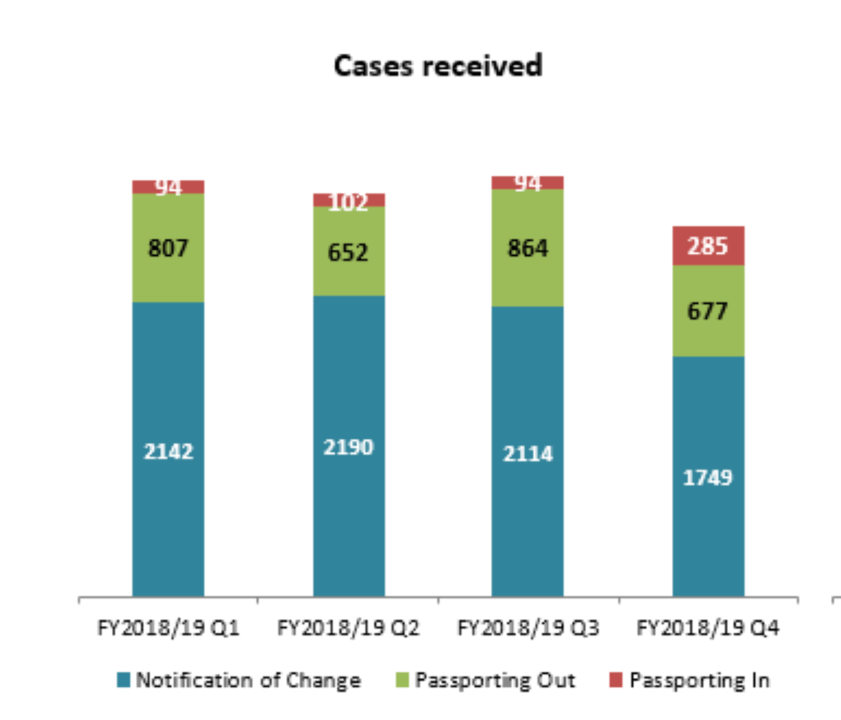

FCA registers rise in “Passporting In” notifications from EU firms in Q4 FY2018/19

There was an increase in Passporting In notifications from EU firms looking to take advantage of the Temporary Permissions Regime.

The UK Financial Conduct Authority (FCA) has earlier today posted the Authorisations Quarterly Key Performance Indicators (KPIs) for the final quarter of FY2018/19. The data provides an insight into the work of the FCA’s Authorisations Division during the three months to end-March 2019.

The data shows a drop in the overall volume of passporting cases received in Q4. The most significant fall was in outbound passporting applications. However, this was partially offset by an increase in “Passporting In” notifications from EU firms looking to take advantage of TPR (Temporary Permissions Regime). The number of “passporting in” cases rose to 285 in Q4, compared to 94 in Q3.

Earlier in May, the FCA confirmed the extension of the deadline for notifications for the TPR to October 30, 2019.

As previously guided, TPR would allow EEA-based firms passporting into the UK to continue new and existing regulated business within the scope of their current permissions in the UK for a limited period, while they seek full FCA authorisation.

This regime will also allow EEA-domiciled investment funds that market in the UK under a passport to continue temporarily marketing in the UK. The deadline for applying to the Trade Repository and Credit Ratings Agencies has also been extended to the same date. For EEA payment services and e-money firms, the notification window for temporary permission is closed, but it will open again under the relevant HM Treasury Regulations on July 31, 2019 and end on October 30, 2019.

Nausicaa Delfas, Executive Director of International at the Financial Conduct Authority said:

‘The FCA continues to plan for all Brexit scenarios, which includes a no-deal Brexit. Extending the deadline for firms to notify the FCA they want to enter the TPR is part of this ongoing work. It is important that firms also continue to plan for all scenarios, including the possibility of a no-deal Brexit at the end of October 2019.