FinanceFeeds detailed review of 2017 – October to December. MT4 and its ubiquity, a highly opinionated podcast, keeping your brokerage safe from malice & hogwash from CySec

As 2017 draws to a close, we look at the important details that shaped the industry this year, continuing with April to June as the first part in a four part series this week. FinanceFeeds remains committed to detailed reporting from within the industry’s major centers and continuing to work closely with the most important companies that shape the entire future of this business internationally.

2017 has been another very eventful year, however there have been some distinct differences between the past twelve months and the developments that have formed the commercial landscape for the majority of this decade.

In particular, the entire spectrum of the FX industry does not resemble its structure at the end of the last decade, when MetaTrader 4 was in its relative infancy and a plethora of small brokerages made their way onto the retail market, as nowadays, a combination of consumer wisdom, regulatory understanding in some of the more important regions, and a need to elevate the standard of smaller brokerages with third party solutions away from the ‘second tier’ status that they have held until now in the shadow of the large, publicly listed companies in the world’s most technologically advanced major financial centers.

FinanceFeeds has committed vast resources to reporting and conducting research from within the companies that lead this industry worldwide, a matter which we consider as vital as working with our esteemed and high level partners whose expertise and engagement assist us in providing the absolute detail on every aspect of developments in this business globally.

In this four-part series this week, FinanceFeeds takes a detailed look back at the events of the year that have been influential and changed the direction of our industry, in chronological order:

September 2017

The ubiquitous off the shelf retail FX trading platform which brought to fruition a combination of 1231 active retail brokerages and white labels has been the darling of the small firms located in second tier regions such as Cyprus, the CIS and the developing economies within the APAC region, as it has given them very low entry barriers, and has equally been the bete noire of some of the most esteemed brokerages in first tier regions including America, Australia and Britain whose prowess and holistic understanding of the electronic trading business encompasses vast R&D and ultra sophisticated trading systems.

In some cases, it is fair to say that MetaTrader 4 is a quick and ready solution for smaller firms to approach new markets, and also for them to easily onboard client bases of other firms due to the familiarity of the trading interface and its compatibility with externally developed software such as Expert Advisors (trading robots).

In Japan, however, where domestic firms dominate and just four large companies account for 40% of all retail FX volume worldwide, MetaTrader 4 has become non-existent.

The need for proprietary platforms in the world’s largest domestic retail FX market is paramount, just as it is in the United Kingdom and North America, and in September this year, FinanceFeeds reported that ArenaFX was the final broker to terminate its MetaTrader 4 based solution.

The Japanese Forex industry is famous for its conservatism and domestic focus. That is why it is rarely surprising when Japanese FX brokers put an end to a service that is not originally Japanese.

The company attributed the move to “Forex restructuring” and set September 30, 2017, as the deadline for closing all positions on the platform.

ArenaFX has been offering MT4 trading to its clients since early 2013. The decision to terminate the MT4 offering will affect both live and demo accounts. The company has already stopped accepting applications for new MT4 accounts.

Several Japanese Forex brokers, including Japan’s retail FX giant Monex Group, Inc. (TYO:8698) and YJFX, a subsidiary of Yahoo Japan Corporation (TYO:4689), have stopped offering MetaTrader 4 earlier. YJFX said back in the fall of 2014, when it announced its plans to terminate the offer of MT4, that its decision was sudden and gave no specific reasons for the move. After abandoning MT4 in the autumn of 2014, Monex focused on the development of its proprietary platform TradeStation.

MT4 is still on the menu of a number of Forex brokers operating in Japan, including the Japanese subsidiary of OANDA, as well as Forex.com Japan, a subsidiary of Gain Capital Holdings Inc (NYSE:GCAP). Speaking of which, let’s recall that Forex.com Japan is about to change some of the MT4 servers. The upgrade is scheduled for August 12, 2017.

October this year was a month in which the highly effective nature of Chinese social media made its presence felt, this time with Australian brokerage IC Markets as its target.

On October 12, following the Chinese national holidays which began on October 1 and finished on October 8, speculation has begun to emerge that there are difficulties being experienced by traders in China wishing to make withdrawals from IC Markets.

FinanceFeeds China received several reports from within the mainland, from a series of brokerages as well as large IBs, highlighting concern over what appears to be a backlog in withdrawal processing by IC Markets.

