ESMA’s report reveals only €1.8m in sanctions under MiFID II imposed in 2019

The report shows only half of member states imposed such sanctions with most of these not including a fine.

The European Securities and Markets Authority (ESMA), the EU’s securities markets’ regulator, today published its report on the sanctions and measures imposed under the Markets in Financial Instruments Directive (MiFID II) by National Competent Authorities (NCAs).

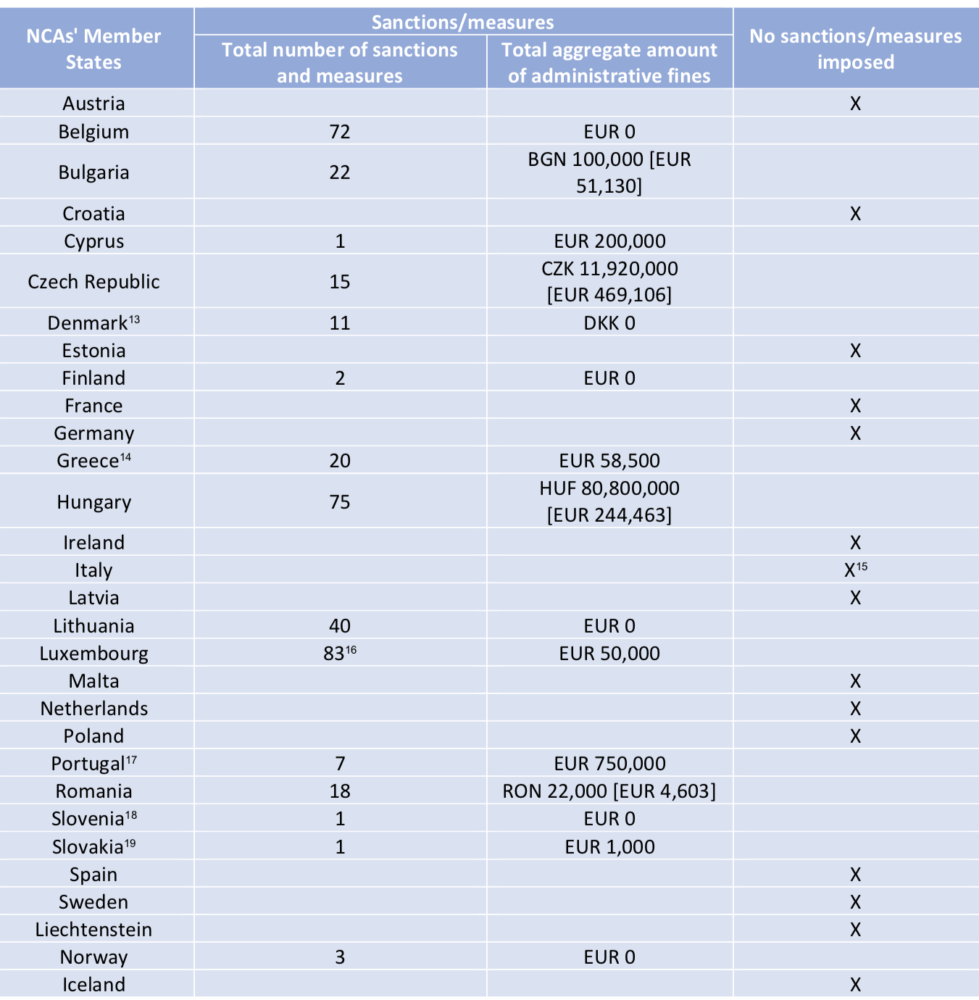

The report shows that the NCAs in 15 (out of 30) EU/EEA Member States imposed such sanctions last year. Most of these sanctions did not include a fine. For instance, in Luxembourg, there were 83 sanctions. Only one violation resulted in an administrative fine of EUR 50,000, while the remaining violations were sanctioned by injunctions (that may give raise to administrative fine if the entities do not rectify the deficiencies that have been identified during on-site inspections).

Portugal imposed fines of EUR 750,000 last year, being the EU/EEA Member State that imposed the biggest volume of fines under MiFID II last year.

In 15 Member States, NCAs imposed sanctions and measures which resulted in a total of 371 sanctions and measures. Those totalled EUR 1,828,802. The comparison between the 2019 and 2020 reports shows an increase in the number of Member States where sanctions and measures were applied, the total number of sanctions and measures reported and the aggregated amount of administrative sanctions imposed.

ESMA believes that (i) as MiFID II/MiFIR has been applicable for two years and due to the considerable time that enforcement processes take from the beginning to their conclusion; and (ii) the differences between the requirements of the MiFID II framework and national legislation on sanctions and measures highlighted above the data does still not allow to determine clear trends or tendencies in the imposition of sanctions and measures, nor to provide the basis for detailed statistics or clear comparisons across Member States.

If an NCA reported that “no/zero” sanctions and measures were imposed in 2019, this does not necessarily mean that the NCA did not take any enforcement action of MiFID II rules. Instead, a NCA’s report of no imposed MiFID II related sanctions and measures in 2019, may also stem from practical factors, such as the considerable time that enforcement processes take from the beginning to their conclusion. This may have led to sanctions and measures or criminal proceedings ongoing in 2019, being pushed beyond the cut-off date of the reporting period (i.e. 31 December 2019).