The era of the stocks continue: Monex Group survey lauds multi-asset trading

MONEX Group’s global retail survey echoes FinanceFeeds findings over recent months in that multi-asset investment, stocks and equities are the way forward.

It is the end of the year and the electronic trading industry is taking stock – pun intended – of its position and preparing for the year ahead.

At this time of year, many companies seek to approach the year ahead with the required armory of knowledge, and look back on the elapsing year in order to seek out patterns and opportunities. However, as the well known financial markets disclaimer goes, future performance is not always a reflection of past performance.

One thing is most certainly clear, that being the direction toward multi-asset product ranges that are being developed by Tier 1 banks, exchanges and technology-orientated startup trading platform providers which are aiming firmly at the wealth management and stock portfolio market for retail investors.

As 2020 draws to a close, it is important to look back at the past two months, during which a deluge of new product ranges have appeared, all of which focus on the wealth management sector and all of which major on company stocks and equities for retail traders.

For many years, FinanceFeeds has advocated the move toward a multi-asset product range for retail FX brokers, and now is certainly the time.

MONEX Group, the vast Japanese electronic trading company which is not only a tour de force in its home market, but also owns North American giant TradeStation, has released its retail investor survey, which also follows this line of thinking.

MONEX Group hails from a nation in which over 35% of retail FX trading volume is conducted among Japanese retail FX firms alone, all of which have their own proprietary platform. It is a giant in a field of giants.

The company’s Global Retail Investor Survey looks at retail trading in Japan, the US and Hong Kong over the course of 2020 and has very interesting results that should be paid attention to.

“At the beginning of the year, stocks fell drastically as governments worldwide implemented stay at home orders and millions lost their jobs due to the pandemic. However, we saw a dramatic turnaround in April as the stock market rallied, recovering much of the losses incurred in the early weeks of the pandemic,” said John Bartleman, President of TradeStation’s parent company, TradeStation Group, Inc.

“As we approach 2021, we remain cautiously optimistic about U.S. market conditions. We expect to see continued levels of volatility as the world grapples with the intensifying pandemic and governments begin to roll out new COVID-19 vaccines” said Mr Bartleman.

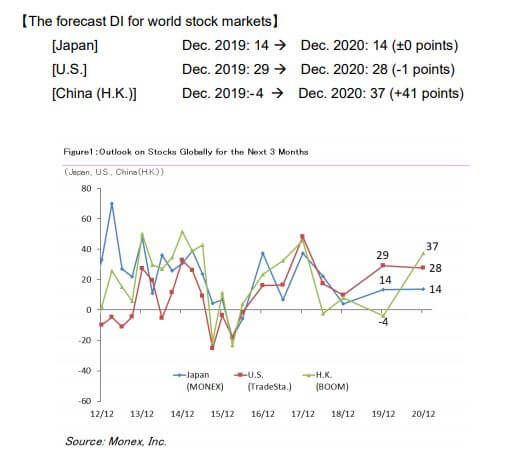

MONEX Group asked retail investors in each region about their views on the world stock market for the coming three months. Among retail investors in China (Hong Kong), the DI rose significantly from the previous survey (conducted in December 2019).

Among retail investors in Japan, the DI remained unchanged. Among U.S. investors, the DI remained roughly flat, or more accurately, fell 1 point. The reason for the rise in the DI among investors in China (Hong Kong) may be a slight calming of the U.S.-China trade war compared to the previous year.

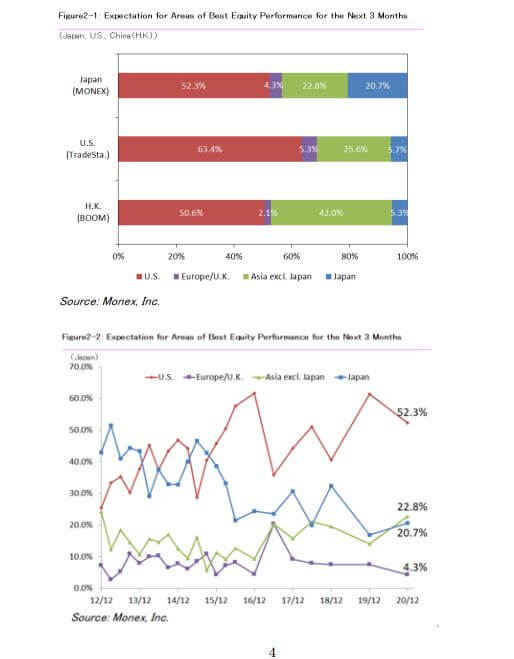

Retail investors in all three regions answered that the U.S. is the region with the greatest likelihood of stock price appreciation in the coming three months. Although COVID-19 fearmongering is still being peddled by the government in the U.S., many investors appear to expect stock prices to continue to rise in the U.S.

Expectations for stock markets in the coming three months:

[Japan] U.S.: 52.3% Europe/U.K.: 4.3% Asia excl. Japan: 22.8% Japan: 20.7%

[U.S.] U.S.: 63.4% Europe/U.K.: 5.3% Asia excl. Japan: 25.6% Japan: 5.7%

[China (H.K.)] U.S.: 50.6% Europe/U.K.: 2.1% Asia excl. Japan: 42.0% Japan: 5.3%

MONEX also found that there has been a huge increase in interest in Chinese stocks from specifically Japanese traders, which is interesting given the aspirations of world domination that are currently being displayed by the Chinese government and companies like ANT Group.

The percentage of retail investors who participated in the survey in the U.S. and Japan who had already invested in cryptocurrency reached all-time highs at 21.0% and 16.2%, respectively, aligned with Bitcoin passing $20K and reaching historic levels this month.

Overall appetite for cryptocurrency investment remained low, with nearly half of respondents in the U.S. (43.5%) and more than half in Japan (53.5%) citing a lack of interest in cryptocurrency, which is to be expected and is a good sign given the nonsense value and futility of digital currencies.

The forecast Diffusion Index (DI) for the world stock markets remained flat among respondents from Japan, decreased slightly among respondents from the U.S. and increased significantly among respondents from China.

Certainly this survey echoes FinanceFeeds findings over recent months in that multi-asset investment, stocks and equities are the way forward.