This day in history: May 20, 2011: Saxo Bank provides TD Waterhouse with FX and CFD trading for UK market

In episode seven of this series on FinanceFeeds, we take a look back at “This day in history” within the world of FX. Every Friday morning, we take a journey through annuls of time to look at the various groundbreaking developments that continue to take place in our fascinating industry. Five years ago today, technology-led electronic trading company […]

In episode seven of this series on FinanceFeeds, we take a look back at “This day in history” within the world of FX. Every Friday morning, we take a journey through annuls of time to look at the various groundbreaking developments that continue to take place in our fascinating industry.

Five years ago today, technology-led electronic trading company Saxo Bank signed a deal with TD Waterhouse, which is the brand used for a Canadian brokerage within Toronto-Dominion Bank, and which was also formerly used for TD’s American and British brokerages.

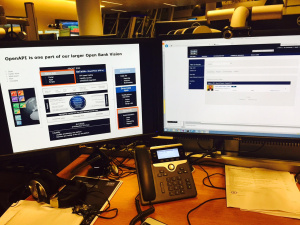

Back in 2011, white label partnerships provided by non-bank electronic trading firms that develop their own proprietary technology were relatively rare, however Saxo Bank had long since been an expert in such integrations of its trading environment within large institutions, a facet of the company’s business which has evolved further over the last year with the introduction of the Open API based SaxoTraderGo device neutral solution.

Nowadays, Saxo Bank white label partners can access the code and develop their own integrated trading applications for multiple puposes.

Meeting with Saxo Bank Senior Director and Head of OpenAPI Benny Boye Johansen at the company’s head office in Hellerup, Denmark in December last year, FinanceFeeds took a close look at the ethos behind its development, drawing on 24 years of Saxo Bank’s fintech prowess.

“A good way of explaining the main idea behind the OpenAPI solution is perhaps to view Saxo Bank as an engine in the middle of the trading environment” said Mr. Johansen. “You probably know that we are connected to a lot of exchanges, liquidity providers and we package our solution so that it can be used very flexibly to suit the purpose of various end clients and institutions which operate differently to each other such as white label partners, banks, fund managers and specialist trading firms” said Mr. Johansen.

“And so, we have always had an open infrastructure. For many years we offered liquidity through a FIX API, we have used our Trade Event Notification Service (TENS) for execution drop copy and essentially keeping our system in sync with those of our close collaborators, we have more than 300 “End of Day files” for reporting and reconciliation, and we provide a variety of administrative tools and web services to allow shallow or deep integration with our partner companies” – Benny Boye Johansen, Senior Director & Head of OpenAPI, Saxo Bank

“What is new with OpenAPI is that it allows a third party client, client company or application developer to not only integrate into our infrastructure, but to essentially completely rewrite the front end trading application. So if you take a step back, I would say that OpenAPI is a complement, and additional piece in the puzzle in the ways you may work with Saxo Bank” concluded Mr. Johansen.

On the face of it, five years is a veritable lifetime in this fast moving industry, however by 2011, Saxo Bank had amassed several years in the development and integration of its solutions into those of institutions in the form of white label partnerships, therefore taking FX and CFD trading to TD Waterhouse was an interesting move in that Toronto Dominion Bank is a banking institution yet it took its feed from Saxo Bank, which is a fintech company and electronic trading provider.

The movement toward electronic platforms and the ecosystem behind them was very much on Toronto Dominion Bank’s agenda in 2011, as just before onboarding Saxo Bank’s white label solution, TD Ameritrade had bought North American trading platform company thinkorswim which was founded by Tom Sosnoff in 1999.

ThinkorSwim provides services including thinkDesktop, webBasedTrading, thinkAnywhere, thinkMobile, thinkMicro, and paperMoney, and the ActiveTrader component of such products to provide access to exchanges in Chicago, including the Chicago Board Options Exchange (CBOE).

The solution offered by the TD Waterhouse and Saxo Bank white label partnership was a direct market access solution which was connected to the TD Derivatives Web Trader platform as well as the TD Derivatives Professional platform, with commissions on CFD equity trades starting from 0.15% (minimum £15) on all markets. The account also included Futures, enabling customers to trade over 450 instruments on live market prices from over 15 exchanges around the world.

Featured Image: Saxo Bank, Hellerup, Denmark, Copyright FinanceFeeds