Euronext registers 2.5% drop in spot FX trading revenues in Q2 2019

Spot FX trading generated €5.4 million of revenue in the second quarter of 2019, down 2.5% compared to the corresponding period a year earlier.

Euronext NV (EPA:ENX) has just reported its results for the second quarter of 2019, with revenues from spot FX trading activity marking a drop from the equivalent period a year earlier.

Euronext FX (formerly known as Fastmatch) recorded average daily volumes of $17.5 billion, down 18.5% compared to the second quarter of 2018. Spot FX trading generated €5.4 million of revenue in the second quarter of 2019, down 2.5% compared to the corresponding period a year earlier.

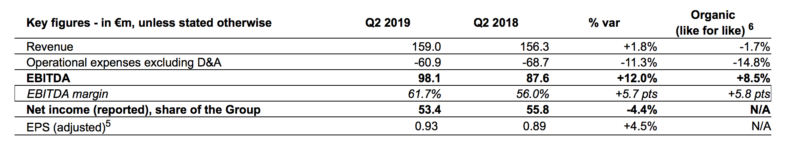

Across all segments, revenue marked a growth of 1.8%, reaching €159 million in the second quarter of 2019. Total revenue contribution of Oslo Børs VPS was €4.5 million, consolidated from June 14, 2019. In May 2019, Euronext launched an unconditional offer at NOK 158 plus a fixed interest payment of NOK 3.21 per share for all issued and outstanding shares in Oslo Børs VPS not already owned by Euronext.

Listing revenue was up 8.6% to €29.7 million driven by the strong performance of Euronext’s Corporate Services, and listing revenue from Oslo Børs VPS contributing €1 million. Cash trading revenue was down 5.9% to €50.7 million. Advanced Data Services revenue, however, increased by 5.2% to €30.9 million, on the back of good performance of indices business.

Custody, Settlement and other post-trade revenue was up 38.8% to €7.7 million mainly due to the post-trade CSD revenue from Oslo Børs VPS contributing €2.1 million.

EBITDA grew 12.0% to €98.1 million in the second quarter of 2019. Net income fell 4.4% to €53.4 million.