EU regulations weigh on number of new customers at Playtech’s financials division in H1 2018

During the first half, as preparation for the new measures issued by ESMA, the management decided to take a prudent approach to marketing spend on new customer acquisition.

The effects of the new rules for CFD offering to retail investors introduced by ESMA are made apparent by the report of another company which is engaged on online trading – Playtech PLC (LON:PTEC), or more precisely, its financial division TradeTech Group.

In a filing with the London Stock Exchange today, Playtech said that, during the first half of 2018, as preparation for the new measures issued by ESMA, the management decided to take a prudent approach to marketing spend on new customer acquisition. Management has taken the view that the incoming regulation may potentially impact the ‘customer life time value’ and ‘accordingly cost per acquisition’ metrics across the market. This resulted in slower growth in number of new customers in the period.

On the brighter side, in the B2B business segment, TradeTech saw revenue up 39% and 15%, and volumes up 109% and 55% on a proforma basis. This brought the business close to reaching the $1 trillion level in trading volume from B2B customers in the 6 months of 2018.

Playtech notes the importance of the CFH and TradeTech Alpha acquisitions, which complimented the existing frontend and backend technology and enabled TradeTech to deliver an end to end solution for brokers, delivering a full suite of products from unique trading platform and CRM systems, to liquidity control, risk management, real time risk applications and more. TradeTech’s strategy is to continue to establish its capabilities across the entire value chain in the financial trading sector.

Revenue in the TradeTech Group was €52.3 in the first half of 2018, up 16% versus the first half of 2017. The functional currency of the TradeTech Group is US Dollars and, looking at revenue on a USD basis, the H1-2018 growth was 37%; reflecting growth in both the B2B and B2C verticals driven through higher volume of trading.

Cost of operations in the Financials division decreased by €2.1 million in the first six months of 2018. However, on a USD basis the adjusted cost base increased by 17.5% due to the inclusion of ACM during the first half of 2018. Excluding the ACM expenditure, like for like adjusted costs in USD for the TradeTech Group were relatively flat year on year.

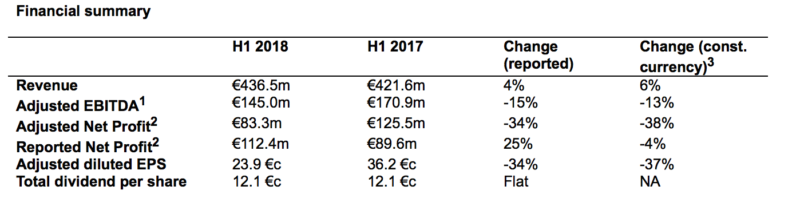

In terms of overall performance of Playtech, the results were not quite rosy, due to headwinds in Asia. Total reported revenue increased by 4%, but Adjusted EBITDA decreased by 15%. Adjusted Net Profit decreased by 34% predominantly due to the decrease in revenue from Asia.