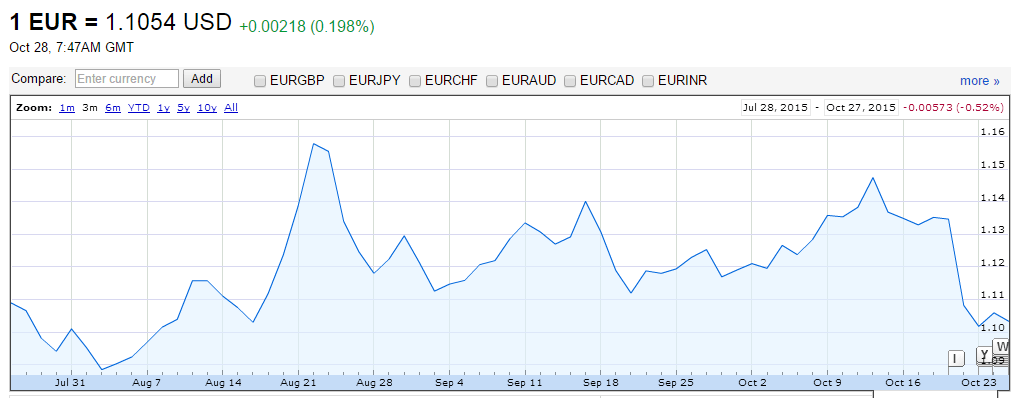

Euro at its lowest point since August as EU teeters on the brink of obscurity. Will GBP take over?

This has been yet another dark week for the Euro as its value languishes at a lowly 1.105 against the US Dollar representing the lowest valuation against the dollar since August which was a month fraught with concern over the potentially catastrophic ‘Grexit’ which would leave the European Central Bank and International Monetary Fund exposed […]

This has been yet another dark week for the Euro as its value languishes at a lowly 1.105 against the US Dollar representing the lowest valuation against the dollar since August which was a month fraught with concern over the potentially catastrophic ‘Grexit’ which would leave the European Central Bank and International Monetary Fund exposed to over a third of their combined capitalization, or the equally catastrophic prospect of the fiscal bottomless pit that is Greece remaining in the EU and its prime minister resisting urges to repay debts, and instead ask for more from the coffers.

As that situation went quiet, the Euro began to climb in value during the end of the summer, however it collapsed this week as the unsustainable debt crisis that blights mainland Western Europe is now joined by another liability in the form of a mass exodus of migrants from countries in the Middle East including Syria from their temporary abodes in Eastern European nations such as Slovenia and Hungary into Western Europe after considerations that the European Union may break up if a solution to the migrant situation is not reached.

Thus far, the figures stack against any sustainability for the European Union. The entire union is constructed of debt-ridden, trade-union led member states in the West such as France, Italy, Portugal, Spain and Greece. Whilst France’s debt to GDP ratio remains at 250% (China’s is 1%), and the French workforce retains its short working week, Spain, Portugal and Greece remain non-producing countries with over 50% youth unemployment and a large politically motivated youth movement which riots in the streets if the government does not continue to provide handouts.

This leaves Germany and Britain to power the entire fiscal system for the entire continent.

As Britain is not in the Eurozone, and has just done a very shrewd £30 billion deal with China to further its business relationship with the most industrially and technologically sophisticated nation on earth, this leaves Germany, a nation whose traditional legacy manufacturing industry is on borrowed time.

Volkswagen’s fixing of its emissions level readings by fitting devices to its cars to provide false readings may well become a subject which the US government will make an example of, and a lawsuit of that level could be enough to finish the company off, plus Asian companies with economies of scale are able to produce equal products much more efficiently. Add this to the 800,000 (and growing) number of migrants which Germany has settled on a semi-permanent basis who will likely come with cap in hand to the welfare system and offer little in the way of economic or industrial benefit to the nation, and Germany’s once strong economy appears to be a ticking time bomb.

It is remarkable that an undemocratic, socialist, anti-business system which bonds together a series of nation states which have little in common with each other industrially or culturally has lasted this long, however these factors plus the closing of borders by Eastern European nations, hinting at a potential exit by some member states from the union may be considered large contributing factors toward the decline of the price of the Euro.

Market volatility

Back in February, in the wake of the extreme and unprecedented volatility in the FX markets which occurred on January 15 as a result of the Swiss National Bank removing its 1.20 peg on the EURUSD, industry leaders expressed their prediction, with many anticipating far more volatility ahead.

This was most likely a correct analysis and stands true even 10 months on, because the fluctuations that have occurred this week are likely to pale into insignificance if member states begin to leave the EU.

The transfer of debt and differences in output that would ensue from such a move would generate vast fluctuations in the price of the Euro, and indeed investors are likely to remove their funds from Euro-based accounts in case a run on states leaving the EU follows the first to leave.

Keeping the Pound was most definitely one of the most sensible things that the British government has done over the last 10 years, especially as the nation’s capital is the complete opposite to any other European Union member state in that it is a highly technological, international financial powerhouse, handling most of the world’s interbank FX order flow across all global markets, and home to some of the finest quality liquidity providers in the world.

Add this strength and London’s modernity and robustness to its recent partnership with China, and a demise of the EU may well be of little consequence to British financial industry leaders.

Indeed, we may see a time when the ‘cable’ is out of favor, and USDGBP takes over, as the two currencies have retained a very steady pattern over the last year, and the trend toward adding multi-asset instruments to retail trading platforms could be a continuing, and necessary measure.

Chart courtesy of Google Finance