Drew Niv foregoes part of annual bonus due to financial condition of Global Brokerage

Each participant in the bonus plan is entitled to a bonus based on a target amount equal to 200% of such participant’s base salary for 2016.

Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, has informed its shareholders of the proposals for its Annual Meeting of Shareholders, to be held on July 3, 2017.

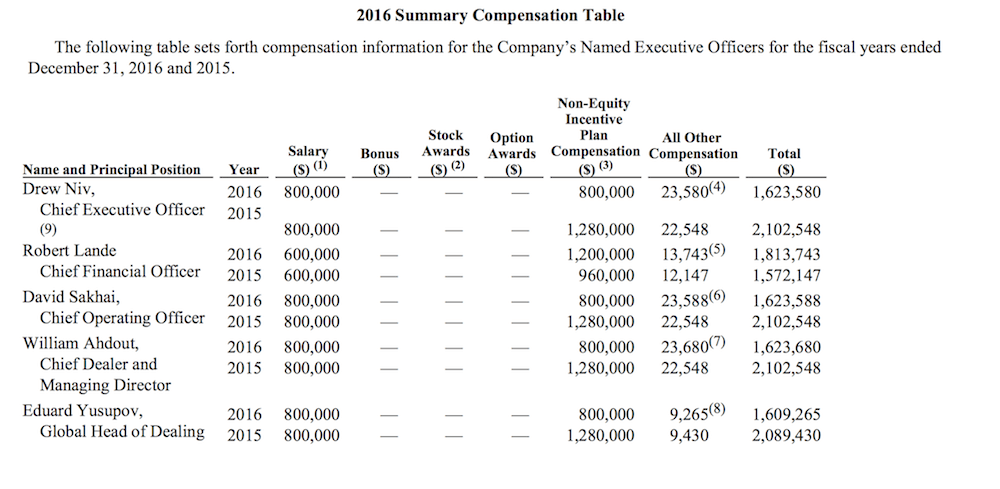

Along with the information that one would normally expect to see in such a document, the company provides details on the bonus awards for its directors. A number of them, including Drew Niv, who resigned as an interim CEO of Global Brokerage earlier this month, are foregoing a part of their bonuses.

Under the bonus plan, each participant, including each of Global Brokerage’s Named Executive Officers, is entitled to get a bonus based on a target amount equal to 200% of such participant’s base salary for 2016. This represents the so called “2017 Annual Bonus”. For the year ending December 31, 2016, the 2017 Annual Bonus is calculated as follows:

- The 2016 Individual Objection Portion – 50% of the target will be earned if the participant achieves the individual objectives and goals set for the participant;

- The 2016 EBITDA Portion – 50% of the target will be earned if the Company achieves an adjusted EBITDA for 2016 equal to at least $40 million.

In March this year, the Compensation Committee found that each of the Founder-Director and/or executive officer participants, including Drew Niv, David Sakhai, William Adhout, Eduard Yusupov and Robert Lande had achieved the individual objectives, entitling them to the 2016 Individual Objective Portion of the 2017 Annual Bonus.

However, the Compensation Committee and the Founder-Directors, including Drew Niv, David Sakhai, William Adhout, and Eduard Yusupov, agreed to forego payment of the 2016 Individual Objective Portion of the 2017 Annual Bonus. They made that call after considering the financial condition of the company.

Global Brokerage is now having hard time remaining listed on NASDAQ due to low market capitalization. FXCM is under pressure to get cash to repay its loan to Leucadia, with the recent sale of its stake in FastMatch set to generate $55.6 million. We still have no information on eventual deals for Lucid Markets and V3 Markets, although FXCM continues to actively market them for sale.

Another interesting topic is whether Drew Niv will get the $3.2 million in severance payments he is entitled to in case of a termination of his contract without cause or resignation for a good reason. Although the document concerning the Annual Shareholder Meeting did not shed any light on this particular matter, it did specify what a “good reason” is.

“For purposes of the Founders Severance Agreements, “good reason” means:

- a sale, divestiture or other disposition of substantially all of the assets and operations (whether by sale of equity interests in the entity or by asset disposition) of the Company (Global Brokerage – Ed.) or Forex Capital Markets Limited (FXCM UK – Ed.), including pursuant to a sale of Global Brokerage, Inc. or any other parent entity that results in either the Company or Forex Capital Markets Limited ceasing to be a member of the Company Group;

- a sale, divestiture or other disposition of the assets and operations of one or more members of the Company Group which, in the aggregate, results in the disposition of the essential operating capabilities of the Company Group;

- without the Named Executive Officer’s consent, a change in his duties and responsibilities which is materially inconsistent with his position with the Company Group, a reduction in his annual base salary, a reduction in his target bonus under the Annual Incentive Bonus Plan for the 2015 and 2016 calendar years, or, for the 2017 and subsequent calendar years, a reduction in the target bonus under the Annual Incentive Bonus Plan for a calendar year (if any) after such target bonus has been established in writing for such year.”