The rumor appeared at the time to have stemmed from one of IC Markets’ large introducing brokers (IBs) in China, and, as is often the case, has made its way across brokerages and into retail FX forums, as this is how commercial grievances are often handled in China.

One particular representative of a large, Western brokerage with several offices in China approached FinanceFeeds today with the bold claim “We understand IC Markets to be having troubles with Chinese IBs” and considered this to be ‘news.’

Within a few hours of such rumors having circulated, FX110.com, which is a Chinese retail portal that calls itself the ‘Forex Police’ had published a notification that “IC Markets clients are able to withdraw but support team responses are very slow.”

“Currently, what we understand is that the head of the firm’s Chinese office has moved to Europe, and the Chinese branch will move to Hong Kong, and client support will be moved to IC Markets in Australia” is the supposition that has been published on Chinese media.

FinanceFeeds contacted IC Markets with regard to this matter, and explained that it is understood among many Chinese IBs that there is a backlog of over 100 withdrawals, which are not being executed in a timely manner.

IC Markets response was “Unfortunately we cannot control the rumors. They may have stemmed from our competitors, and there is no backlog of withdrawals, only client emails due to the holidays.”

Whether this is the case or not, there is certainly some credibility in IC Markets’ response, because the allegation that the firm is ‘not paying its largest IB’ did indeed emanate from another brokerage, itself not in the best condition, which relies on China for its survival.

With regard to the assertion on FX110.com that IC Markets is restructuring, IC Markets categorically maintains that this is not the case at all, and that its operations will remain as they are currently, with full support in mainland China, and that the firm’s senior executives have not moved from the company.

Quite simply, this reaction has been brought about by media speculation in China, and by customers who have experienced a longer customer service response time than is usually the case, however, given the holiday in China and the sheer volume of business in China.

Some speculators have publicly broadcast that there are up to 400 customers waiting for withdrawals, which is absolutely demonstrative of the escalation of dramatic guesswork that is currently pervading the airwaves from Shanghai to Shenzhen.

IC Markets confirmed to FinanceFeeds on October 12 that there were no delays and they are covering the withdrawals, albeit slowly, citing a shortage of staff as a reason for this following the week-long holiday in China.

“There are no delays with withdrawals and all trading accounts are operating as normal” said the IC Markets executive.

Whilst not quantifying the exact number of customers affected, FinanceFeeds explained that there is speculation that up to 400 customers have experienced slow withdrawals, to which IC Markets replied “yes indeed, we are processing these normally.”

“We are just trying to reassure clients that everything is fine. As you can see, you got straight through to us. If the withdrawal request is received before 01:00 GMT (12:00 AEST) it will be processed on the day of receipt. If your withdrawal request is received after this time it will be processed on the following business day” – IC Markets

Concluding, IC Markets explained “Please don’t beleive everything you read online. Everything is fine, it is business as usual for us, and all clients who have contacted us will be replied to as soon as possible.”

Insidious or benign, the media is a very quick platform within China to which IBs and clients take in order to flex some degree of power and advance their cause.

Whilst this appears to be very much a storm in a teacup, ASIC, the regulatory authority under which IC Markets operates, may stipulate specific withdrawal timescales, however when customers outside the Australian jurisdiction are concerned, this is not enforceable.

As a brokerage, protecting your technological infrastructure is as vital as operating a successful brand and ensuring good conduct toward clients.

As summer gave way to fall, FinanceFeeds looked at a serious matter that had affected several brokerages in the form of a DDOS attack, with many executives that spoke to us considering that it had been transmitted by an industry-specific VPS provider that recently gained a high profile status with a series of investments and an IPO prospectus.

Distributed denial of service attacks – or DDOS attacks – on commercial technological infrastructure are a bugbear which has blighted the world of international business for some considerable length of time.

This terminology refers to the attacking of a corporate information technology system in which the perpetrator seeks to make a machine or network resource unavailable to its intended users by temporarily or indefinitely disrupting services of a host connected to the internet.

Denial of service is typically accomplished by flooding the targeted machine or resource with superfluous requests in an attempt to overload systems and prevent some or all legitimate requests from being fulfilled, and has been a common method used by those with malicious intent toward a specific industry, or on a more macro scale, a company toward which a grudge his held, or to attempt to eradicate competition.

