FCA passporting data show no indications of firm responses to Brexit

The passporting data for the quarter to end-September 2018 does not point to any firm responses to Brexit.

The UK Financial Conduct Authority (FCA) has earlier today published its latest quarterly KPIs which concern the three-month period until the end of September 2018. These Authorisations Quarterly Key Performance Indicators (KPIs) provide key metrics on the performance of the FCA’s Authorisations Division.

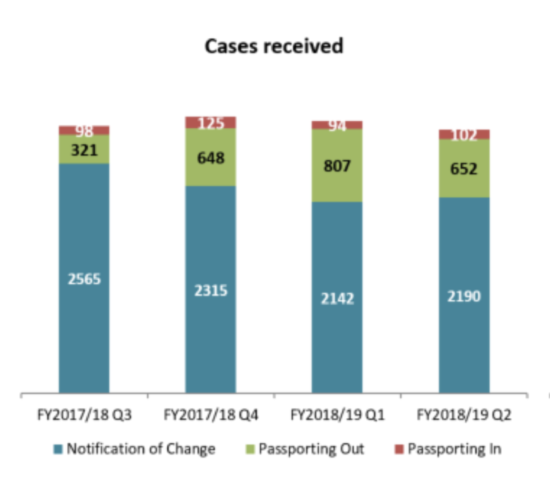

Given the dynamics around Brexit, the FinanceFeeds’ team has been eager to take a look at the passporting data. The numbers show that cases received have dropped for the third quarter in a row in the second quarter of fiscal year 2018/2019. However, the reductions have been negligible.

As one can see from the chart below the number of “passporting in” cases in Q2 2018/2019 was 102, whereas the number of “passporting out” was 652.

“There are no clear trends indicative of firm responses to Brexit”, the FCA says.

Let’s note, however, that the data concern the quarter July-September quarter, which means that the numbers are not affected by the most recent announcement made by the FCA. In November, for instance, Nausicaa Delfas, Executive Director of International, and a member of the Executive Committee at the FCA, said more than 1,300 firms and funds were interested in the proposed temporary permissions regime (TPR).

The UK regulator published a consultation on the proposed temporary permissions regime in October this year. The regime is set to allow EEA firms and investment funds to continue to carry on regulated business in the UK for a limited period after Brexit while they seek full authorisation in the UK. The consultation paper sets out how the FCA expects the regime to work in practice, how firms and funds can enter it, how long it will operate for, and the rules the regulator proposes should apply to firms and fund marketing activities during the regime.

Put briefly, firms should register between January and March 2019 for the temporary permissions regime, and it will apply for a maximum of three years. Firms will be given with ‘landing slots’ within which they’ll need to submit their authorisation application. While in the scheme, the FCA proposes to operate a system of substituted compliance for certain new rules which impose obligations, so that in most cases firms will not need to start complying with the full UK implementation of a given rule until the point at which they become UK authorised.