DeFi vs Crypto: Different adoption patterns show different motivations

Emerging markets are driving cryptocurrency adoption out of necessity while DeFi adoption is powered by experienced cryptocurrency traders and investors looking for new sources of alpha in innovative new platforms.

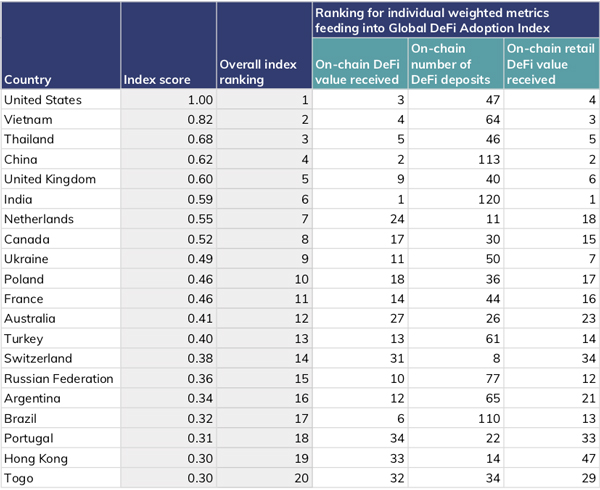

Chainalysis has released its DeFi Adoption Index. The first thing that stands out is that, unlike with the Crypto Adoption Index, many of the countries ranking highest are those with high raw volumes of cryptocurrency value moved, both currently and historically.

DeFi adoption is being led by United States, China, Vietnam, the UK, and several other Western European countries.

“These tend to be middle to high-income countries or countries with already-developed cryptocurrency markets, and in particular strong professional and institutional markets”, said the report.

DeFi stands for “decentralized finance” and refers to a class of decentralized cryptocurrency platforms that can run autonomously without the support of a central company, group, or person.

It is probably the biggest phenomenon within the crypto space at the moment and adoption is only likely to increase, with decentralized exchanges and lending platforms getting much attention.

While DeFi’s safety and compliance obligations raise concerns, its adoption cannot be ignored. The DeFi Adoption Index by Chainanalysis is designed to highlight countries with the highest grassroots adoption by individuals, rather than those sending the largest raw values of funds.

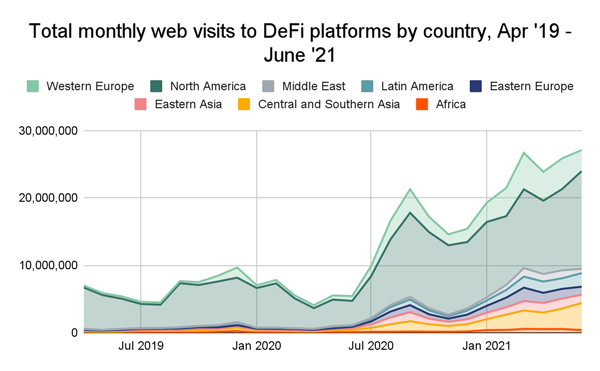

“The data suggests that while grassroots cryptocurrency adoption generally is highest in emerging markets, DeFi adoption is strongest in high-income countries that already had substantial cryptocurrency usage, especially amongst traders and institutional investors”, the report states.

The index measures on-chain cryptocurrency value received by DeFi platforms weighted by PPP per capita with the total retail value received by DeFi platforms, and individual deposits to DeFi platforms.

The index measures on-chain cryptocurrency value received by DeFi platforms weighted by PPP per capita with the total retail value received by DeFi platforms, and individual deposits to DeFi platforms.

“This year, we removed the individual deposits metric from our overall cryptocurrency adoption index because it artificially favors DeFi transactions over those carried out on centralized exchanges, since DeFi protocols’ non-custodial nature means all DeFi transactions are captured on-chain, whereas trades within a centralized exchange are only captured on exchange order books”, the firm explained.

“However, that’s not a concern in this case where we’re only measuring DeFi transactions, which means we can measure individual transactions to get an idea of the number of users interacting with DeFi protocols.”

Data shows that large transactions make up a much bigger share of DeFi activity, suggesting that DeFi is disproportionately popular for bigger investors compared to cryptocurrency as a whole. The majority of DeFi transactions in Q2 2021 were valued above $10 million.

Comparing the DeFi Adoption Index with the recently released Crypto Adoption Index, it is noticeable the difference in motivation.

Emerging markets are driving cryptocurrency adoption out of necessity while DeFi adoption is powered by experienced cryptocurrency traders and investors looking for new sources of alpha in innovative new platforms.

How to introduce Crypto to retail investors: Devexperts announces free webinar for Brokers