eForex rockets for Swissquote in first half of 2019

Swissquote’s strategic expansion which included the completion of the acquisition of Internaxx Bank in Luxembourg and a MAS (Singapore) license for its APAC division took place in the first half of 2019, however despite the cost of such expansion, revenues and profit are almost identical to this period last year

Swissquote Group Holding SA (SWX:SQN), Switzerland’s most prominent online trading bank, has experienced a considerable increase in revenues from its eFX business, which comprises of OTC derivatives offered via its own proprietary platform, as well as the provision of liquidity to brokers via its prime of prime division.

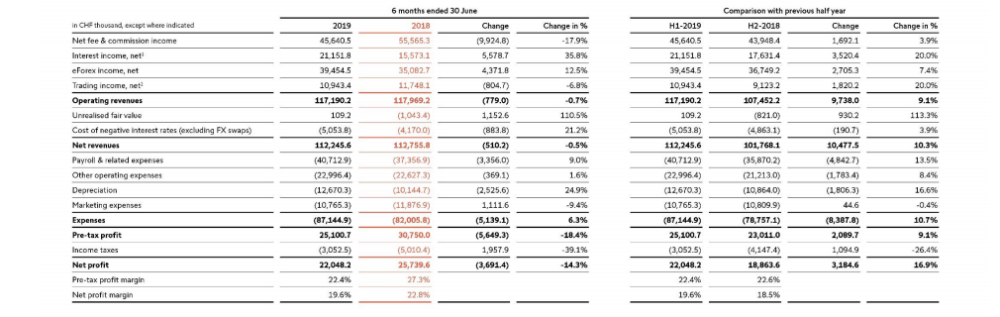

The company’s first half of 2019, which it officially reported today, demonstrated that net eForex income was up 12.5 percent to CHF 39.5 million (CHF 35.1 million).

This growth was due to a 33.8 percent increase in assets held in eForex accounts to CHF 439.8 million. In addition, margins were generally improved.

Overall, the firm’s revenues have remained very stable and are inline with the first half of 2018, which is of particular interest considering that the company, well known for having expanded its business susbtantially over the past decade via a series of very structured acqusitions – namely MIG Bank and ACM – had completed the acquisition of Internaxx Bank.

This Luxembourg-based bank was fully integrated into the Swissquote Group on 22 March. The Internaxx figures were consolidated into the Swissquote figures effective 23 March.

The deal, which was first announced in August 2018, with its finalization having been reported by FinanceFeeds in March this year, was finalized after receiving regulatory approval from the European Central Bank and the CSSF (Commission de Surveillance du Secteur Financier) in Luxembourg.

The acquisition of Internaxx gives Swissquote unrestricted access to the EU’s markets and will further increase Swissquote’s standing as the online investment provider of choice for both institutional and retail clients. Internaxx’s service offering will be expanded with a greater range of products and access to new investment platforms.

Over a period of just over three months, Internaxx contributed CHF 3.5 million to the result (CHF 1.3 million in net fee & commission income, CHF 1.8 million in net interest income and CHF 0.4 million in net trading income).

On 30 July the Monetary Authority of Singapore (MAS) granted a Capital Market Service License (CMSL) to Swissquote Pte Ltd, which was founded in Singapore.

In terms of overall net profit, Swissquote announced a decrease of approximately CHF 10 million in pre-tax profit for 2019 owing to one-off costs for the integration of Internaxx, the founding of Swissquote Pte Ltd. as well as outlays for a Brexit contingency plan. The stablity of income which is comparable to the income figures for the same period of 2018 is therefore a remarkable achievement considering the capital outlay required for these expansion directives.

Based on current estimates, Swissquote is now projecting only a CHF 6 million decrease in 2019 pre-tax profit. Out of this one-off costs of CHF 1.2 million were incurred in the first half and a further CHF 5 million are forecast for the second half of 2019. In addition, CHF 1.8 million are projected in 2020 (total: CHF 8 million).