“With its unique combination of KYC-compliant identity verification, real-time fraud prevention solutions, and expert support, VideoIdent Flex is a powerful tool for the UK market.”

The mid-term plan will be to integrate DVS’s Guarantee Vault with D7, the digital post-trade platform of Deutsche Börse and its post-trade business Clearstream. This will allow D7 for the first time to expand its digital asset product portfolio to non-securities.

DeFi Lending Protocols Are Offering Stronger Guarantees To Attract More Cautious Investors

Read More →DeFi lending is attractive as it offers much higher interest rates than the average bank savings account, but investors should also be aware that using these protocols can be much riskier than depositing money into a traditional financial institution.

“StoneX Payments proudly services more than 80 bank customers across the US, EU, UK and APAC regions, including many of the world’s largest and systemically important banks, offering 140+ currencies across 180 countries.”

The US dollar continues its upward trajectory, buoyed by robust retail sales figures and shifting expectations around Federal Reserve rate cuts.

Quor customers’ will be able to accelerate their adoption while rapidly expanding into new automation opportunities within the platform.

“With its unique combination of KYC-compliant identity verification, real-time fraud prevention solutions, and expert support, VideoIdent Flex is a powerful tool for the UK market.”

The mid-term plan will be to integrate DVS’s Guarantee Vault with D7, the digital post-trade platform of Deutsche Börse and its post-trade business Clearstream. This will allow D7 for the first time to expand its digital asset product portfolio to non-securities.

To conceal their misappropriation, Nawabi created and issued false account statements that misrepresented trading returns the pool participants supposedly earned. When clients wanted their money back, Nawabi wouldn’t return them their funds.

Israeli-based, but London-stock market listed Plus500 Ltd (LON:PLUS) today reported a 4% increase in revenue for the first quarter of 2024, with figures rising from $207.9 million in Q1 2023 to $215.6 million.

“The Webull Desktop platform, which has been in demand since our launch earlier this year, ties this all together.”

“Their support is vital. 2023 was my first season with RoboMarkets, and among the highlights of the year were, of course, the victory at the Red Bull Ring, the additional podium finishes, and the pole positions. We were contenders for the title, and that’s a strong foundation for my second season in the RoboMarkets BMW M4 GT3.”

“StoneX Payments proudly services more than 80 bank customers across the US, EU, UK and APAC regions, including many of the world’s largest and systemically important banks, offering 140+ currencies across 180 countries.”

Trading software and liquidity services provider Finalto has gone live with its Over-the-counter Derivative Product (ODP) Liquidity Solution in South Africa in early 2023.

Trading software and liquidity services provider Finalto received two accolades at the iFX EXPO LATAM 2024 held in Mexico City earlier this month.

The US dollar continues its upward trajectory, buoyed by robust retail sales figures and shifting expectations around Federal Reserve rate cuts.

Quor customers’ will be able to accelerate their adoption while rapidly expanding into new automation opportunities within the platform.

The USD/JPY exchange rate has been steadily climbing towards the significant milestone of 155 yen per US dollar, a level not seen since 1990.

Advertisement

“Delivering this out-of-the-box integration aligns closely with our company purpose to unlock the power of finance for everyone and our mantra of ‘doing well by doing good’.”

Quor customers’ will be able to accelerate their adoption while rapidly expanding into new automation opportunities within the platform.

Transaction Network Services (TNS) has announced the launch of Complete Commerce – a full-stack, modern and secure payment and network capability.

Liquid Mercury, a leading crypto trading technology provider, announced today that it is providing a request for quote (RFQ) platform to GFO-X, the UK’s first regulated and centrally cleared trading venue dedicated to digital assets derivatives.

OSEAN DAO is advancing rapidly: With company registration on the horizon, the organization is preparing to acquire its first boat and has announced a 5 million $OSEAN commemorative airdrop scheduled for May.

The Cyprus Securities and Exchange Commission (CySEC) has extended the suspension of FTX.com’s CIF license, which allowed the insolvent platform to operate throughout Europe, until September 30, 2024.

As the Bitcoin community counts down to the upcoming Bitcoin halving, Mark Zalan, CEO of GoMining, shared exclusive insights into how the company is gearing up for this pivotal event in the cryptocurrency world.

Celebrating its 14th anniversary, Tools for Brokers (TFB), hosted a private networking event in Cyprus, gathering industry professionals to discuss future trends and innovations.

For access to the full interview and to explore more about Finalto’s contributions to the FX industry, you can visit the March 2024 edition of e-Forex magazine.

Advertisement

The retail FX industry has rapidly evolved in the last 15 years so it’s no wonder that systems purchased or developed over the last 10 to 15 years are no longer fit for purpose. Patching up tech stacks is not the answer. The way forward for brokers is to streamline their operations with SaaS-based, customisable, consolidated tech stacks.

