Exclusive: PrimeXM’s liquidity integration with MetaTrader 5 in detail – The new multi-asset direction of retail broking

Today, PrimeXM and MetaQuotes demonstrated their fully integrated MetaTrader 5 order routing and custom liquidity management system for multi-asset retail trading. We take an exclusive first look in great detail with senior executives from MetaQuotes and PrimeXM

Today, in Limassol, Cyprus, which has now proven itself as more than a center for retail FX brokerages, but the world’s major off-the-shelf trading platform development center.

Cyprus has developed its fully comprehensive retail FX service provision to such a refined degree that it now hosts full end to end solutions for brokerages, and today marks the launch of a very important milestone, that being the integration of PrimeXM‘s XCore liquidity management system into MetaTrader 5.

This afternoon, Richard Bartlett, Global Head of Sales at PrimeXM and Anthony Papaevagorou, Head of Sales at MetaQuotes Software, developer of the MetaTrader 5 platform, convened in order to provide full detail with regard to the customizable access to multi-asset live markets that will be available to brokerages, as well as the methodology which allows MetaTrader 5 server owners to provide their own liquidity solution to other institutions and retail brokerages.

Introducing the development to the FX industry, Mr Papaevagorou explained “MetaTrader 5 is most certainly the way to go. I can elaborate on why it cannot be compared to MetaTrader 4, and I will go through the means by which MetaTrader 5 providers can connect go global liquidity providers.”

Why MT5?

Unlike MetaTrader 4, MetaTrader 5 is a multi-asset platform, allowing all types of markets including exchanges to be connected to one trading environment. Everything is unlimited so therefore brokers can work with unlimited symbols, groups and venues” said Mr Papaevagorou.

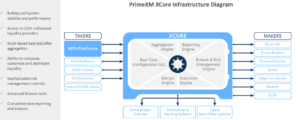

Mr Bartlett expanded on this, explaining PrimeXM’s raison d’etre as an FX connectivity and hosting provider. “It is important to note that we are not just a bridge or gateway firm. We offer hosting to companies which operate across global markets and our XCore product is an end to end smart order routing system.”

“Additionally, an important factor is that we have established our own global infrastructure with 120 connections to banks, ECNs, liquidity providers and datacenters, those being NY4, LD4, TY3, which are the geographically important locations, therefore we made dedicated connections to these areas” continued Mr Bartlett.

Mr. Papaevagorou further explained why the MetaTrader 5 solution is geared toward this multi-faceted trading environment alongside the PrimeXM XCore system. “For those brokers with a full system license instead of white label, full control over system settings is allowable as is the option to work with any liquidity provider of choice. This enables the brokerages to maximize their profits as they will not be sharing profits with third parties as they would be if they were white label customers.”

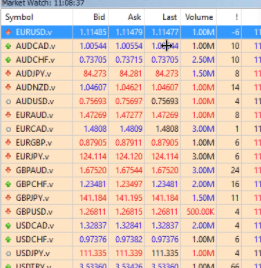

Presenting the crucial points that are relevant to PrimeXM XCore technology, Mr Papaevagorou highlighted the differentiation of MetaTrader 5 in this regard. “To start with, while viewing the MarketWatch function, the main advantage on MetaTrader 5 is that brokers can offer unlimited symbols. This is a great advantage with PrimeXM as this can be connected to multiple sources which means several thousand trading products, representing a versatile range whether its FX pairs, indices, metals, stocks, or commodities” he said.

Mr Bartlett added on this point “Companies can pick and choose the liquidity providers and add as many to the same system as required. Similarly, brokers have strict cotnrol over their liquidity via the front end graphical user interface and different types of liquidity streams that can be channeled into MetaTrader 5. Brokers can also manage white labels this way if they are a MetaTrader 5 server owner.”

Essentially, any liquidity provider in the world can be added.

Mr Bartlett was very keen to highlight an important factor, that being that PrimeXM does not charge maker fees. “This allows firms to negotiate the best commissions” he said. “On the same lines, we can offer a centralized location as well which allows for the scalability to offer liquidity to any type of client from institutions to retail brokers.”

Mr. Papaevagorou explained the rationale behind the recent updates that have been made to MetaTrader 5. “The reason we added the new ‘tick data’ section for each symbol is that in the near future we will launch new data feed function that will allow traders to create their own synthetic symbols. The more products you are working with through PrimeXM, the more products you have access to” he said.

This converges with the customizable aspect explained by Mr Bartlett.

“We have now provided an extended detail section, where users can see categories such as Bid High, Bid Low, Ask High, Ask Low. If a trader right clicks on symbol specification, he can see all conditions based around each trading product” said Mr Papaevagorou. “If connecting via PrimeXM to a Tier 1 trading environment, all order prices which are all available on the market they are trading on are viewable” he said.

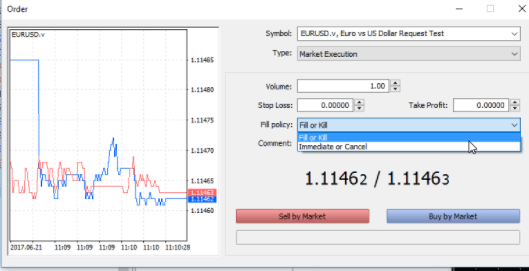

“As demonstrated here, we have now a ‘fill or kill’ function, which I can best explain by asking you to imagine that a trader buys 20 lots, but only 15 are available. In this circumstance, the available 15 would be filled, and the remaining 5 would be canceled” said Mr Papaevagorou.

