FCA data: FX/CFD/Spreadbetting complaints account for 5% of all investment complaints in H1’2017

The data on complaints reported by FCA-regulated firms show 3,471 complaints concerning FX/CFD/Spreadbetting were opened in the first half of 2017.

The Financial Conduct Authority (FCA) has earlier today posted some numbers concerning complaints received by companies it regulates. The data show 3,471 complaints concerning FX/CFD/Spreadbetting were opened in the first half of 2017. They account for 5% of the total number of complaints filed by clients of investment firms.

Concerning the investment firms data, 38% of investments complaints were closed within 3 days, compared with 35% in the second half of 2016, so there is a small improvement in this dynamic. Furthermore, 93% were closed within 8 weeks compared with 92% in the second half of 2016. On the downside, however, only 49% of complaints were upheld, the lowest of all the product groups.

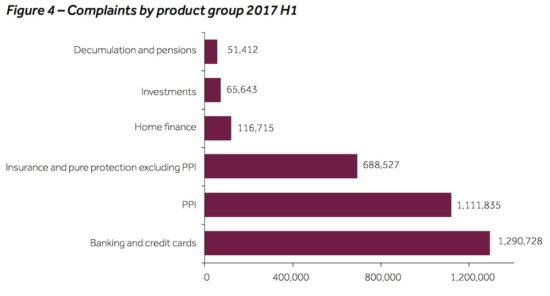

Looking at the overall picture, across all product groups, between January and June 2017 a total of 3.32 million complaints were received by 3,160 firms, up from a total of 2.06 million complaints reported by 2,796 firms in the corresponding period in 2016.

Most complaints were closed within 8 weeks (96%) and 43% of all complaints received in the first half of 2017 were closed within 3 days.

In August this year, the UK Financial Ombudsman Service reported no enquiries about foreign currency products & services were received from consumers in the quarter from April 1, 2017 to June 30, 2017.

The zero such enquiries for the period in question compare to 252 foreign currency enquiries received during the whole year to March 31, 2017. Of these, 26 were referred to an ombudsman for a final decision and the rate of complaints upheld in favor of consumers was 36%.

During the April-June 2017 quarter, the number of spread betting enquiries received was 66, up 20% from the 55 enquiries received by the Ombudsman in the corresponding quarter a year earlier. The number of complaints referred to an ombudsman was 37 in the three months to June 30, 2017. The portion of complaints upheld in favor of consumers, however, was relatively low at 15%.

Regarding derivatives, the Financial Ombudsman received 50 enquiries in the April-June 2017 period, down by nearly 37% from the same period in 2016. The number of complaints referred to the ombudsman was 39, with the percentage of complaints resolved in consumers’ favour being 28%.