FCA publishes data on UK retail intermediary market situation in 2018

Total reported annual revenue from retail investment business increased by 12% between 2017 and 2018 (from £3.95bn to £4.42bn).

The UK Financial Conduct Authority (FCA) has published its latest analysis of the intermediary sector based on data drawn from the Retail Mediation Activities Return (RMAR). The analysis gives an update on firms in the retail intermediary sector based on data for 2018.

Revenue earned by intermediary firms increased in 2018 compared to 2017, continuing the trend seen in recent years. Revenue earned by mortgage, retail investment and non-investment insurance firms increased by 16%, 12% and 8% respectively in 2018.

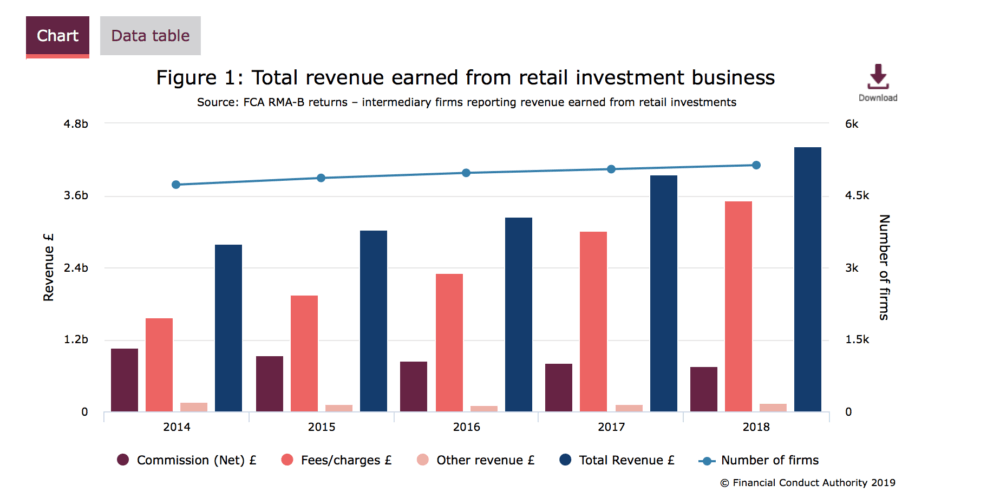

Total reported annual revenue from retail investment business increased by 12% between 2017 and 2018 – from £3.95 billion to £4.42 billion. Revenue for 2018 is up by 58% on 2014 and the number of firms reporting revenue (5,131) up by 9% over the same period.

Commission declined further as a source of revenue for retail investment businesses, accounting for 17% of revenue earned in 2018 compared to 20% in 2017. This continues the trend seen since the implementation of the Retail Distribution Review (RDR) at the end of 2012.

The regulator notes, however, that commission remains the dominant source of revenue for mortgage and insurance broking, accounting for 79% and 84% of revenue respectively.

Nearly all (96%) of financial adviser firms reported making a profit with total pre-tax profits up to £872 million from £698 million in 2017. The bulk (73%) of firms with over 50 advisers reported a profit, but across the firms of this size an aggregate loss of £18 million was reported due to significant losses reported by a few firms.

The proportion of revenue earned by financial adviser firms from restricted advice has been increasing relative to fully independent advice, up from 33% in 2016 to 37% in 2018.

Small firms remain a significant part of the intermediary sector. Nearly 9 in 10 financial adviser and mortgage broker firms have 5 or fewer adviser staff. Over 6 in 10 financial adviser and mortgage broker firms are required to hold only the minimum base capital specified for their type of business.

Premiums paid in 2018 for renewal of professional indemnity insurance (PII) cover remained steady as a proportion of revenue (around 1.5% across all firm types). The smallest firms pay a higher proportion of their revenue at around 4%.

Firms that provide advice on, or arrange, mortgages, insurance policies or retail investment products for consumers have to provide information about their activities on the RMAR. The FCA uses this information to help it supervise the activities of these intermediary firms and inform the FCA’s other regulatory functions. The regulator has published data from the RMAR since 2016.

Typically, up to around 12,000 firms complete at least one element of the RMAR, ranging from sole traders up to large broker companies and adviser networks, the FCA explains.