Deutsche Bank’s net income drops 67% Y/Y in Q1 2020

Deutsche Bank’s net income was ahead of market expectations but was down from the year-ago quarter.

Deutsche Bank AG (ETR:DBK) today posted its financial results for the first quarter of 2020, with net income ahead of market expectations as the bank has advised, but still markedly down from a year earlier.

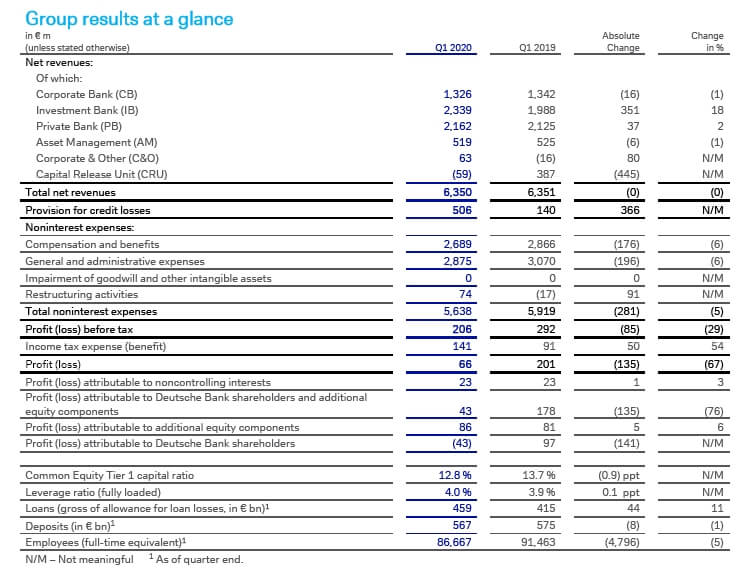

Net income for the first quarter of 2020 was EUR 66 million, down 67% from the result recorded in the same period a year earlier. The loss attributable to Deutsche Bank shareholders was EUR 43 million. Group profit before tax was EUR 206 million, despite bank levies of EUR 503 million and pre-tax transformation-related effects of EUR 172 million. These effects comprised transformation charges of EUR 84 million and restructuring and severance of EUR 88 million.

Group revenues were EUR 6.4 billion in the first quarter of 2020, flat year-on-year, despite the bank’s exit from equities trading in July 2019. Revenues in the Core Bank were 6.4 billion euros, up 7% year-on-year both on a reported basis and excluding specific items, reflecting delivery on the bank’s transformation strategy.

The bank continued its strategic transformation as planned. Revenue and expense performance in the Core Bank reflected continued momentum and execution of strategic priorities. Of the total transformation-related effects anticipated between 2019 and 2022, 73% have now been recognised. The number of employees on a Full Time Equivalent (FTE) basis declined by 930 to 86,667 at the end of the quarter.

Provision for credit losses was EUR 506 million, or 44 basis points of loans, and included approximately EUR 260 million related to COVID-19. Provision for credit losses taken in the quarter increased allowance for loan losses to EUR 4.3 billion, equivalent to 95 basis points of total loans. The full-year 2020 outlook is for provision of credit losses of 35-45 basis points of loans.

The Core Bank, which excludes the Capital Release Unit, reported adjusted profit before tax of EUR 1.1 billion, up 32%, driven by 7% growth in revenues ex-specific items and a 4% reduction in adjusted costs ex-transformation charges.

The Capital Release Unit recognised a pre-tax loss of EUR 767 million which was in line with internal expectations. Leverage exposure was reduced by EUR 9 billion to EUR 118 billion in the quarter, while risk weighted assets were down EUR 2 billion to EUR 44 billion.

The CET1 capital ratio was 12.8% at quarter-end, compared to 13.6% at the end of 2019, and approximately 240 basis points above regulatory requirements.

Liquidity reserves remained strong at EUR 205 billion at the end of the quarter, down by 8% from EUR 222 billion. This development largely reflected drawdowns on committed facilities as the bank supported demand from clients. However, the Liquidity Coverage Ratio, at 133%, remains EUR 43 billion or 33%, above regulatory requirements.

Provision for credit losses was 44 basis points of loans, reflecting conservative underwriting standards, strong risk management and a low-risk, well-diversified loan portfolio but higher year on year driven by the aforementioned impact of COVID-19.

Deutsche Bank reaffirmed its 2020 target of EUR 19.5 billion in adjusted costs ex-transformation charges and reimbursable expenses associated with the BNP Paribas transfer. A reduction in compensation and benefits expenses was driven by workforce reductions, while reduced IT expenses reflected lower software amortisation. Bank levies in the quarter declined 17% versus the prior year period.