cTrader gains IB functionality within trading platform: Could this challenge dominance of MT4 in China?

Spotware Systems, developer of the cTrader electronic trading platform, has today launched an integrated functionality for introducing brokers (IBs) within the platform itself. As onboarding clients via IBs has become a very cost-effective and streamlined method of bringing new clients onboard for among retail brokerages worldwide, it is interesting that Spotware Systems has taken this […]

Spotware Systems, developer of the cTrader electronic trading platform, has today launched an integrated functionality for introducing brokers (IBs) within the platform itself.

As onboarding clients via IBs has become a very cost-effective and streamlined method of bringing new clients onboard for among retail brokerages worldwide, it is interesting that Spotware Systems has taken this step.

Indeed, in regions such as China and South East Asia, the majority of retail brokerages in the Western hemisphere are reliant on networks of introducers and representatives rather than digital marketing and advertising media in order to maintain a client base. Equally interesting is that MetaTrader 4 has been dominant in China and the Far East for a number of years due to its compatibility with expert advisers (EAs) which are the prefered method of trading among retail traders in China, however for brokerages, it could be that cTrader’s new IB functionality may challenge MetaTrader 4’s dominance as brokerages could view this as a vital tool with which to attract and maintain vital IBs.

This feature is now available to all existing broker-clients for no additional charge and is available to all future brokers also for no charge.

In terms of functionality, the IB program can be configured from cBroker and used by IB’s from cTrader, and allows brokers to hand over additional responsibilities to their IBs and brings a new level of transparency to partnership programs.

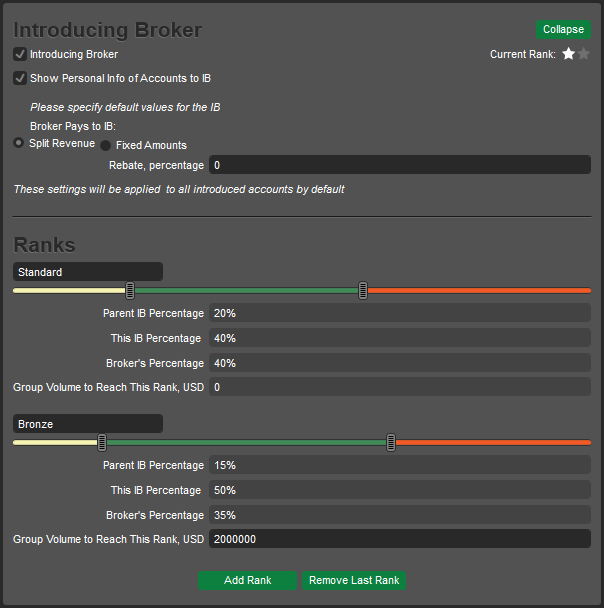

The application gives Brokers full control and a huge variety of configuration settings to craft the perfect plan for their IBs, plans can be adjusted on a per IB basis. It gives the option create fixed commission ranks, revenue sharing ranks or fixed value rewards. Ranks are associated with achievements.

cTrader now includes a built in application accessible only to IBs which allows them to manage their introduced clients. Any trader can submit a request to their broker to become an IB from within the cTrader platform. The cTrader IB Program supports unlimited levels of IBs, as a result if an IBs client becomes an IB, the parent IB continues to profit, there is no limit on how many Sub-IBs or introduced clients an IB can have.

Once a request to become an IB is approved access to the cTrader IB Center is available. Commission plans are clearly displayed, showing current traded volume and what volumes need to be achieved to access higher ranks and what commission plan the IB will apply for the following month, all of this information is conveniently displayed in the form of a progress bar.

cTrader displays IBs commissions to their accounts immediately and provides a detailed breakdown of earnings from each and every trade executed by their clients, all statements can be viewed within specific time periods and may be exported. Everything is displayed in real time.

“Now IBs will never be out of sync with their business, with real time calculation of their revenues, in depth reports displaying exactly where commissions originated and clear summaries of performance. Our IB Program brings a new level of transparency to partnerships programs, just like our platforms, manipulation is impossible and our end users are fully informed of all activity within their accounts.” James Glyde, Business Development Manager, Spotware Systems.

Depending on the brokers settings IB’s can be supplied with a huge range of tools to assist with the management and retention of their clients. IBs can give rebates and bonuses which can be converted, all converted bonuses and rebates are paid from the IB’s balance. Additionally IBs can view all of their clients and their balance, trading volume, when they last logged in, a history of their trades and depending on the brokers settings their contact details.

IBs can generate trackable links which are unique to their cTrader ID, to use on websites and in email campaigns. cTrader ID uses advanced attribution technology to track any Trader which has used an IBs referral link and applies that trader to the relevant IB of their brokerage when creating an account. These cookies do not expire.

“Now IBs have the best possible tools to increase their revenues and acquire new clients. The range of resources available to IBs within the IB Center helps them to retain clients and encourage higher trading volumes helping them to access more attractive rewards as they climb the revenue sharing structure their broker has tailored for them. Our cookies have no expiry date, meaning IBs will never miss an opportunity, even if a trader doesn’t convert for months. James Glyde, Business Development Manager, Spotware Systems.