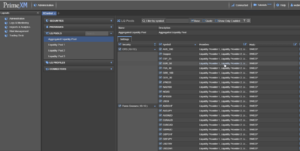

Mr Papaevagorou stated “As far as system administration is concerned, there are three main things to consider when working with liquidity providers, those being our Gateway section, Group section and Routing sections on MetaTrader 5.”

“Of utmost importance is that a gateway connection is always required, and that way users can define which symbols can be traded through that gateway. The parameters that are selectable in this section of the platform allow users to add any specific parameters that would be provided from PrimeXM” he said.

“This includes, but is not limited to, which groups of clients a broker would like to set to use ‘straight through processing’ (STP), the creation of such groups that can be passed through the gateway as one specific execution type, and routing procedure in which the system provides each client with a personal order routing system that allows brokers to decide which types of traders would be routed through a specific gateway” said Mr Papaevagorou.

Mr Bartlett then explained “When looking at the techological topography of the MetaTrader 5, it is a parallel processor, meaning that it does not process sequentially and can handle thousands of orders per second. It can operate custom liquidity feeds, on a per symbol level, and our gateway is fully inhouse developed, meaning it uses absolutely no third party components and has been developed in conjunction wth MetaQuotes who have tested it to maximize all that MetaTrader 5 offers.”

Mr Papaevagorou highlighted this further, saying that “There is a timeout management function, for example. This manages order time outs if there is an internet connection error. There is a further section which displays which groups of clients are set to be executed on an STP basis through a gateway, and different types of groups are viewable. Users can of course create specific specific groups that can be passed through the gateway.”

“The clever part of the routing section is where you can add conditions, can give different types of conditions, and can define which type of trading account is offered, meaning that brokers can select specific accounts to be sent on an STP basis to PrimeXM” said Mr Papaevagorou.

Mr Bartlett then said “In addition we are able to offer institutional grade hosting for MetaTrader 5 within this framework, so that clients can access the entire front to back system, right through from trade processing, hosting, execution, to integration.”

“Each and every XCore system is a dedicated environment built for each client” said Mr Bartlett. “Therefore it is like being in your own dedicated FIX environment that is connected the worlds liquidity providers. Any liquidity provider can be added so therefore any provider in the world can be accessed” he said.

“The key aspect is the aggregation engine which is used by 200 hedge funds, brokers and institutions. The benefit of this is that by aggregating liquidity providers it creates competition to fight for flow so they have to stream better bid/offer prices to make tighter prices to pass on to clients.” – Richard Bartlett, Global Head of Sales, PrimeXM

“In today’s environment, efficient global connectivity is vital. It is a major advantage that we have dedicated global infrastructure linked in one network via low latency fiber lines. This is important for operations on global level and for extending connectivity to end clients using the framework of lease lines. Clients tend to host platforms with us too, as these are arranged as a colocated set up with the platform and liquidity providers all colocated, managed and owned by PrimeXM, with us providing software but also managing the network” said Mr Bartlett.

“This way, firms can leverage our hosted solution and securely offer reliable execution to clients” said Mr Bartlett.

Mr Bartlett explained the recently established low latency lease line in mainland China which PrimeXM has established.

“When brokers attempt to connect to mainland China, they are faced with many challenges” he said. “Our locally hosted lease lines have two key benefits, the first being that it bypasses the Chinese internet firewall as clients connect within China to a solution that is based in the mainland and therefore is inside the national firewall, therefore it is considered local traffic as far as authorities are concerned. The second is that overseas lines coming into China, even if not blocked by the government, are unreliable and subject to vast latency due to government surveillance, and this has a negative effect.”

Mr Bartlett demonstrated how users are able to generate separate XCore accounts. For example, brokers can run A book or B book execution models and operate different settings for each account. This means that they can do partial B booking down to symbol level, and then the system will sweep the order book and give the same prices and execution times on both A and B Book, therefore giving a consistent experience, which is backed up by a logs and monitoring section that shows how all liquidity providers are connected, and view the entire health of the system.

“If, for example, a clinet complains to a brokerage about slippage, the broker can access granular reports on each section, as the broker has access to all logs that the XCore system captures. Those include the deal and the liquidity aggretation. They can see a view of the running margin and exposure with different liquidity providers” said Mr Bartlett.

“Users can simply enter the balance amount of a specific liquidity provider and then the system keeps track of the running margin with each liquidity provider by working from the margin engine. This can then be used in a risk management environment in which brokers can set different cients into a risk pool and it will B book up to a certain risk level and automatically switch to A book thereafter, whilst providing all information for running profit and loss and market exposure” explained Mr Bartlett.

Also, brokers using this system will have the ability to set pre-aggregation mark ups. “If you are a broker working with two liquidity providers and want to favor one over other, and want to skew prices, you can make markups on the bid/ask level. You can then apply the commission charged from each liquidity provider on each instrument. The system then sees the two prices provided by each liquidity provider and notes that they are the same, so it then looks at the commission to see which is the cheapest for the broker. It then executes the one with the lowest commission” said Mr Bartlett.

“The same principle applies with mark up profiles” he continued. “There are different markups for different scenarios with different clients, therefore brokers can apply different settings and minimum and maximum spread parameters to manage slippage, and can control the behavior of the system and how it responds to market conditions.”

In summary, this solution empowers brokerages that would otherwise have to spend a fortune in developing their own proprietary front to back trading solution and order routing engine, and in doing so is poised to propel the multi-asset retail electronic trading industry into the future.