Whilst it is a great shame that in this age of sophistication and the availability of all resources from which to educate oneself continuously that fully grown adults still feel the somewhat primitive need to attack their competition via malicious activities rather than raise their own standards to be able to be part of a diversified range of services that contribute to a great and continually advancing industry sector, it unfortunately does exist.

This week, the increase in DDOS attacks on retail brokers has been a subject of investigation by FinanceFeeds, and something to be wary of, especially from within the boardroom of retail FX brokerages toward whom these have been directed.

This time, one of the channels via which the attacks have been distributed is via ancillary services such as VPS providers, once again highlighting the need for brokerages to ensure that they form partnerships with only the very well recognized firms in the industry that are specialists and understand how to develop their topography as well as their support and protection systems in a way that is completely tailored toward the infrastructure used within retail FX brokerages and its connection to the outside world – usually liquidity providers and automated trading systems.

In FinanceFeeds experience, there are three bona fide, industry-standard providers in that sector, those being oneZero, PrimeXM and Gold-i.

All three of these companies fully understand how to design and host an industry-specific liquidity management system and order execution solution that is completely integrated with the retail platform and is completely aligned with the systems used in the liquidity providers and live market to which it connects.

If taking a full solution from a brokerage with its own proprietary software, then that should be firmly stuck to, without attaching unsupported third party systems to it.

In October this year, FinanceFeeds has gained information from several brokerages that this particular wave of DDOS attacks was distributed via VPS software provided by ancillary third party VPS providers, creating a deployment via that channel into the technological and hosting solutions of brokerages.

VPS software performs a function by which it virtually positions the trader within close proximity of a trading server used by their brokerage, with the intention of reducing latency when executing trades and ensuring less requoting due to distance related time lag, and in some cases provide a better market access advantage in order that retail traders can execute trades quicker than competing traders attempting to execute the same trade.

Opinions vary on their necessity and effectiveness, however it is absolutely clear that security needs to be a matter of concern these days.

In one case, disruption occurred for two days last week, those being Thursday and Friday, with several brokerages having raised complaints to their liquidity provider and prime brokerages, who then narrowed it down to the commonality of using the same VPS provider as an externally provided solution.

One of the pitfalls in this particular sector is that in many cases, VPS software is the fruit of ‘garden shed’ programmers who have either retired from, or moved on from large software firms outside the FX industry and are effectively fringe enterprises with very little staff, and whose operators are idealistic programmers with little commercial acumen.

FinanceFeeds is aware of one particular firm which promises to host an entire MetaTrader 4 terminal and its externally developed EAs (!!!!) on one virtual server, however its owner is not experienced in how to structure critical partnerships with bona fide companies within the electronic financial services sector and in desperate attempts to offload the entire loss-making company to anyone whatsoever, strikes up partnerships with fraudulent HYIP operators with very little system security – let alone the potential damage that can be done to customer trading accounts.

One particular VPS programmer that FinanceFeeds approached last week explained “We see and deflect DDOS attacks on clients every day. We saw a big one on Friday aimed at a client of ours, and currently we continue to deflect and mitigate it for them. Brokers are attacked every day, and this has become commonplace for our industry now.”

In October last year, FinanceFeeds obtained back office reports which demonstrated that for approximately one hour, FX industry technology provider Integral Development Corporation experienced a service outage that lasted for approximately between the times of 8,43am and 10.50am on October 18, 2016.

FinanceFeeds contacted senior executives at Integral Development Corporation in order to establish the cause of this and to gain perspective on how it was resolved, however no reply was proffered, thus FinanceFeeds conducted investigations via trading logs and back office systems reports of several industry partners.

Whilst the reports from the back offices at various sources confirmed the outage, it is important to research the cause, which according to various industry information gathered by FinanceFeeds deduced that the cause of the outage was rectified in planned maintenance later in the day, itself taking 15 minutes longer than usual.

According to several industry sources, the outage occurred during the morning, however, at approximately 5.00pm Eastern Standard Time, during the period which is a period colloquially known as ‘roll’, which is when a number of server restarts happen and many traders in jurisdictions outside North America are inactive, Integral Development Corporation conducted maintenance which included a resolution to the cause of the outage earlier in the day.

This calls into question whether a back up system should be in place which diverts to an emergency server farm in the case of such an outage. Such systems have been commonplace in financial technology infrastructure for many years, including during my early years from 1991 onwards when infrastructure providers were continually testing uninterruptable power supplies (UPS) and uploading entire data sets onto DAT tapes constantly, to be able to switch to other servers in the event of an outage.

