DOJ determines restitution to be sought from individuals involved in Yukom binary options fraud

The US Government has determined the sums to be paid by five former Yukom employees – Lissa Mel, Shira Uzan, Yair Hadar, Leoria Welles, and Austin Smith.

The criminal proceedings targeting individuals involved in the fraudulent binary options scheme around Israeli-based Yukom Communications continue at the Maryland District Court.

The main criminal case targets Lee Elbaz, the former CEO of Yukom, who was found guilty on all four counts in August and faces sentence of life imprisonment. There are also a set of other criminal cases targeting employees of Yukom, who reported to Elbaz.

On September 12, 2019, the US Department of Justice (DOJ) filed a document with the Court proposing a restitution framework in these criminal proceedings.

The US government believes that the binary options scheme perpetrated by Lee Elbaz and her co-conspirators caused losses of more than $100 million to tens of thousands of victims across the United States and the rest of the world. For instance, an attachment to an internal Yukom email that went to Elbaz and other co-conspirators, showed a collective $110,303,678 in net deposits, including $37,264,521 net deposits from investors in the United States, and 86,674 “FTDs” or first-time deposits for BinaryBook and BigOption as of May 2016.

The government plans to offer evidence at sentencing that the actual “net deposits” made by victims of the scheme surpassed $140 million. These net deposit figures represent the actual losses to individual investors – the money they sent to Yukom and its affiliates, minus any money they were able to withdraw from the scheme.

The government explains that it keeps identifying as many of these victims as possible and quantifying their respective losses for purposes of restitution. Given the number of victims and the complexity of the scheme, including many victims who had multiple account numbers, this is a time-consuming process that is still ongoing.

The government has been providing notice of updates in the case to victims of the scheme through alternative notification procedures – namely, through a Department of Justice website – because it believes that there are a large number of potential crime victims in this case, making it impracticable to notify them on an individualized basis.

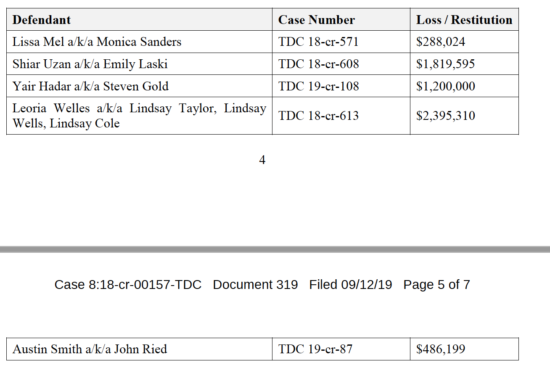

There are five former Yukom employees who have recently pleaded guilty to defrauding investors. The five additional defendants are Lissa Mel, Shira Uzan, Yair Hadar, Leoria Welles, and Austin Smith. As part of their plea agreements, the government has agreed with each of these five additional defendants as to a loss figure, reflecting the actual loss attributable to each defendant from his or her role in the scheme. The government believes that for Elbaz’s co-conspirators who largely reported to her and who have pleaded guilty, it is appropriate for the Court to cap their liability for restitution to correspond with the loss that the parties have agreed was caused by each defendant.

The proposed restitution for each defendant is:

- Lissa Mel a/k/a Monica Sanders – $288,024;

- Shira Uzan a/k/a Emily Laski – $1,819,595;

- Yair Hadar a/k/a Steven Gold – $1,200,000;

- Leoria Welles a/k/a Lindsay Taylor, Lindsay Wells, Lindsay Cole – $2,395,310;

- Austin Smith a/k/a John Ried – $486,199.

In contrast, the government submits that Elbaz, who managed and oversaw the entire scheme, should be held liable for the entire restitution amount.

The Government requests that the Court enter an order allowing the government additional time to identify victims for purposes of restitution, and to prepare a final schedule and restitution amount for the Court. The government suggests a date of November 7, 2019 to submit a restitution schedule.