ESMA registers rise in investor complaints in Q1 2019

The two primary causes of complaints filed with EU national regulators in the first quarter of 2019 were the execution of orders (33%) and unauthorised business (14%).

The European Securities and Markets Authority (ESMA), the EU’s securities regulator, has earlier today published the second Trends, Risks and Vulnerabilities (TRV) report for 2019. The document includes data about investor complaints received by national competent authorities (NCAs) in the EU in the first quarter of 2019.

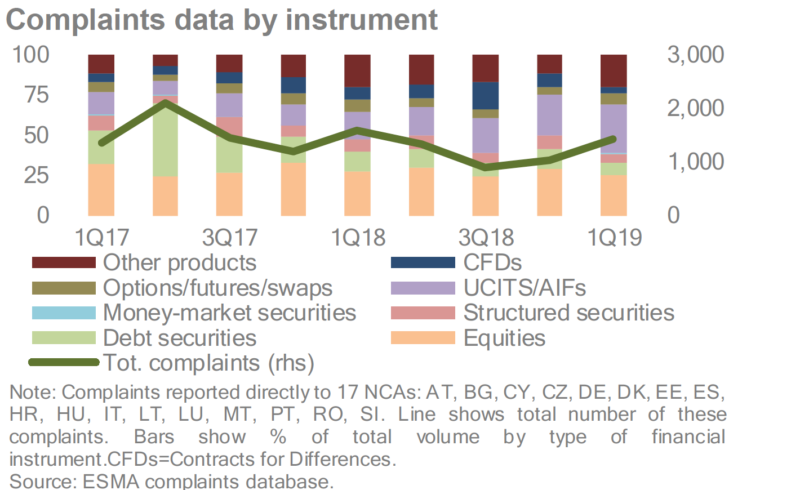

The overall number of consumer complaints made to NCAs rose in the first quarter of 2019, marking the highest level in a year. ESMA offers interpretation of the trends via comparison with events from the past few years.

In particular, the pan-EU regulator notes that 1H16 saw a spike in aggregate complaints, attributable to underlying issues in relation to contracts for differences (CFDs) and binary options in 2015 – complaints being a lagging indicator – and issues around bank resolutions.

The two primary causes of complaints filed with NCAs in 1Q19 were the execution of orders (33%) and unauthorised business (14%). The execution of orders has been a leading cause of complaint since 2016. Complaints relating to investment advice, which had been the second most common cause in 2017, were lower in much of 2018 and in 1Q19. One reason for this trend was a spike in complaints recorded with one NCA in 2H17 about the provision of advice concerning certain investment vehicles.

Regarding the type of financial instrument cited in complaints, the proportion of complaints referring to debt securities fell substantially over the last two years, at 7% in 1Q19 compared with 46% in 2Q17. This trend was driven by firm credit events and bank resolutions in more than one country that had previously led to complaints.

ESMA did not renew its temporary measures, under MiFIR product intervention powers, restricting the offer of CFDs to retail investors and prohibiting the offer of binary options to retail investors, as most national regulators introduced their own permanent intervention measures on a national basis that are at least as stringent as ESMA’s measures. ESMA’s measures in relation to binary options and CFDs, which applied throughout the EU, applied for one year from July 2, 2018 and August 1, 2018, respectively. Back then, ESMA, along with NCAs, identified a significant investor protection concern in relation to CFDs and binary options offered to retail investors.

ESMA has been critical of the CFD restriction measures proposed by some national regulators. Thus, for instance, ESMA has criticized Poland’s KNF because the Polish product intervention measures with regard to CFDs envisaged lower margin requirements for more experienced traders. ESMA stated that it does not consider that lowering margin requirements for experienced clients is appropriate. Nevertheless, Poland implemented the planned measures regardless of the stance of the pan-EU watchdog.