ESMA restrictions weigh on CMC Markets’ profits in FY2019 but stockbroking business grows

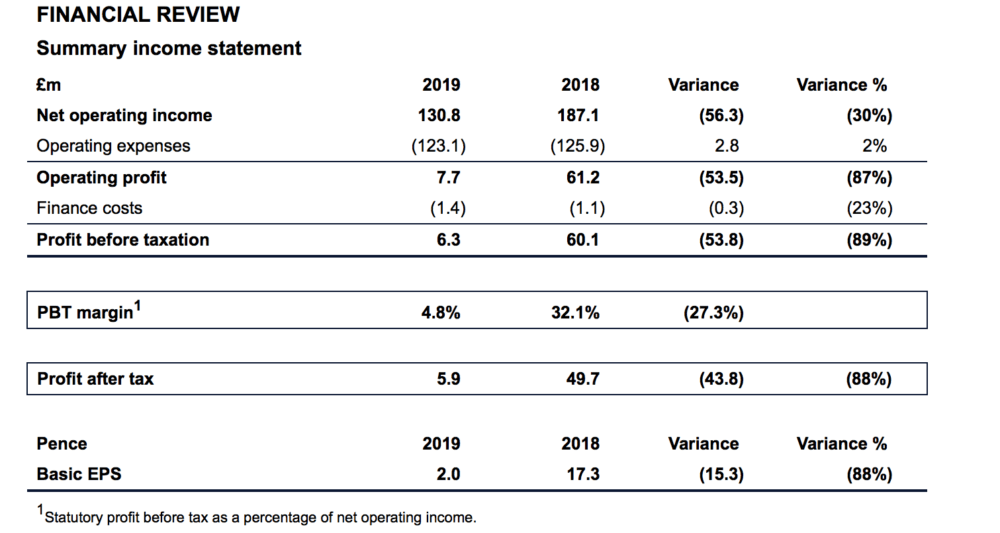

The 88% drop in profit after tax for the year to end-March 2019 was due to lower net operating income and the operational gearing in the business.

Online trading services provider CMC Markets Plc (LON:CMCX) has just posted its final results for the year to end-March 2019, with ESMA product intervention measures hitting earnings but stockbroking business growing.

CMC registered profit after tax for the year of £43.8 million, down 88% from a year earlier. The drop was blamed on lower net operating income and the operational gearing in the business.

Net operating income for the year fell by £56.3 million (30%) to £130.8 million, primarily due to a significant decrease in trading volumes from those clients that were impacted by ESMA regulation, and a further reduction in overall client volumes due to lower levels of market volatility. This had a particular impact on the second half with net operating income lower than first half performance at £60.2 million (H1 2019: £70.6 million).

Active client numbers have fallen by 5,857 (10%) to 53,308, as a result of fewer trading opportunities resulting in more clients stopping trading than the prior year. In addition, the Group implemented enhanced appropriateness checks during the year. This contributed to the acquisition of fewer new clients, however, the quality of those new clients has improved, which, CMC says, is encouraging for the future.

Regarding the impact on active clients resulting from the implementation of ESMA measures, during August 2018 there was a rise in clients who stopped trading in the UK and Europe, however, monthly active client numbers have remained broadly stable for the remainder of the financial year and client money levels have remained strong, rising £27.6 million (9%) to £332.4 million.

Lower active client numbers in conjunction with the lower net operating income has resulted in revenue per client falling by £896 (30%) to £2,068.

The value of client trades has decreased by £328 billion (13%) to £2,259 billion, due to lower volumes from ESMA impacted clients and fewer trading opportunities for other clients.

Profit before tax decreased to £6.3 million from to £60.1 million, reflecting the high level of operational gearing in the business whereby much of the decrease in net operating income directly impacts the bottom line.

Stockbroking, however, provided a piece of positive news. The Australian stockbroking business has grown significantly during the year due to the successful implementation of the ANZ Bank white label partnership at the end of H1 2019. This has been the main driver of the 81% increase in revenue to £15.5 million (2018: £8.5 million).

CMC also provided an update with regard to its preparedness for Brexit. In order to guarantee CMC’s permission to operate in the European Union on an uninterrupted basis, the Group has established a new subsidiary in Germany. The necessary staff have been recruited in anticipation of starting to onboard new clients in the region later in the financial year. The Group’s headquarters will remain in the UK.

In terms of outlook, Peter Cruddas, CMC Markets’ CEO commented:

“This has been a difficult period of trading for CMC and our sector, but having now weathered the ESMA transition, we exit this year with renewed confidence in the future. We have learned as our clients adjusted to the imposition of much lower leverage levels at the same time as experiencing range bound markets. As a result, we have adjusted our business to ensure we capture revenue appropriately and manage the net risk we are exposed to from higher client margins against smaller positions being held for longer periods”.