The crypto industry, under regulatory scrutiny, seeks a tailored compliance strategy to address unique cybersecurity risks, emphasizing the need for innovative, sector-specific regulatory frameworks.

DeFi lending is attractive as it offers much higher interest rates than the average bank savings account, but investors should also be aware that using these protocols can be much riskier than depositing money into a traditional financial institution.

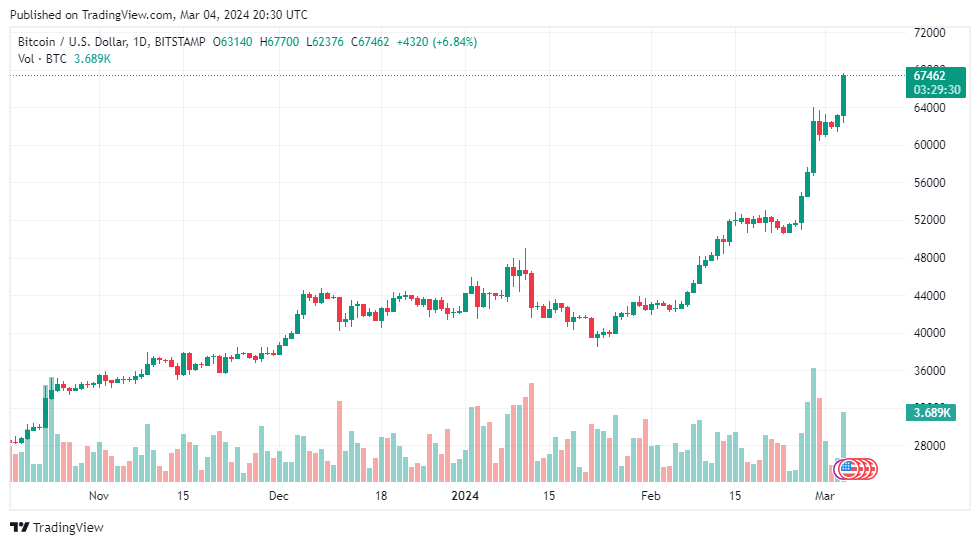

Bybit, recognized as one of the top three cryptocurrency exchanges globally in terms of trading volume, has recently published a comprehensive report highlighting the future supply constraints of Bitcoin.

Join NiceHash as it commemorates a decade of crypto innovation with its first Bitcoin-focused conference in Maribor, showcasing a journey of growth, resilience, and significant contributions to the cryptocurrency mining sector.

Mon Protocol and Pixelverse make history in the annals of Blockchain gaming as they set up the architecture for the melding of their technologies.

FBS, a leading global broker, introduces its revamped mobile trading application – the FBS app. The upgraded solution is available for Android and iOS users, providing them with all the tools and resources for online trading.

Step into the new phase of digital realms with Somnia’s L1 blockchain and omnichain protocols, designed to link various virtual experiences and improve content creation.

Embark on the Future: Binance App Surges with 6.3M Downloads in 2024’s Dawn, Redefining Crypto Accessibility. Dive into the World of Web3 with Binance’s Intuitive Interface and Join Over 183M Users in the Financial Revolution. Trust, Security, and Limitless Possibilities Await.

Permissionless Capital is calling for Web3 startups to join its Permissionless Opportunities Event. This initiative aims to equip eligible Web3 startups with the essential resources for evolving their ideas and launching their products in the market.

Discover how TON Society and HumanCode’s groundbreaking $5 million incentive program is revolutionizing digital identity verification through advanced palm scanning technology, fostering a safer, bot-free environment for the TON ecosystem.

OKX, the world’s second-largest cryptocurrency exchange by trading volume, has seen the departure of two of its top executives, Tim Byun and Wei Lan, according to a report from CoinDesk.

Binance.US has appointed Martin Grant, a former chief compliance and ethics officer at the Federal Reserve Bank of New York, to its board of directors.

“My new role marks a new milestone for me, and I am excited to be part of a rapidly growing company redefining investing and trading. GTN’s mission resonates with my passion for harnessing technology to empower fintechs and financial institutions to foster financial inclusion.”

FV Bank now lets clients deposit euros directly into USD accounts, streamlining international business banking and offering a wider range of deposit options for its global clientele.

PayRetailers Arg S.R.L.’s recognition as a PSP Aggregator by the Central Bank of the Argentine Republic enhances its payment services in Argentina, emphasizing efficient and secure solutions.

In recent years, the integration of cryptocurrency payments within the realm of Forex trading has surged dramatically. This transition signifies a profound shift in the financial landscape, offering a wide range of benefits for both brokers and traders alike.