Euronext reports 5.6% rise in spot FX trading revenues for 2019

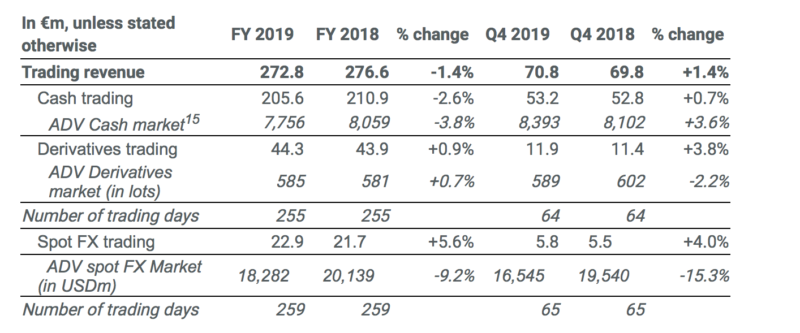

Spot FX trading generated €22.9 million of revenue in 2019, up 5.6% compared to €21.7 million in 2018.

Euronext NV (EPA:ENX) has just posted its financial report for the final quarter and full year 2019, with spot FX trading registering growth in revenues.

Spot FX trading generated €22.9 million of revenue in 2019, up 5.6% compared to €21.7 million in 2018, thanks to improved yield management. Spot FX trading generated €5.8 million of revenue in the fourth quarter of 2019, up 4.0% compared to €5.5 million in 2018.

Spot FX trading activity on the Euronext FX spot foreign exchange market recorded average daily volumes of $18.3 billion in 2019, down 9.2% compared to $20.1 billion in 2018, due to low volatility environment through 2019. The volumes were down 15.3% in the final quarter of 2019.

In 2019, Euronext consolidated revenue increased to €679.1 million, marking a rise of 10.4% from the preceding year. The growth was mainly driven by the consolidation of Oslo Børs VPS, the contribution of Investor Services and the strong performance from Corporate Services, which offset lower trading revenue in a subdued environment for cash trading.

In the fourth quarter of 2019, Euronext consolidated revenue increased to €185.7 million, up 18.1% from the equivalent period a year earlier.

Net profit for 2019 increased by 2.8% from a year earlier, to €222.0 million. This represents a reported EPS of €3.19 basic and €3.17 fully diluted in 2019, compared to €3.10 basic and €3.09 fully diluted in 2018.

In the final quarter of 2019, the net profit amounted to €49.0 million, staging a drop of 1.2% from a year earlier. This represents a reported EPS of €0.70 basic and €0.70 fully diluted in Q4 2019, compared to €0.71 basic and €0.71 fully diluted in Q4 2018.