Euronext registers 10.8% rise in spot FX trading revenues in Q3 2019

On the back of positive foreign exchange impact and yield management, spot FX trading generated €6 million of revenue in the third quarter of 2019.

Euronext NV (EPA:ENX) has just posted its results for the third quarter of 2019, with revenues staging a rise from the year-ago period thanks to the consolidation of Oslo Børs VPS, the contribution of Investor Services, the strong performance from Corporate Services as well as solid performance by the cash trading and FX trading businesses.

Spot FX trading activity on Euronext FX spot foreign exchange market recorded average daily volumes of $19.4 billion, flat compared to the third quarter of 2018. Thanks to positive foreign exchange impact and yield management, spot FX trading generated €6 million of revenue in the third quarter of 2019, up 10.8% compared to the equivalent period in 2018. The result is also higher than the €5.4 million in spot FX revenues reported in the second quarter of 2019.

In the third quarter of 2019, consolidated Euronext revenue increased to €181.7 million, up 20.4%. On a like-for-like basis (excluding the consolidation of Oslo Børs VPS, Commcise and OPCVM360 in Q3 2019), consolidated Euronext revenue increased by 2.5% from a year earlier to €154.6 million.

Non-volume related revenue accounted for 52% of total Group revenue in the quarter to end-September 2019, increasing from 46% of total Group revenue in the same period in 2018.

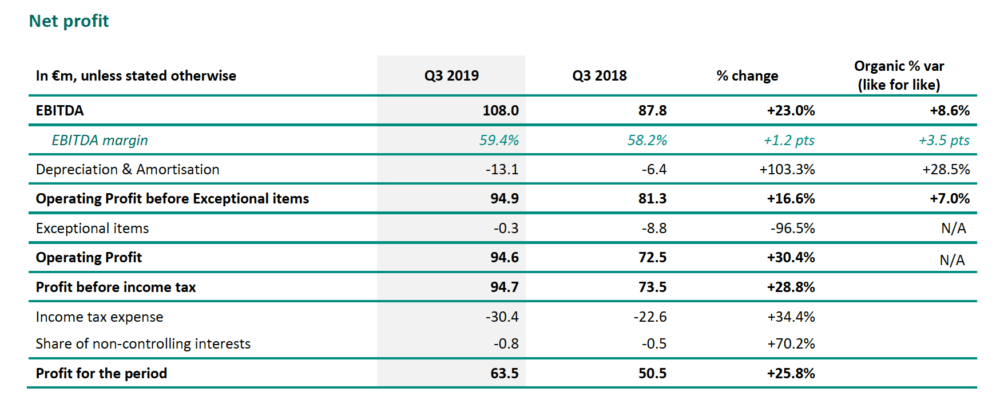

Operational expenses excluding Depreciation & Amortisation increased to €73.8 million, up 16.8%, i.e. €10.6 million, as a result of the consolidation of Oslo Børs VPS, Commcise and OPCVM360. On a like-for-like basis, operational expenses excluding Depreciation & Amortisation decreased by -6.1% compared to Q3 2018.

As a result, EBITDA for the quarter was €108 million, up 23%, representing a margin of 59.4%, up 1.2 points compared to the third quarter of 2018. On a like-for-like basis, EBITDA for the third quarter of 2019 was up 8.6%, to €95.3 million, and EBITDA margin was 61.6%, up 3.5 points, compared to the same perimeter in the third quarter of 2018.

Net income for the third quarter of 2019 grew 25.8% from a year earlier to €63.5 million.