In this case, many customers did not complain about the outage, and indeed service was restored promptly.

Whether this was a DDOS attack or not was never confirmed, however in the summer this year, such a pattern re-emerged, this time with retail brokerages in Japan.

In June, Kabu.com Securities, a subsidiary of Mitsubishi UFJ Financial Group Inc, fell victim to a DDoS attack. The cyber attack happened early this morning, according to a report by the company confirming the incident.

The cyber attack targeted the website of the company, which was unavailable for about 36 minutes today. At 9:00, abnormal traffic was detected through the DDoS protection service and the company immediately launched an investigation. At 9:02 it became difficult to access Kabu.com’s website.

At 9:28, the company confirmed that the cause for the abnormal traffic is a cyber attack. At 9:38, the team managed to block the malicious cyber attack and the access to Kabu.com’s website was restored.

During this wave of attacks, Saxo Bank, equally a fintech company as it is a brokerage, moved from a reactive to a proactive protection setup, meaning that its service will be presented at a new IP address.

The company stated in July this year that in order to ensure resilience against the ever-growing threat of cyber attacks, it was making adjustments on how the SaxoTraderGO platform is exposed to the external world. With regard to that, Saxo moved from a reactive to a proactive protection setup, meaning that its service will be presented at a new IP address.

At that time, the firm stated that should white label partners be currently using CNAME entry in their DNS for their Login URL towards Saxo, no action from their end is required and the change will be transparent when the IP address is changed by Saxo.

If the partners were using A-Record towards Saxo, they would have needed to change their DNS configuration from A-record to a CNAME.

Further to that, Japan’s Hirose FX confirmed that it was subjected to a DDoS attack on Monday, September 18, 2017.

The services affected included the corporate website, as well as Hirose FX’s trading tools, such as the LION FX platform. Logging into the platform and accessing the website was hampered for more than an hour on Monday morning. The services were restored at 11:28.

Outside of Asia, Canada’s Questrade was also subjected to a DDOS attack this summer.

It is important to note here that all of these waves of DDOS attacks have been experienced at the retail broker end of the entire infrastructural topography of the FX industry, hence it is worth being very careful how your firm is connected to both the outside world and to its providers.

Once again, reiteration of the need to stick to proven industry standard providers, those being oneZero, Gold-i and PrimeXM is very important, especially given that many DDOS attacks have been successful in disrupting Japanese brokers, those which do not use MT4 and therefore tend not to use the aforementioned providers, and those which have experienced it recently in Western markets have complained that it has been distributed via ancillary VPS providers.

CySec Hogwash on MiFID II

On October 24 at the Crowne Plaza hotel in Limassol, a small city which has in just less than a decade generated a global profile as the center of retail FX and electronic OTC derivatives center, CySec Chair Demetra Kalogerou addressed FX industry participants from regulated companies within Cyprus during a breakfast symposium on the forthcoming MiFID II regulations, hosted and organized by MAP S Platis’ regulatory reporting and infrastructure division, MAP FinTech.

FinanceFeeds has dedicated considerable attention to the forthcoming MiFID II regulations, which are due to be implemented in January 2018 and will effectively require extensive changes and upgrades to the infrastructure used by OTC derivatives firms in within the European Union, and has hosted symposiums on this matter in London, as well as reported on a real time basis from within regulatory technology seminars in London and Limassol, presented by those at the leading edge of trade reporting technology.

This particular seminar, however, marked a milestone in addressing the companies that will be directly affected by the MiFID II rulings, yet have not been provided, in many cases, with detailed information with regard to their responsibilities post-implementation.

That particular milestone is the opening speech having been delivered by CySec Chair Demetra Kalogerou, this being the very first time that a regulatory chairperson has addressed OTC electronic trading industry executives on a face to face basis, in order to speak directly to those who require the information.

FinanceFeeds was at the seminar, and can deduce, once again, that there is a vast dichotomy with regard to information and the imparting of it between the regulatory authority, in this case CySec, and the professional consultancies who have built their business around providing regulatory reporting solutions.

In fact, it is not a dichotomy, it is a gulf the size of the Aegean Sea.

