DOJ to hold binary options fraudster Lee Elbaz liable for $140.3m in losses

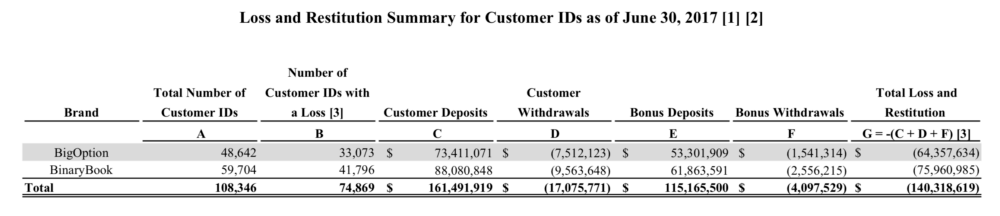

The Department of Justice has estimated the total victim losses and restitution owed in the case concerning the binary options fraud stemming from Yukom’s operations amount to $140,318,619.

Binary options fraudster Lee Elbaz, the former CEO of Israel-based Yukom Communications who was found guilty on four counts in August, now awaits her sentencing.

In the meantime, as the Department of Justice prepares its sentencing memorandum in this case, it has filed documents related to restitution. As per the documents, submitted at the Maryland District Court on November 7, 2019, the United States government has calculated total victim losses and restitution owed in this case as $140,318,619.

As the government set out in its prior filing, the government submits that the appropriate structure for restitution in this case is to identify the overall restitution figure for the fraudulent binary options scheme directed by Lee Elbaz and order that each defendant is jointly and severally liable for the restitution amount up to the actual losses attributable to that defendant.

The Maryland District Court has already sentenced three individuals involved in the scam evolving around Yukom, which provided investor “retention” services for two websites, known as BinaryBook and BigOption, promoting and marketing binary options. Those binary options were fraudulently sold and marketed. The Court has ordered that these three defendants pay restitution consistent with this approach.

On August 23, 2019, Lissa Mel (a/k/a “Monica Sanders”) was sentenced to 12 months and 1 day of incarceration, followed by 2 years of supervised release, and was also ordered to pay $288,024 in restitution.

On September 20, 2019, Liora Welles (a/k/a “Lindsay Cole,” “Lindsay Wells,” and “Lindsay Taylor”) was sentenced to 14 months of imprisonment, followed by 2 years of supervised release, and was ordered to pay $2,395,310 in restitution.

On September 23, 2019, Yair Hadar (a/k/a “Steven Gold”) was sentenced to 8 months of imprisonment, followed by 2 years of supervised release, and was ordered to pay $1,200,000 in restitution.

The government is now asking the Court to follow that approach in the remaining two cases (targeting Shira Uzan and Lee Elbaz). DOJ will hold defendant Elbaz jointly and severally liable for the entire restitution and loss figure of $140,318,619.

Let’s recall that, on October 4, 2019, Judge Theodore D. Chuang sided with the Government and denied Elbaz’s motion for release pending her sentencing.

In his Order, the Judge noted that the wire fraud conspiracy evolving around Israeli-based Yukom was an extensive international conspiracy involving companies based in Israel and Mauritius engaging in fraudulent telephone and email communications designed to cause individuals to invest in purportedly legitimate financial instruments under false pretenses.

Elbaz, as the CEO of Yukom, instructed numerous retention agents to lie to potential investors in order to procure such investments. Elbaz also had a role in the work of retention agents working for another company, Numaris, located in Tel Aviv, Israel, and with another company, Linkopia, based in Mauritius. Although the precise loss amount has yet to be calculated, exhibits introduced at trial provide evidence that the fraud may have involved over $100 million, with over $36 million from the United States.

The Court notes that even if the loss amount proved to be significantly lower, such as a conservative loss amount calculation of more than $9.5 million, the offense level would still be approximately 31, factoring in the same enhancements for number of victims and the international nature of the scheme that were applied for other defendants in this same scheme. Even with a conservative two-level upward role adjustment, the total offense level would be 33, resulting in a guideline range of approximately 11 to 14 years of imprisonment.

This significant potential sentence is a substantial factor in illustrating the significant risk of flight, the Judge said.