FastMatch revisited after symmetrical “last look” announcement – Inside investigation

The Electronic Communications Network (ECN) partially owned (just below 40%) by North American electronic trading stalwart FXCM, hit the headlines ever since the SNB peg removal in early 2015. Besides of rumours that FXCM were selling their share to balance their financials, FastMatch had announced in March 2015 free brokerage to non-bank market makers in […]

The Electronic Communications Network (ECN) partially owned (just below 40%) by North American electronic trading stalwart FXCM, hit the headlines ever since the SNB peg removal in early 2015.

Besides of rumours that FXCM were selling their share to balance their financials, FastMatch had announced in March 2015 free brokerage to non-bank market makers in an aggressive attempt to increase market share and privileging clients that offer liquidity on the platform via orders instead of quotes.

By the end of 2015, FastMatch hardened its stance on “last look” by requiring symmetrical last look on the ECN to every single client in order to remove the risk of dishonest market making.

That particular announcement came one month after the New York Department of Financial Services fined Barclays $150 million for abusing “last look” practices in which the firm rejected unprofitable trades and lied to clients about the reasons, while giving clients a false sense of security as to what the market price actually is.

The possibility of liquidity providers to give a last look before executing a trade is somewhat frustrating to many clients, in risk of facing slippage.

ndependently of market makers’ need to protect against trading on stale prices due to latency and from high frequency trading clients, technology and sophisticated risk management has taken the industry to a level that can automatically hedge its spot FX exposure.

Still, some firms may need to use “last look” for now, but in order to keep companies from give in to temptation of rejecting unprofitable trades, “symmetrical last look” as a motto and a requirement was cheered by market participants that celebrate more transparency.

A group of central banks, including the Bank of England, are preparing a rule book to govern FX trading everywhere and is expected to be published in May 2017. ECNs other than FastMatch have already changed policy regarding “last look”, such as FXall and Hotspot limiting the practice, the latter one from 200 milliseconds to 100 milliseconds. FastMatch is the only to require symmetrical “last look” to clients that don’t use the “no last look” model.

FinanceFeeds reporter Ricardo Esteves spoke today to Dmitri Galinov, CEO at FastMatch Inc., to learn what changed in the firm’s activity and market share since the decision of requiring symmetrical “last look”.

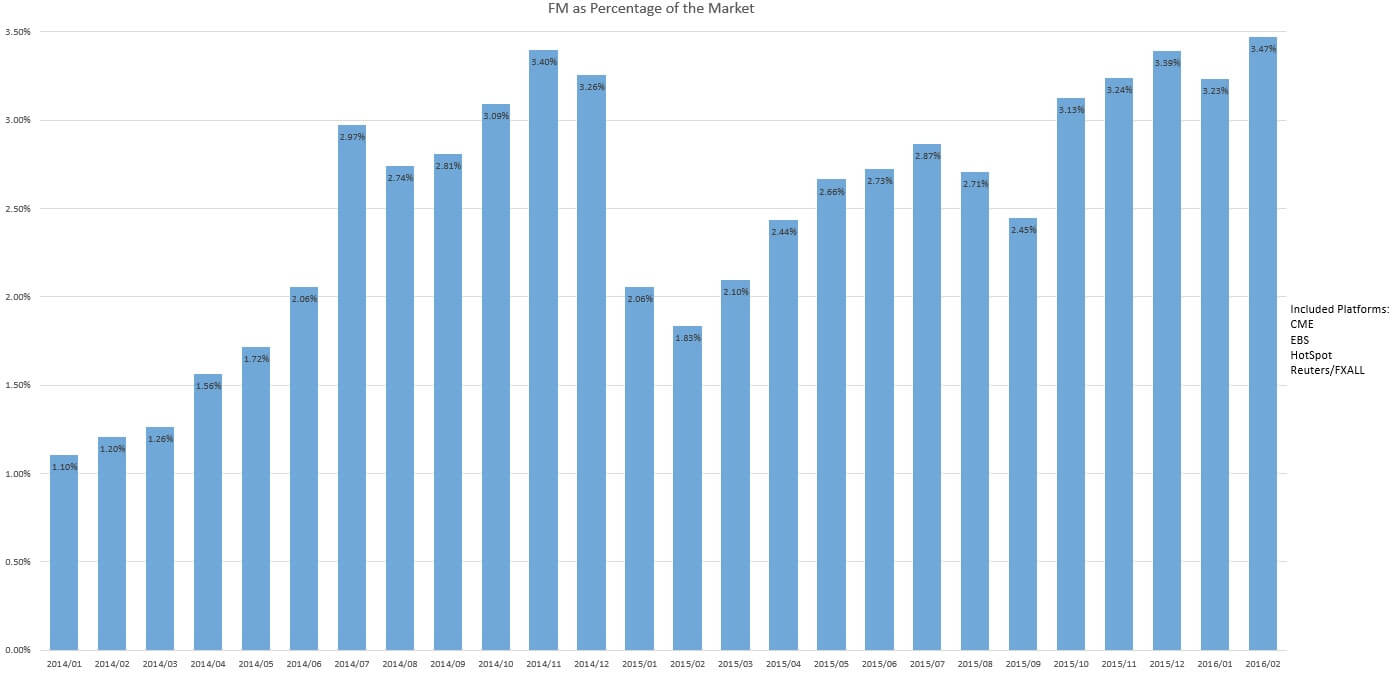

How did FastMatch market share evolve in the last three months?

“The market share is slightly up from the beginning of the year. Reduced fees started to play effect, but it takes time for clients to see smaller bills and adjust their long term behavior.”

What was the general response of market makers?

General response of the market makers was positive, most of them are confident they can operate in the new structure.

How many decided to leave because of the mandatory symmetrical last look?

We only had one market maker decided to stop quoting because of the new requirement. We also had another market maker to switch from last look quoting to no last look quoting as a result of the requirement.

With a nearly unchanged market share against its main competitors since the start of 2016, FastMatch’s volume this year is averaging 14% of CME, 37.2% of Hotspot, and 133.1% of GTX.

Photograph: Park Avenue and 57th Street, New York. Copyright FinanceFeeds