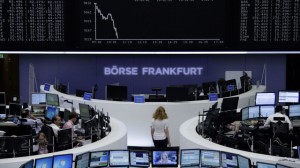

European markets went into red at the end of trading on Monday

The European markets went into red at the end of trading on Monday. The decline in crude oil prices once again had a negative impact on investor sentiment. The pan-European index Euro Stoxx 600 ended with a decrease, although opened the session with a growth. The crude oil futures fell more than 1% for the […]

The European markets went into red at the end of trading on Monday. The decline in crude oil prices once again had a negative impact on investor sentiment. The pan-European index Euro Stoxx 600 ended with a decrease, although opened the session with a growth. The crude oil futures fell more than 1% for the more expensive USD and the increase in the supply of crude oil from Libya. Energy shares written off 1.3% at mid-day for this decline. Large companies like Total and Royal Dutch Shell reported losses over 1%

The European markets went into red at the end of trading on Monday. The decline in crude oil prices once again had a negative impact on investor sentiment. The pan-European index Euro Stoxx 600 ended with a decrease, although opened the session with a growth. The crude oil futures fell more than 1% for the more expensive USD and the increase in the supply of crude oil from Libya. Energy shares written off 1.3% at mid-day for this decline. Large companies like Total and Royal Dutch Shell reported losses over 1%

The shares of mining companies were the best performers in the morning session after the markets reacted to the reduction of the basic interest rate in China by 25 points to 5.35% on Saturday. The market resources are considered the most exposed to fluctuations in the second largest economy in the world. Companies such as Anglo American and Rio Tinto recorded moderate growth of its shares on Monday and helped the FTSE 100 to hit the green.

However, the rise was soon wiped off with the continuation of the day. Marius Paun and Jonathan Sudariya, two investors in the brokerage agency Capital Spreads, said that the reduction of interest rates is “more a sign of weakness rather than something to promote the bulls”. Meanwhile in the US Nasdaq index briefly touched the psychologically important threshold of 5,000 points on Monday. Investors were inspired by good economic data from the US and the reduction of interest rates in China.

Deflation in the Eurozone in February reached 0.3% yoy, below expectations of 0.4%. This is the third consecutive month of deflation of the currency union, but the pace of its decline on expectations for the Program for quantitative easing by the European Central Bank. The PMI index for the euro area reached 51.0 points in February, unchanged in January. The unemployment dropped to 11.2% for the Eurozone in January.

In Moscow held a march in memory of murdered on Friday opposition leader Boris Nemtsov, attended by about 100,000 people. The protesters carried banners reading “Do not be afraid” and chanted “Russia without Putin”. The Russian President Vladimir Putin took over the investigation into the murder of one of the main opposition, despite doubts about his personal interest in the murder.

Market shares of the French cable operator Numericable-SFR rose 2.6% after Vivendi accepted the offer of Altice for the 20% share in the company. Vivendi’s shares fell more than 6%, while those of Altice rose more than 3%.