FCA-regulated Emma launches stock trading ahead of crypto, commodities, forex

Emma has added commission-free stock trading to its “financial super app” which soon will expand to cryptocurrencies, commodities and forex.

Emma has added commission-free stock trading to its “financial super app” which soon will expand to cryptocurrencies, commodities and forex.

The FCA-regulated budgeting app quickly grew its user base to more than 1 million customers in the United Kingdom after first catering to 30,000 early birds who registered on the waiting list.

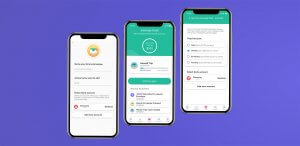

Emma allows users to see all their financial life in one single platform, track day-to-day spending, and set budgets. With the launch of Emma Invest, customers can access more than 2,000 fractional global stocks and trade in real-time, commission-free.

Emma Invest enables users to track stocks with watchlists, view stocks under categories like top trending, female CEOs, biggest daily movers, view the latest market news and more.

Emma goes from budgeting to multi asset trading

Edoardo Moreni, Chief Executive Officer of Emma, said: “Emma was built to empower millions of individuals to live a better and more fulfilling financial life. Our plan has always been to bring access to financial services closer to our users. We are thrilled to be able to release commission-free trading. Investments will be just one of the many verticals we will fully integrate with Emma. Our team is working on a savings account which we plan to release by the end of the year.”

The firm announced it is working on expanding Emma Invest’s trading offering beyond stocks in order to include cryptocurrencies, commodities, forex.

In addition, the investment platform will soon include Social Trading to allow users to share their investments, see what their friends are doing and help build a stronger retail investors ecosystem across Europe.

The Financial Conduct Authority approved Emma only one month after the app’s launch of the beta version with the goal of operating as a wealth manager, an artificial intelligence that sits between users and their financial services.

The London-based firm calls itself the “banking app for millennials” and has already integrated several financial services firms, including challenger banks Revolut and Monzo.

Emma is an anagram of the initials of its founders (Marino and Edoardo Moreni, who met at the University of Manchester).

The firm is taking advantage of the UK’s new Open Banking initiative stemming from the updated Payment Services Directive (PSD2) and designed to promote competition in the sector by forcing banks to allow challengers secure access to their customer details.