Exclusive: Massive redundancies at FXPRIMUS as over 10 staff leave the company in one go

FXPRIMUS, which has been the subject of customer dissent in China, and a shift toward the ICO space with its involvement in Trade.io, has let 10 members of staff go at once, representing a significant percentage of its total headcount.

Today marks a day in which a well known brokerage with a longstanding history has succumbed to a wave of headcount reductions.

FXPRIMUS, which was established initially in North America before rescinding its NFA license and subsequently attempting an Initial Public Offering (IPO) to list its stock in Australia which was blocked by the Australian Securities and Investments Commission (ASIC) in 2015 just a month before the Mauritius authorities suspended the firm’s Investment Dealer License.

The firm then established in Cyprus with a CySec license and moved its entire operations to Limassol, and once there, embarked on some novel marketing campaigns to set it aside from some long established retail FX competition.

During its time in Cyprus, the firm has looked at expansion into new markets, not all of which have been ventures that have borne fruit.

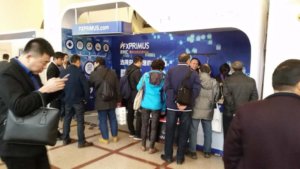

In December, at the Shanghai Money Fair, the world’s largest retail electronic trading event which every year hosts over 350,000 attendees ranging from retail traders to introducing brokers, an contretemps between FXPRIMUS and a series of retail traders occurred.

FinanceFeeds attended the event, and was party to the incident, which occurred on Friday December 1, in which a series of customers approached the stand of Cyprus based retail FX brokerage FXPRIMUS and staged a protest which, according to many witnesses who translated their cause from Chinese to English centered around them alleging that FXPRIMUS owes them sums of money.

The Shanghai Money Fair ran from December 1 until December 3, 2017, with this incident occurring on December 1.

FXPRIMUS subsequently exited the event, leaving their booth derelict, and the following day a series of protesters arrived at the venue, staging their apparent discontent, with one female customer alleging that she had lost $15,000, although how she had lost it was not made clear.

In China, it is quite common for this to occur, with many overseas retail brokerages having experienced this type of media-orientated campaign which sets out to damage the reputation of the firm in question. Protests are often filmed and uploaded to social media or industry-related groups, as this is the only method of arbitration in China, a communist country which does not have litigation specialists and whose government only has jurisdiction over Chinese companies.

Following the protest at the then-derelict FXPRIMUS booth on Saturday December 2, the organizers of the event boarded up the booth, which remained boarded up until Sunday, when the event concluded.

Today it has been explained to FinanceFeeds by sources very close to the matter that FXPRIMUS has let over 10 members of staff go from its operations, representing a large proportion of its staff, including some key members of management in Cyprus.

FinanceFeeds has investigated this in detail via former employees and found it to be a substantial headcount reduction.

Recently, FXPRIMUS became involved in the Trade.io ruse that has been established in Cyprus as an Initial Coin Offering (ICO) resource which states that ICOs have flocked to the board and the management team in order to seek their expertise on how to achieve success.

Trade.io issued 500 million trade tokens with 275 million available in the sale. During the pre-ICO period, a maximum 100 million TradeTokens were said to be sold at a price of 1 ETH (or fiat equivalent) which equates to 200 TradeTokens. Indeed, as with all ICOs, the outcome of this is completely non-transparent and FXPRIMUS involvement in this has extended to the employment of various members of FXPRIMUS staff at the Trade.io operation alongside advisory board members that include organizers of Cyprus based FX industry events and former binary options fraudsters.

When attempting to approach FXPRIMUS to ascertain the reason for the staff exodus, the phones were not answered, even on the main customer service telephone number, and a representative of FXPRIMUS that we contacted via the company’s live chat facility explained that “we do not disclose that information as this is an internal matter.”

Further sources including former employees contacted by FinanceFeeds confirmed the redundancies, however were unable to confirm the reasons, other than calling it ‘spring cleaning’.