Europol, Dutch and Luxembourg authorities clamp down on crypto mixing service Bestmixer.io

Bestmixer.io offered services for mixing the cryptocurrencies bitcoins, bitcoin cash and litecoins.

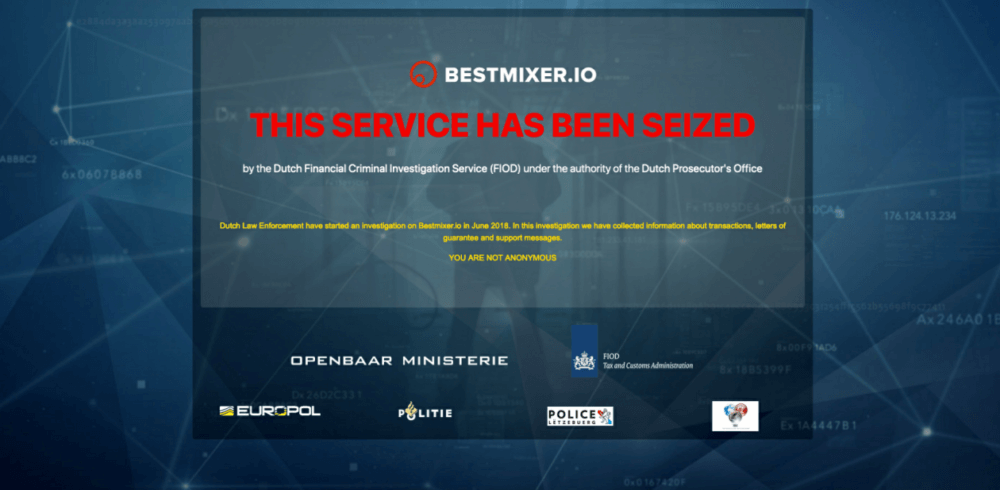

Today, the Dutch Fiscal Information and Investigation Service (FIOD), in close cooperation with Europol and the authorities in Luxembourg, put an end to cryptocurrency mixing service Bestmixer.io. The investigation resulted in the seizure of six servers in the Netherlands and Luxembourg.

Bestmixer.io was one of the three largest mixing services for cryptocurrencies and offered services for mixing the cryptocurrencies bitcoins, bitcoin cash and litecoins. The service started operating in May 2018, with its turnover hitting at least $200 million (approx. 27,000 bitcoins) in a year’s time.

The investigation so far has demonstrated that many of the mixed cryptocurrencies on Bestmixer.io had a criminal origin or destination. In these cases, the mixer was probably used to conceal and launder criminal flows of money.

The Dutch FIOD has gathered information on all the interactions on this platform in the past year. This includes IP-addresses, transaction details, bitcoin addresses and chat messages. This information will now be analysed by the FIOD in cooperation with Europol and intelligence packages will be shared with other countries.

Let’s recall that, in January 2018, Europol, INTERPOL and the Basel Institute on Governance has seen the agencies agree on stepping up their efforts to combat the misuse of cryptocurrencies by criminals and terrorist financiers to launder money and support other criminal activities. The enforcement agencies voiced their intentions to take action against digital currency mixers/tumblers.