Digital assets at center of enquiries handled by FINMA’s FinTech Desk in 2017

Blockchain, cryptocurrencies and ICOs accounted for the bulk of enquiries handled by the Swiss regulator FinTech Desk in 2017.

Various blockchain applications were the topics of the majority of enquiries received by the Fintech Desk of the Swiss Financial Market Supervisory Authority (FINMA) last year.

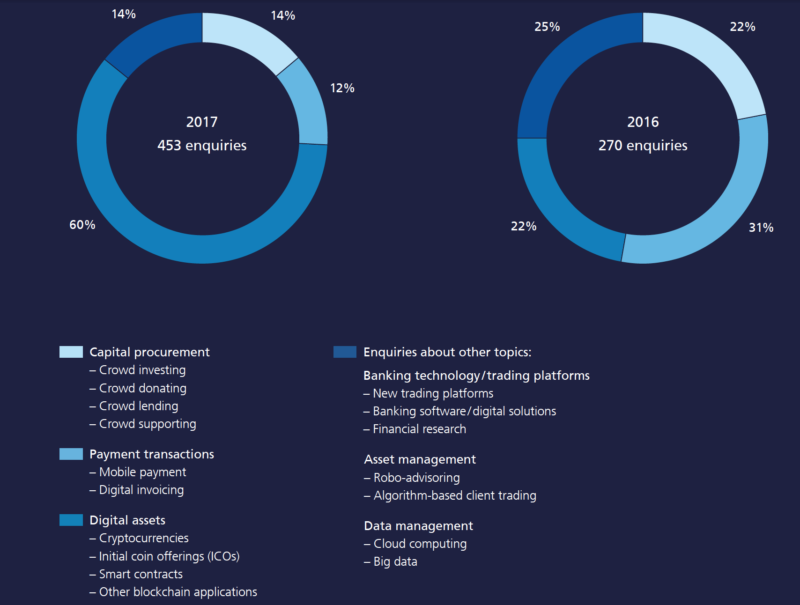

The Annual Report for 2017 published earlier today by the regulator shows that FINMA’s FinTech Desk handled 453 enquiries last year, a pronounced increase from the 270 enquiries received in 2016. Most queries in 2017 were about blockchain, cryptocurrencies, initial coin offerings (ICOs) – topics which are also central to FINMA’s supervisory work. The digital asset enquiries accounted for 60% of the total in 2017.

FINMA has noted major growth in initial coin offerings (ICOs) conducted or offered in Switzerland since mid-2017. Although the regulator acknowledges the innovative potential of blockchain technologies, it also points out its inherent risks, especially for investors. Some parts of the ICO procedure may already be covered by supervisory law depending on the structure.

For that matter, in September last year, FINMA said it had initiated investigations of several ICOs to examine possible breaches of supervisory law. In specific instances, FINMA closed down providers of fake cryptocurrencies.

Thus, FINMA has taken action against providers of the fake cryptocurrency “E-Coins”. The unauthorised providers had accepted several million Swiss francs in public deposits without holding the required banking licence. FINMA has also launched bankruptcy proceedings against the legal entities involved.

According to the regulatory findings, at least since 2016, the QUID PRO QUO Association has been issuing E-Coins, a crypto currency developed by the association itself. In collaboration with DIGITAL TRADING AG and Marcelco Group AG, the association provided interested parties with access to an online platform on which E-Coins could be traded and transferred. These three entities accepted funds amounting to at least four million Swiss francs from several hundred users and operated virtual accounts for them in both legal tender and E-Coins.

FINMA notes that these activities are similar to the deposit-taking business of a bank and are illegal unless the company in question holds the necessary licence.

In its annual report for 2017, the Swiss regulator notes that digitalisation and the scarcity of investment opportunities are prompting market participants to submit various preliminary enquiries or applications for innovative business models and products, either for a statement of opinion or approval/authorisation – for example, to approve or authorise a fund investing in virtual currencies as an asset class. These developments are giving rise to new challenges for all parties involved. In 2018, FINMA will continue the dialogue with industry players to clarify upcoming fundamental issues.