CySEC’s Innovation Hub engages with 19 firms on various projects

Most projects concern regtech (regulatory and AML) compliance tools and distributed ledger technology (DLT), the Cypriot regulator explains.

More than a year after the Innovation Hub launched by the Cyprus Securities and Exchange Commission (CySEC) started accepting applications, the Cypriot regulator has published a report regarding the progress marked by the initiative.

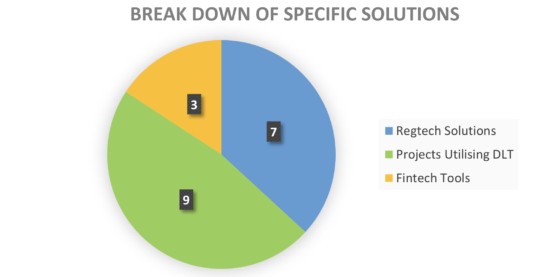

The Hub has engaged with 19 companies in relation to specific queries and/or products with a wide range of interests in innovation, ranging from regtech (regulatory and AML) compliance tools based on data analytics and big data reporting, and distributed ledger technology (DLT), to using artificial intelligence tools for both Fintech and Regtech purposes.

The Innovation Hub also engaged with more than 10 third parties, including Legal practitioners, Auditing Firms, University representatives, Credit Institutions and Associations, who were seeking to understand CySEC’s view on financial innovation.

The Innovation Hub engaged with seven Regtech Firms in relation to AML and/or regulatory compliance tools, six of which operate on the basis of data analytics and data reporting. One employed Artificial Intelligence. The compliance areas covered by those tools included client categorization and jurisdictional marketing restrictions, firm reporting, and best execution facilitating compliance with the Investment Services and Activities and Regulated Markets Law (the Cypriot law transposing MiFID II). Regtech tools serving AML compliance purposes were focused on tracking suspicious transactions and carrying out enhanced Client Due Diligence through innovative solutions.

The Innovation Hub engaged with nine entities involved in projects utilizing DLT. Six entities involved in tokenized projects for real estate-backed offerings of instruments utilizing DLT (including blockchain). Also, one company intends to operate an MTF platform for small and medium-sized enterprises operating in a DLT environment. Another company is specializing in developing trading platforms operating on a blockchain technology basis.

One investment fund (venture capital) intends to invest in blockchain technology start-ups, for which a meeting in person with documentary evidence of the investment project has been provided.