Drew Niv resigns as Global Brokerage interim CEO

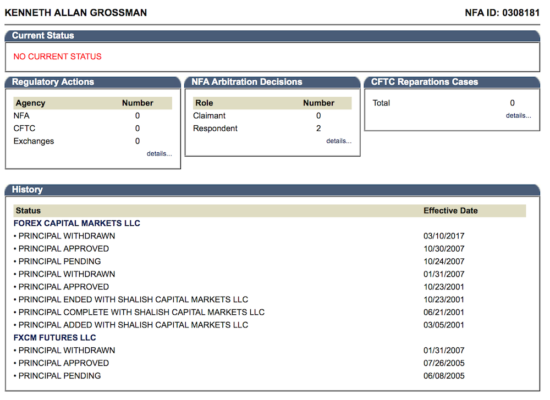

Kenneth Grossman, who becomes Global Brokerage’s new CEO, has no current status according to the NFA database.

There is more FXCM-related news today, as Global Brokerage Inc (NASDAQ:GLBR), has just officially announced the resignation of Drew Niv as its interim CEO.

The move had been expected given the US regulatory findings against FXCM’s US business and Mr Niv. Furthermore, Mr Niv has already relinquished a raft of top roles in the FXCM “family of companies”, including his director position at Forex Capital Markets Limited (FXCM UK), as well as his director role at FXCM UK Merger Limited earlier this year. Effective March 9, 2017, Drew Niv stopped being a listed principal of Forex Capital Markets LLC (FXCM US), according to data from the United States National Futures Association (NFA).

The interesting moment about Mr Niv’s departure is whether his resignation will allow him to pocket the $3.2 million in severance payments he is due in case of a termination of his contract without cause or resignation for a good reason. The document released by Global Brokerage today does not provide any details on the matter.

The company has also announced the name of its new CEO – Kenneth Grossman. Mr Grossman is one of the founding partners of FXCM. The NFA database shows he has no current status, after his registration as a Principal of Forex Capital Markets LLC was withdrawn on March 10, 2017.

Global Brokerage Inc is now having hard time retaining its NASDAQ listing after earlier this month it got notified of insufficient market capitalization to comply with NASDAQ listing requirements. In order to remain listed there, the market value of the company’s publicly held shares has to surpass $15 million for ten consecutive business days between the issue of the notification and October 30, 2017.