David Bowie’s foresight in the world of investing should be allowed to live on

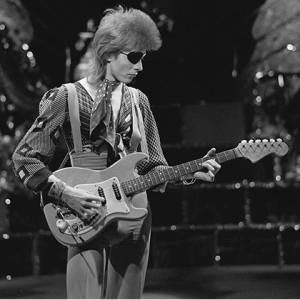

Today marked the passing of an icon, David Bowie, who departed from this world today at the age of 69 after a very private battle with cancer. A career which spanned over 40 years provided a worldwide audience with a continually modernizing style of music which began with his pioneering efforts in glam rock in […]

Today marked the passing of an icon, David Bowie, who departed from this world today at the age of 69 after a very private battle with cancer.

A career which spanned over 40 years provided a worldwide audience with a continually modernizing style of music which began with his pioneering efforts in glam rock in the early 1970s through to the ambient years of the 1990s.

It has often been said that David Bowie lived the future – his music being a clear reflection of that – and yet had no real regard to think too far ahead, feeling his way into the future of music the way that a blind man finds his way ahead by sensing it with the end of his fingertips.

This avantgarde means of keeping millions of fans entertained extended into his very innovative efforts in the world of finance.

Celebrity bonds were largely his creation, after investment banker David Pullman invested $55 million in the colloquially termed ‘Bowie Bond’ in 1997.

These celebrity bonds were commercial debt securities – effectively asset backed – which were issued by a holder of fame-based intellectual property rights to receive money in advance from investors on behalf of the bond issuer and their celebrity clients in exchange for the right to collect future royalty monies relating to the works covered in the intellectual property rights listed in the bond.

Genius it certainly was, and typically backed by music properties, caught the mood of the moment in post-80s Britain reflecting David Bowie’s inimitably intellectual songs which flew in the face of the post-instrial and anti-capitalist ‘grunge’ scene of the time as a polar opposite.

Unfortunately, in 2007, after the concept of the celebrity bond had been long since embraced by many other esteemed artists including James Brown, Ashford & Simpson and the Isley Brothers, as well as capturing the inaugural interest in the ‘digital age’ when iTunes and other legal online music sources led to an increased interest in celebrity bonds, the concept ceased to exist after the 10 year expiry date had passed, and the royalty rights of David Bowie’s pre-1997 works were handed back to him.

An attempt by Goldman Sachs in 2011 to revive the concept in the form of a SESAC (Society of European Stage Authors and Composers) bond was canned due to lack of interest.

Despite a good return, with the bonds paying an interest rate of 7.9% with an average lifespan of 10 years, Moody’s downgraded the rating of the bonds from A3 to Baa3 in 2004, placing them just one level above junk status.

FinanceFeeds spoke to multi-asset investment company Hargreaves Lansdown today in order to gain the company’s perspective on the viability of such products, and it was explained:

“When investing in a bond, you are making your decision based on income stream expected for the capital sum payable, taking into consideration your perception of risk.”

“Celebrity provides the comfort of widespread name awareness, however this doesn’t guarantee success and as with most celebrity endorsed products there could well be a premium paid somewhere along the line.”