FCA’s Brexit impact assessment outlines risks associated with loss of passporting

In the short term, the loss of passporting creates a number of cliff-edge risks, such as a need for firms to secure regulatory permissions to service existing and new business.

The UK Financial Conduct Authority (FCA) has earlier today published its “EU Withdrawal Impact Assessment” in response to a request by the Treasury Select Committee. The document outlines the major risks and challenges for the UK financial services industry, as seen by the FCA.

If the EU and the UK do not ratify a Withdrawal Treaty in time for March 29, 2019, absent any alternative agreement, the UK would leave the EU with no implementation period. In a financial services context, this would translate into defaulting to a “third country” relationship, with market access determined under World Trade Organisation (WTO) rules and EU or national Member State rules, the FCA explains.

The regulator warns of the consequences of loss of passporting. Under a passporting regime, financial services firms established and authorised in any EEA Member State have access to the single market for the relevant financial services.

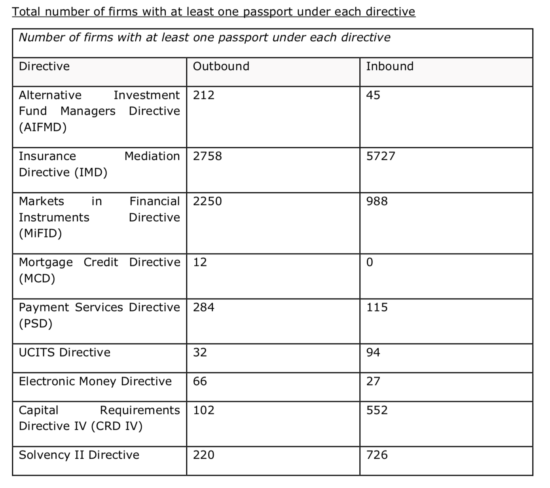

A summary of the volume of cross border passports included in the FCA’s previous correspondence with the Treasury Select Committee shows there are 8,008 EEA firms with passports allowing them to undertake business in the UK, and 5,476 firms in the UK hold passports allowing them to undertake business across the EEA. When the UK leaves the EU, passporting rights will cease to apply.

“If the EU and UK do not take action to manage risks caused by the loss of passporting, existing cross-border flows of business may be disrupted on the UK’s exit on 29 March 2019”, the FCA warns.

In the short term, the loss of passporting creates a number of cliff-edge risks, such as a need for firms to secure regulatory permissions to service existing and new business. Without this, firms may lose the ability to conduct cross border business, which creates legal and operational risks.

Furthermore, in such a scenario, EEA and UK firms may also be unable to trade certain securities across both jurisdictions. This could lead to a fragmented market as UK and EEA firms would no longer be able to use the same pool of liquidity. Over time, this could have a harmful impact on financial services markets more widely, through reduced competition and increased costs for consumers in both the EEA and UK. A potential reduction in the depth of the markets available to UK and EEA participants could also result in higher costs or make it more difficult to execute larger transactions, according to the FCA.

In the short term, the regulator expects the the risks to be low although specialist markets may be disproportionately affected. Over time, more significant restructuring could affect markets more widely.

The FCA expects the loss of passporting to have consequences for outstanding cross-border contracts. The performance of many contractual obligations agreed before exit is unaffected by the UK’s withdrawal. However, the performance of certain activities that are linked to those contracts may be subject to authorisation in certain Member States.

After the UK’s withdrawal, firms may need to get local authorisation to service existing cross-border contracts. An FCA analysis to date suggests the impact is most significant in the insurance, uncleared OTC derivative and cleared derivative markets. There are also potential risks to financial stability and consumer protection – in particular in the EU – if firms cannot service these contracts.

On the brighter side, the FCA, Bank of England and Government have taken action to manage risks in the UK. This includes setting up a temporary permissions regime (TPR), which will allow inbound EEA firms and funds that want to continue operating in the UK after exit to continue to operate as before, including carrying on new business, while applying for full authorisation in the UK.

In terms of customer protection, the FCA is proposing to extend the reach of FSCS cover to include more EEA firms so as to help maintain protection for UK consumers.