Ms Kalogerou’s 30 minute repertoire was one which had garnered tremendous anticipation, as MiFID II, an infrastructure and procedure-changing set of all encompassing rulings, has been a massive bone of contention for all firms globally, hence being fully enlightened by Ms Kalogerou herself on how CySec will work with firms and what their detailed requirements are from a highly knowledgeable FX industry center’s leading regulatory figure would represent a turning point in how regulatory heads are viewed.

It would mean that finally, regulators have thrown away the gray-suit-and-briefcase out of touch haplessness that they demonstrated when the financial markets first became electronic, and have finally become fintech-savvy cornerstones of our industry.

Sadly, this is far from the case.

Far from enlightening the astute, senior level audience of compliance executives with detailed and FX industry specific matters, Ms Kalogerou read verbatim from ESMA circulars.

Urbane and highly experienced regulatory technology expert Demetris Taxitaris, General Manager of MAP S Platis had introduced Ms Kalogerou, his own method of presenting a pinnacle of regulatory changes having been poignant indeed.

Mr Taxitaris mentioned the £35 million penalty issued yesterday to Bank of America’s Merrill Lynch for failing to report transactions – exactly the type of scene that is likely to be set once MiFID II has been implemented, as the European Securities and Markets Authority.

“Many people have asked me if we have liaised with the FCA since yesterday, however we did not know that FCA would impose that fine on Merrill Lynch yesterday and make it global, hence we didn’t consult with the FCA on it but it does demonstrate exactly how important this matter is, and in my opinion EMIR will be even more important going forward” he said.

Providing a concise background, Mr Taxitaris explained “We at MAP S Platis have been involved in this field since 2014 as a group, and have been assisting clients extensively in generating reports and backdating reporting which was a specific topic with which Merrill Lynch had issues with FCA.”

“However” he said, “It would be more interesting going forward to see how authorities approach this topic especially after the implementation MiFID II in January.”

“Generally, we operate as a compliance group. Compliance runs through all of our services and is a prominent feature across our internal audit, accounting and licensing services, and extends to our HR agency and recruitment services” explained Mr Taxitaris, before informing delegates that “We are here to assist all of you with any compliance matters going forward including with MiFID II as it comes into play.”

Mr Taxitaris then handed over to Ms Kalogerou, who quipped “We aren’t here to talk about the fine imposed on Merrill Lynch, we will stick to our own penalties here!”

“The reason that I came here today is that it a very topical theme here in Cyprus at the moment is MiFID II, along with the EMIR reporting directive, both being very important regulations, thus it is very good to talk about the technical issues” she said.

Ms Kalogerou then explained that she intended to provide an overview of how CySec views these regulations, and then focus on the fourth AML (anti money laundering) directive, explaining that she is also very concerned about that particular set of rulings.

Instead, however, of delving deep into the exact responsibilities that will be required by firms that currently, in many cases, consider that they have been left in the dark, Ms Kalogerou began on a complete tangent, that being the Cyprus financial crisis of 2013.

“Let’s talk about the economic crisis and how we got out of it” she said. “Cyprus was able to complete the ecomnomic adjustment program within 3 years. That is a remarkable recovery, and we have since experienced a growth rate 3.5% in terms of our GDP, creating prospects in Cyprus.”

“All the regulations that have now been put in place to prevent economic crises like the one that we experienced in the past. MiFID and EMIR will try to close any loopholes that the previous regulations had such as MiFID I” she said.

MiFID, however, is absolutely not related, nor does it cover, any aspects relating to the Cyprus economic crisis. It is an infrastructure directive that OTC brokerages in the European Union must follow, hence ambiguity as to the point of this was abound.

Now onto the main subject

“MiFID II is a big challenge for the regulators and the OTC derivatives industry. It starts on January 3, 2018 which is now very near. MiFID II and MiFIR will change the landscape of this business as we know it today” – Demetra Kalogerou, Chair, CySec

“There are new rules that take into account recent developments, including the economic crisis and the technological growth that we have experienced and developed in this industry, so that the way that business is conducted can become more efficient and more transparent” she said.

“MiFID II onbjectives are in 5 core areas, those being to enhance investor protection, take into account the innovation of financial technology, to increase transparency and regulator and client reporting requirements, and that organized trading should be on regulated platforms and be able to be reportable in pre and post trade states” she explained.

