencies.

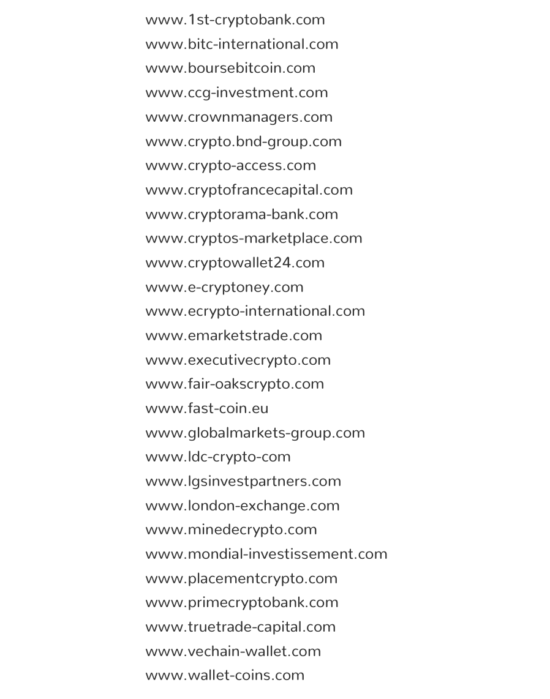

Today, the Belgian regulator has once again warned the public about the risks associated with such unregulated investments. FSMA has also updated its list of fraudulent cryptocurrency trading platforms, adding 28 names to the list.

You can view the latest additions below:

Let’s note that some of the fraudulent entities use tactics that have been adopted by binary options scammers. One of these tactics is to abuse the names of well-known and credible financial services companies. Perhaps you can notice the scam misusing the name of the London Stock Exchange.

FSMA started publishing its “black list” of cryptocurrency platforms in February this year. Back then, the regulator explained that all such entities use the same ruse: they claim to offer the best (or one of the best) trading platform(s), enabling both beginners and professionals to trade in cryptocurrencies in a matter of seconds and with full confidence. Also, some of these platforms offer other financial products with cryptocurrencies as their underlying: savings accounts with supposedly guaranteed returns, servicing rights or derivative products such as CFDs.

Less than a month after Belgium, France also started compiling such a “black list”. The variety of such scams has been significant. In June this year, for instance, France’s AMF published a warning about an individual presenting himself as Stéphane Delaplace who claims to be working at the AMF and to be investigating a trading platform operating via www.union-crypto.com/. The regulator noted that it has no employee called Stéphane Delaplace. Furthermore, the trading platform in question is not authorized to provide services to French residents. The AMF sent the information associated with this case to the public prosecutor’s office.