Exclusive: Focus on multi-asset liquidity across multiple venues. We speak to Swissquote and PrimeXM

As Swissquote Bank begins to distribute its liquidity into PrimeXM’s XCore system, we take a very close and exclusive look at the importance of technological R&D between brokerage and provider, with full commentary from Swissquote and PrimeXM

For retail brokerages, being able to provide a full and genuine multi-asset solution to their increasingly demanding traders, portfolio managers and strategic partners is absolutely paramount.

For many reasons, gone are the days of simply providing a white label MetaTrader 4 spot FX platform at an initial cost of $5000 to a small brokerage that then subscribes to a $1750 support package and allows another small retail brokerage to provide a price feed that originates from, and processes orders to, its internal dealing desk.

The continual evolution relating to the provision of multi-asset liquidity via familiar and ubiquitous retail trading platforms as well as proprietary trading solutions offered by some of the largest retail electronic trading companies in the entire business has resulted in the need to form important relationships between the buy and sell side, along with providers and integration specialists alike.

The advent of regulatory mandates that require retail brokerages to publish their entire order flow and prove ‘best execution’ on a case by case basis such as MiFID II is congruent to the demand from the retail marketplace itself, and last week, PrimeXM entered into a strategic partnership with Swissquote (SWX:SQN) in order to provide liquidity into PrimeXM’s XCore solution, creating an enhancement of execution for brokerages, with the addition of one of the most renowned prime brokerages in the world.

PrimeXM, being one of the industry benchmarks for liquidity integration alongside oneZero, Gold-i and Fortex, has been engaged in a proactive expansion of multi-asset connectivity recently.

Speaking to the company’s Global Head of Sales Richard Bartlett recently, FinanceFeeds looked at the importance of such development closely.

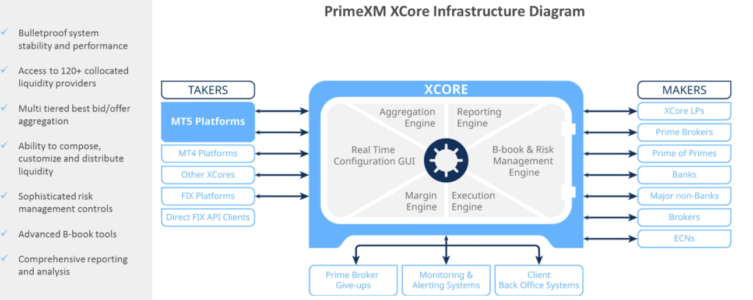

Mr Bartlett expanded on this, explaining PrimeXM’s raison d’etre as an FX connectivity and hosting provider. “It is important to note that we are not just a bridge or gateway firm. We offer hosting to companies which operate across global markets and our XCore product is an end to end smart order routing system.”

“Additionally, an important factor is that we have established our own global infrastructure with 120 connections to banks, ECNs, liquidity providers and datacenters, those being NY4, LD4, TY3, which are the geographically important locations, therefore we made dedicated connections to these areas” continued Mr Bartlett.

“Companies can pick and choose the liquidity providers and add as many to the same system as required. Similarly, brokers have strict cotnrol over their liquidity via the front end graphical user interface and different types of liquidity streams that can be channeled into MetaTrader 5. Brokers can also manage white labels this way if they are a MetaTrader 5 server owner.”

Essentially, any liquidity provider in the world can be added.

Mr Bartlett was very keen to highlight an important factor, that being that PrimeXM does not charge maker fees. “This allows firms to negotiate the best commissions” he said. “On the same lines, we can offer a centralized location as well which allows for the scalability to offer liquidity to any type of client from institutions to retail brokers.”

FinanceFeeds spoke today to Ryan Nettles, Director and Head of FX Trading & Market Strategy at Swissquote, in order to gain the company’s perspective on the integration.

In recent years, we have observed institutions making the switch from sourcing liquidity from single dealer to multi-dealer platforms. For this reason, we have been investing in our technology and infrastructure to improve our distribution capabilities and have selected various trading venues to distribute our liquidity in order to meet the needs of institutional traders” – Ryan Nettles, Director, Head of FX Trading & Market Strategy, Swissquote

“We have observed noticeable growth among FX brokers utilizing PrimeXM’s XCore system therefore we have established a relationship with PrimeXM to be included as a disclosed liquidity provider within their XCore trading venue. We are excited about this new relationship with PrimeXM and we are pleased to add them among our other select trading venues including Integral, OneZero, and Goldi for institutions to take our liquidity across our FX, Precious Metals and CFD products” explained Mr Nettles.

PrimeXM explained to FinanceFeeds that Swissquote’s newly acquired instance of PrimeXM’s XCore will allow the company to offer its clients enhanced execution capabilities via the provision of Swissquote’s liquidity to PrimeXM’s broker clients. PrimeXM’s smart order management and aggregation engine has been developed to cater to the ultra-low latency demands of the market and the new partnership will further improve Swissquote’s advanced distribution abilities.

Through this new partnership, PrimeXM clients will gain access to a source of top-tier co-located liquidity and benefit from competitive discounted fees.

“”We are particularly proud of this new partnership with Swissquote as they are a reputable liquidity provider and through this partnership we will be able to offer our clients another source of top-tier liquidity. Our XCore has been customised to meet the needs of Swissquote and are very happy with the integrated solution we have created together with Swissquote.” Cristian Vlasceanu, PrimeXM CEO

Swissquote’s ethos is one which continues to assess and research sophisticated methods of providing a retail trading environment.

During a meeting with FinanceFeeds at Swissquote’s head office in Gland, Switzerland, Mr. Nettles explained this in detail, focusing on how the bank built its own proprietary systems which efficiently sources and distributes liquidity as well as their risk management system which automatically manages a portfolio of different currencies, precious metals and CFDs.

With regard to the partnership, Kseniya Zubkova, Head of Institutional Forex at Swissquote explained to FinanceFeeds “We are very proud to begin such a promising partnership. The true fusion of FinTech and Banking is invaluable in providing brokers both best execution and the tools essential for successful growth.”