Drew Niv, William Ahdout officially leave Forex Capital Markets LLC – NFA database shows

The NFA database shows that Drew Niv and William Ahdout have No Current Status, effective today.

Effective today, March 9, 2017, Drew Niv and William Ahdout are no longer listed principals of Forex Capital Markets LLC, according to data from the United States National Futures Association (NFA).

The move is in tune with settlements between Forex Capital Markets LLC, its (ex-)principals and US regulators, following findings that the broker misled its clientele and regulators regarding its execution model. The NFA decision that barred FXCM and its principals from membership came into effect on February 21, 2017, but the company and the trio of managers had 15 days after that to comply.

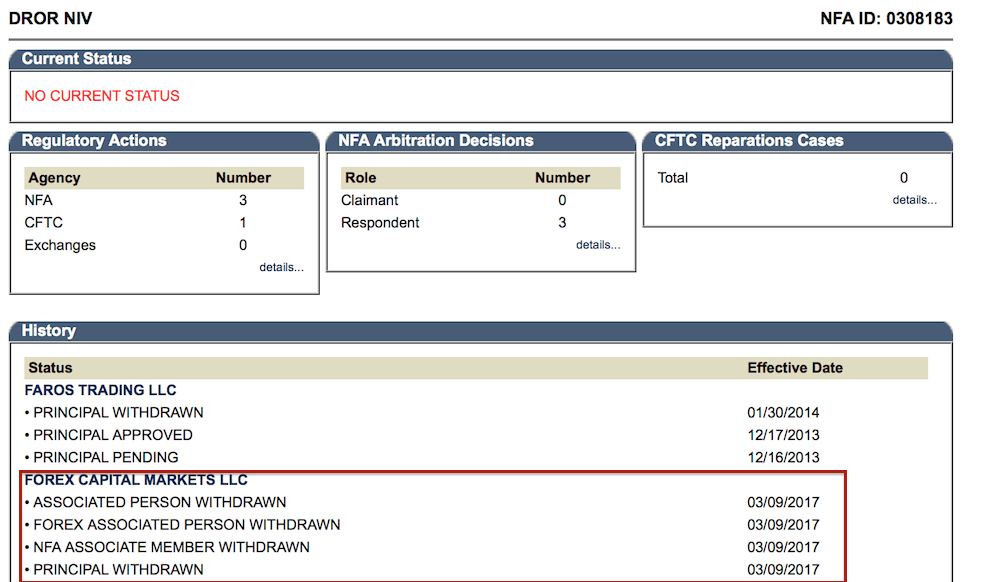

As of March 9, 2017, Dror Niv (or Drew Niv) is no longer an associated person, Forex associated person, NFA associate member and principal of Forex Capital Markets LLC.

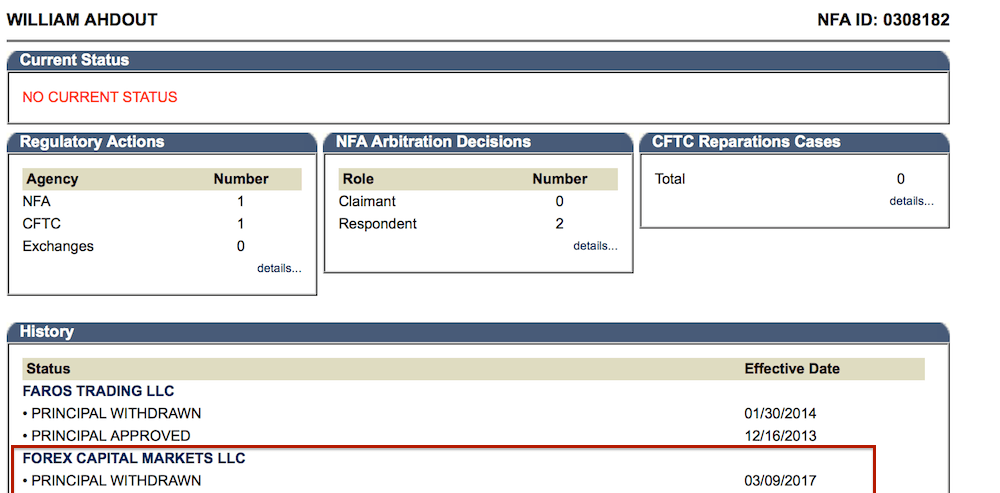

As of March 9, 2017, William Ahdout is no longer a principal of Forex Capital Markets LLC.

The changes have been expected, especially after relevant announcements by FXCM. Also, let’s not forget that Dror Niv’s status in the UK FCA register has become “inactive” on February 15, 2017, after he ceased being a a partner at Lucid and a director at FXCM UK.

FastMatch has also bid goodbye to Mr Niv and Mr Ahdout. In a major reshuffle of its board of directors, FastMatch replaced Drew Niv and William Ahdout with Brian Friedman, President, and Jimmy Hallac, Managing Director, of Leucadia National Corp.

Meanwhile, FXCM Inc has changed its name to Global Brokerage Inc (NASDAQ:GLBR) and is now trading under a new ticker on NASDAQ. Ex-clients of Forex Capital Markets LLC have been transferred to GAIN Capital’s Forex.com, while the US section of FXCM.com shows no mention of “No dealing desk” nor of “Forex Capital Markets LLC”.

Instead, US residents are greeted with a message that they cannot open live trading accounts with FXCM at this point. FXCM claims it is focusing its efforts on its non-US business but we have yet to see whether this claim will materialize.