ESMA rules, lower volatility weigh on IG Group’s revenues in Q1 FY19

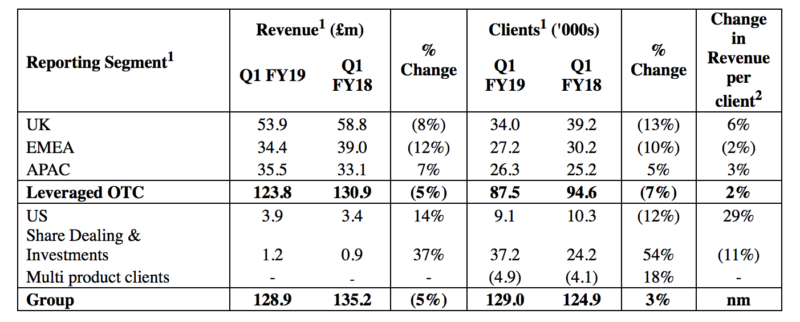

Revenue in the quarter to end-August 2018 was £128.9 million, down 5% from the equivalent period in the prior year.

Electronic trading major IG Group Holdings plc (LON:IGG) has earlier today posted an update on its revenues for the quarter to August 31, 2018, with the performance results affected by the latest ESMA rules and lower volatility when compared to the same period a year earlier.

Revenue for the first quarter of FY19 was £128.9 million, down 5% lower from the equivalent period in the prior year, which was a record quarter. The heightened level of volatility in financial markets and client activity experienced in FY18 have not continued into FY19, IG explains.

The results for the three months to end-August 2018 reflect the ESMA prohibition on offering binary options to retail clients from July 2, 2018, and the measures relating to the provision of CFDs to retail clients from August 1, 2018.

In November 2017, IG launched an online process to enable its sophisticated clients who meet the required criteria to apply to become categorised as an elected professional client. The proportion of UK and EU revenue generated by clients who at the end of the period were categorised as professional was over 50% in Q1 FY19, in line with the company’s previously stated expectation.

The volume of trading by clients categorised as retail clients in the UK and EU was, as previously guided, significantly lower in August than in July following the implementation of the ESMA measures.

IG says it is not possible to draw firm conclusions from a one month period as it will take time for retail clients to adapt to the new rules and change their trading behaviour. The Group’s performance in the month of August has not changed the Company’s previously stated view that the impact of the ESMA measures on historic revenue would have been a reduction of approximately 10%.

The Group has continued to make progress with its strategic initiatives. The Group’s German subsidiary has received a licence in principle, subject to standard conditions, from BaFin to offer financial services to EU clients. This provides certainty that IG will continue to be able to offer its regulated financial products in all EU member states following the UK’s planned exit.