Exclusive: FXPRIMUS exits Shanghai Money Fair among physical threats and protests; booth left derelict. We show both sides

“As a result the company, for safety reasons, had to evacuate its employees from the EXPO with a result of a considerable financial loss as well as commercial loss. These are active clients of FXPRIMUS, who have experienced losses with their respective trading strategies” said FXPRIMUS after receiving threats as their stand was stormed by protesters at the Shanghai Money Fair this month.

When doing business in mainland China as an overseas entity, extreme care is required to pay attention to local requirements in terms of not only how the entity representing an overseas company is structured, but also in terms of media campaigns, offline activities and interactions, or in some cases altercations, with customers.

Relationships between retail providers and their customers in China differ tremendously from from those in other regions with free market economies, in that the government controls every aspect of commercial operation, and there are no litigation or arbitration channels, only mass media campaigns and literally strength in numbers.

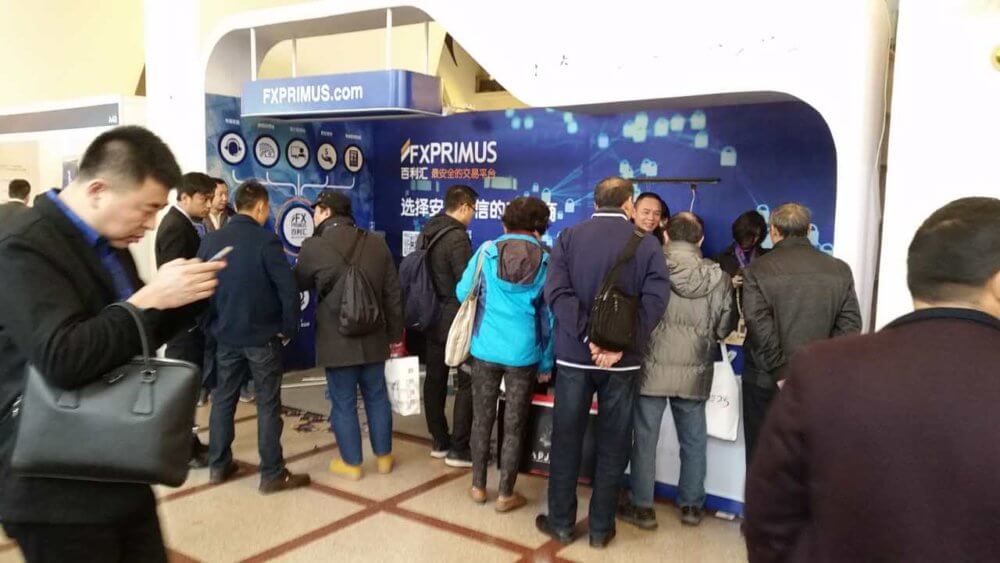

This month at the Shanghai Money Fair, the world’s largest retail electronic trading event which every year hosts over 350,000 attendees ranging from retail traders to introducing brokers, an contretemps between FXPRIMUS and a series of retail traders occurred.

FinanceFeeds attended the event, and was party to the incident, which occurred on Friday December 1, in which a series of customers approached the stand of Cyprus based retail FX brokerage FXPRIMUS and staged a protest which, according to many witnesses who translated their cause from Chinese to English centered around them alleging that FXPRIMUS owes them sums of money.

The Shanghai Money Fair ran from December 1 until December 3, 2017, with this incident occurring on December 1.

FXPRIMUS subsequently exited the event, leaving their booth derelict, and the following day a series of protesters arrived at the venue, staging their apparent discontent, with one female customer alleging that she had lost $15,000, although how she had lost it was not made clear.

In China, it is quite common for this to occur, with many overseas retail brokerages having experienced this type of media-orientated campaign which sets out to damage the reputation of the firm in question. Protests are often filmed and uploaded to social media or industry-related groups, as this is the only method of arbitration in China, a communist country which does not have litigation specialists and whose government only has jurisdiction over Chinese companies.

Indeed, this week, a series of brokerages numbering 40 in total, have been the subject of a government directive instructing the Bank of China to block their payment channels, all of which were well known firms. This demonstrates that it is really only possible to conduct business in China with very comprehensive infrastructure on the mainland, and full transparency of data with the government.

Following the protest at the then-derelict FXPRIMUS booth on Saturday December 2, the organizers of the event boarded up the booth, which remained boarded up until Sunday, when the event concluded.

FinanceFeeds spoke today to FXPRIMUS, which provided a full and comprehensive response to the event’s circumstances, the firm’s senior management responding thus. “The board and management team of FXPRIMUS wish to make a special address to their valued clients and partners in China.”

“We make specific reference to an unfortunate and rather unprecedented event, which occurred on the 1st of December 2017 in Shanghai, where a group of clients actively protested against the company and its employees during the Shanghai MONEY FAIR EXPO by violating, by means of verbal assaults and direct threats for bodily harm towards our employees and by obstructing the smooth operation of the company’s activities to the particular event” continued the official response.

“As a result the company, for safety reasons, had to depart (”evacuate”) its employees from the EXPO with a result of a considerable financial loss as well as commercial loss. These are active clients of FXPRIMUS, who have experienced losses with their respective trading strategies”

FXPRIMUS stated to FinanceFeeds that its company policy is to sympathize with clients in such unfortunate cases, and as such is willing to actively liaise with the relevant parties to provide them with the respective information that they have requested in relation to their transactional history in order for them to understand when and how those losses occurred without prejudice or admission of liability.

The spokesperson continued “By liaising transparently and openly with the said clients and in general with all of the company’s clients, we affirm our commitment to assisting all of our clientele to the extent permissible by law and by the information available to us as we thrive to maintain transparent lines of communication in order that any situation which arises may be resolved.”

The board and management of FXPRIMUS stipulated that it would like to share this case study with all clients and partners, in order that the following points are emphasised:

- Transparency and Honesty is key: We wish to be at all times fully transparent with our clientele in providing them with educational and informative material to not only help them make informed investment decisions, but to also allow them to understand the risks and rewards that are inherent from trading CFDs on margin.

We as always wish to encourage the development of an effective trading plan by each of our clients and to utilise protective mechanisms which the company has in place to minimize such instances of substantial loss of capital, through such measures as the negative balance protection.

- Our emphasis on client fund protection. We pro-actively implement a range of protective measures that contribute to our market positioning as “The Safest Place To Trade”. Read more here: www.FXPRIMUS.com/safety

“With the above announcement, we affirm our strict ethical principles which pervade all of our daily operations, and which have made us the safe brand of choice for our loyal clientele, for more than ten years, and all our rights in this regards and for the particular matter/ incident, clearly stipulated here-above are strictly and expressly reserved” concluded the firm.