Dukascopy’s Swiss Forex Trader app gets updated, adds German, French languages

The expansion of the language lineup of the mobile solution happens as Europe rewrites CFD and FX regulations.

When it comes to good quality fintech and Forex trading, Swiss companies usually come to mind. Dukascopy continues to enhance its tech solutions for Forex traders, with the Swiss Forex Trader mobile application being the most recent solution to undergo improvements.

The latest version (5.1) of the application for iOS devices was rolled out just a couple of days ago, with the designer team claiming that customers can now enjoy improved login speed and some UI improvements. In addition, there is a Chart GMT/EET time switch.

The latest version (5.1) of the application for iOS devices was rolled out just a couple of days ago, with the designer team claiming that customers can now enjoy improved login speed and some UI improvements. In addition, there is a Chart GMT/EET time switch.

The expansion of the list of languages that the app supports is noteworthy. The solution is now available in German and French languages too. The moment when this addition happens is interesting – both France and Germany are implementing changes to the CFD and FX regulations. Digital advertising of the high-risk types of financial products (including CFDs with high leverage) has been prohibited in France as per the Sapin 2 law. Germany’s BaFIN has also unveiled plans to reform CFD regulations.

We will be curious to see how companies comply with the new rules on the tech front. For instance, in March this year, Spotware Systems announced the pending launch of a new AMF Compliant Account type, along with the release of their next version of cServer. The new account type is in tune with requirements by France’s financial markets regulator AMF that brokers must offer a mandatory Guaranteed Stop Loss to their customers among other attributes which relate either to the technology offered or administrative and marketing efforts of the broker.

Going back to the languages topic, let’s recall that about a year ago, in March 2016, Dukascopy added multi-language news to the application, along with Italian and Romanian languages. Talking of news, let’s mention that Dukascopy offers owners of iOS gadgets an Online News application, which provides access to news content from major news agencies, central banks, credit rating agencies, and stock exchanges. In addition, customers may access FX market information from Dukascopy Bank, including quotes, charts, calendars and video materials from the Dukascopy TV studio.

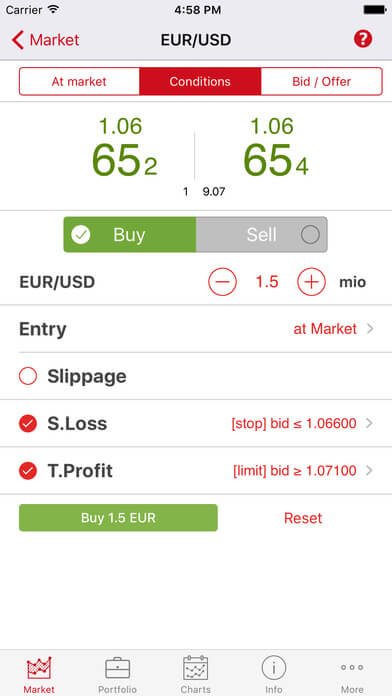

The Swiss Forex Trader mobile app aims to replicate all the main features of the Dukascopy platforms, including ECN liquidity, instant order execution and a variety of trading order types. Customers can also make use of Live Charts and a number of technical analysis tools, as well as Dukascopy TV content.