DappRadar report: Blockchain gaming is a true survivor during crypto winter

Crypto Winter, aka a bear market, is no longer coming—it’s here. However, the wider blockchain gaming space remains resilient amid a growing interest in the so-called move-to-earn games and land sales for the metaverse.

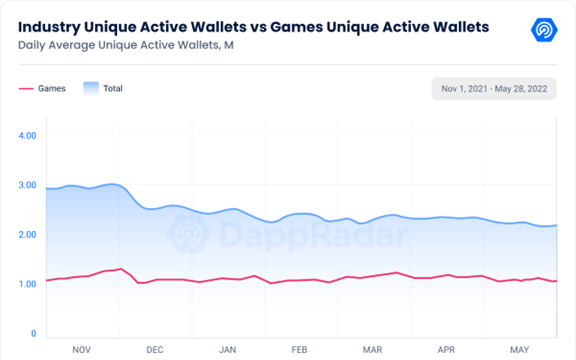

According to the latest BGA Blockchain Game Report from analytics site DappRadar, 1.15 million daily UAW interacted with blockchain games on average in May. However, the figure decreased 5 percent from the prior month.

Defying the crypto winter trend, blockchain games confirmed their status as the industry vertical that is better navigating the bear season. The report further notes that macro indicators for games signal a bullish scenario for the blockchain gaming ecosystem, as game dApps now account for an impressive 52 percent of the total dApp industry activity.

That was alongside the fresh $1.4 billion pumped into Web3 games and related metaverse infrastructure in May alone. The other noticeable investment was the $725 million raised by Dapper Labs to expand further the Flow ecosystem.

The crypto market cap has fallen below $1 trillion for the first time since 2020 — and in hindsight, a number of big names in the crypto industry have made painful layoffs. Similarly, the activity in the dapp industry fell to its lowest point since last September, registering 2.22 million daily Unique Active Wallets (UAW).

The play-to-earn gaming metaverse also continues to attract massive investments and both on-chain metrics and macro events signal a positive outlook for the blockchain gaming industry.

Per the DappRadar x BGA Blockchain Games Report for May 2022, Splinterlands maintains its position as the top blockchain game with 350,000 daily UAW in May while giving a big step towards decentralization.

The report states that Illuvium had generated $72 million from its first land sale, which shows the advantages of Layer2 solutions like Immutable. The game developers managed to sell out the game’s first land plots despite the unfavorable market conditions.

Gaming’s growth will weather crypto bear market

Another notable milestone was reserved for STEPN, which registered 2 million monthly users as the move-to-earn (M2E) paradigm keeps adding exercise enthusiasts. As its name suggests, M2E allows users to earn token rewards based on their physical activity.

In the same vein, Splinterlands was the most played blockchain game in the industry according to on-chain activity, having attracted 350,000 daily UAW, shrinking only 4% from April’s numbers.

What’s more, the report stated that Galaverse reveals major plans for the Gala ecosystem including GRIT, Project Saturn and major updates to TWD Empires and Mirandus.

Axie Infinity, once the most played blockchain game based on off-chain activity. is still feeling the ramifications of the Ronin’s bridge hack. Axie’s on-chain activity has shrunk -39% from April, but is still 55% higher than May 2021.

“Blockchain gaming is proving to be a true survivor during this bear market. We are on the cusp of finally seeing a good amount of blockchain games with truly immersive game mechanics that take entertainment to the next level. We will complete the transition from play-to-earn to play-and-earn,” the report concludes.

The Blockchain Games Report #5, put together in collaboration with the Blockchain Game Alliance (BGA), depicts the factors that are boosting the blockchain ecosystem, using metrics and data to create an understanding of the latest trends. The report sums up different market scenarios to provide a basic overview of the market with respect to DeFi, NFTs, gaming and everything in between.