DanFX entities to be wound up following ASIC action

The Supreme Court of Queensland has found that winding up the companies and the Daniel Ali scheme is clearly appropriate.

An action that the Australian Securities & Investments Commission (ASIC) took against several fraudulent investment entities operated Daniel Farook Ali last year has resulted in a Court ruling to wind up the scam.

Today, ASIC announces that the Supreme Court of Queensland has ordered that three companies associated with Mr Daniel Farook Ali and the unregistered managed investment scheme known as “the Daniel Ali Scheme” be closed.

The companies in question are:

- DanFX Trade Pty Ltd (ACN 613 185 345);

- DanFX Investment Holdings Pty Ltd (ACN 614 172 842); and

- D & S Ali Properties Pty Ltd (ACN 614 851 937).

The Court has noted that winding up the companies and the Daniel Ali scheme is clearly appropriate.

Let’s recall that the action against the fraudulent entities started in November 2017. ASIC alleged that Mr Ali, through his corporate entities, operated an unregistered management investment scheme that had raised approximately $13 million from more than 200 investors.

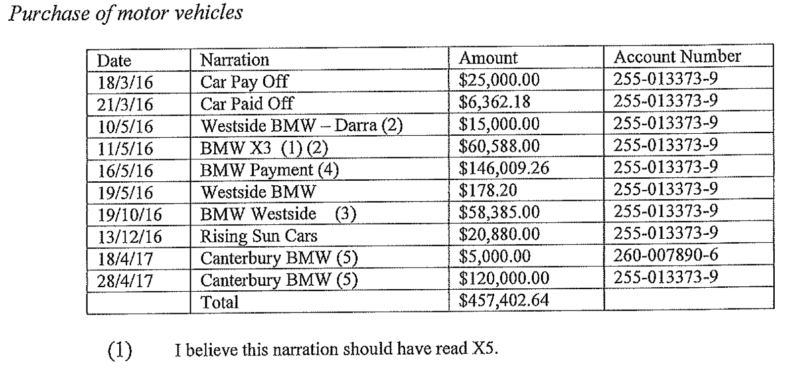

According to an affidavit of Mr Anthony Castley of William Buck Business Recovery, receiver of the Scheme and liquidator of the three entities, a total amount of $12.3 million is owed to investors. The defendant has spent a heavy sum on cars and personal items like gifts from Louis Vuitton, Gucci and Rolex.

Mr Castley’s interim report indicates there are insufficient funds to repay the investors.

The proceeding against Mr Ali in his personal capacity remains listed for a two-day hearing in the week commencing July 23, 2018.

ASIC has permanently banned Mr Ali from providing financial services or engaging in credit activity as a result of fraud charges brought by the Queensland Director of Public Prosecutions in 2012. Mr Ali was sentenced to two and half years’ imprisonment, to be suspended after the first six months in prison. This fraud conviction is unrelated to ASIC’s current proceedings and only came to ASIC’s attention after reports to ASIC about Mr Ali’s current investment scheme.

The charge stemmed from conduct that happened between June 19, 2008 and February 16, 2010, when Mr Ali misappropriated $30,000 provided to him to invest on behalf of eight investors. Instead of investing the funds, Mr Ali used them for his personal expenses.