“One of the key factors is that MiFID II mandates an approved market structure, and ESMA’s intention is to limit OTC transactions in financial markets, and move some of the asset classes onto regulated markets which are represented by exchanges, multilateral trading facilities and specific venues” – Demetra Kalogerou, Chair, CySec

“In Cyprus, very recently, there was a report by ESMA that cited Cyprus as being the second biggest CFD transaction area in Europe after the UK on an OTC basis. This means that the regulator has a lot of work to do” she said. “Product governnance is important” were Ms Kalogerou’s generic musings, however no explanation was given.

Indeed, it may well be that ESMA will attempt to place cetrain trades on exchange, and Ms Kalogerou did highlight that ESMA may check and decide that certain derivatives that are traded through a centralized counterparty should be on exchange or MTF, based on venue test and liquidity test performed by ESMA, however a massive difficulty that is looming over Cyprus is that whilst this may extinguish the binary options fraud and marketing of unregulated products by small firms in Cyprus with their main head offices overseas, it paves the way forward for binary options firms to simply change their ‘platform’ to a cryptocurrency brokerage facility, or begin participating in ICOs.

This is because the European ruling states that ESMA will analyze trades made relating to underlying instruments that have significant liquidity on regulated marketplaces – those being exchanges – and as there is no Cyprus Stock Exchange listing for currency derivatives, nor are cryptocurrencies the subject of exchange liquidity, binary options firms whose product is considered ‘complex’ or too much of an uncertainty for retail clients can simply switch their operations to cryptocurrency and ICO, and carry on.

Ms Kalogerou stated on this subject “I have to make it clear that only the investment firms whose products are eligible for trading, where the underlying instrument is on a trading venue, they are supposed to be connected to a reporting mechanism and have their trades reported to ESMA. If your underlying instrument is not on a venue you are not supposed to report it. For example, in FX, we do not have a stock exchange or venue for FX, hence it will remain OTC.”

Indeed so, however what was omitted from this, is that ESMA could insist that FX products and certain other OTC derivatives that have substantial exchange based liquidity in other ESMA-supervised regions – the UK for example – could be traded via British institutional venues or MTFs, hence the best execution analysis could be conducted with greater ease, and then once again, the floodgates for OTC cryptocurrency fraud and ICO fraud would remain open in Cyprus due to the inability to price or report these transactions on a regulated venue.

“Enhanced governance through a board of supervisors will be required, as well as ESMA’s remit to increase the role of compliance more. There will be a mechanism restricting and prohibiting any instrument that gives concern, which applies to binary options and retail FX, but also structured products that thrive in Cyprus” – Demetra Kalogerou, Chair, CySec

“Companies will have to alter their strategies or turn to the provision of other products for retail investors and maintain complex products only to institutional or experienced investors” she explained, further demonstrating the direction which many smaller, foreign-owned brokerages, especially those with binary option white label brands from Israeli market makers who are now turning to cryptocurrency and ICOs due to the Israeli ‘ban’ on binary options and the reliance that CySec binary options brands have on their Israeli suppliers.

“There is an emphasis that certain instruments may be forced onto exchanges as ESMA continues to assess which are going to have to be traded via what is termed by the MiFID II directive as a ‘regulated marketplace’. The scope is to reduce the OTC market and as long as they have liquidity they will put them onto MTF or RM as part of best execution” – Demetra Kalogerou, Chair, CySec

Having liquidity being the very operative words.

Binary options, cryptocurrency and ICOs do NOT have liquidity.

Neither was it explained how firms that keep a very small number of clients on the books via their Cyprus based, CySec licensed entity, show those to the auditors, then onboard the vast majority of their clients via offshore entities under terms that are completely counter to those set out by MiFID II in terms of best execution, (1:1000 leverage in some cases) and thus are not subject to any form of trade reporting, and then launder money through personal accounts, and operate a P&L model, yet still market their business as a EU compliant, CySec regulated firm under MiFID ruling.

FinanceFeeds has approached CySec on this matter several times, yet no dialog has ensued, yet this morning, Ms Kalogerou, alluding to the 4th EU anti money laundering directive that is currently in the Cyprus parliament awaiting implementation explained

“95% of clients in Cyprus are non-face to face, so they are in the category of high risk as far as the new AML directive is concerned, so you will have to build an internal risk based tool, that helps assess th risk of non-face to face clients as far as money laundering is concerned, then the onus is on you to put htem in the category of low, medium or high risk” – Demetra Kalogerou, Chair, CySec.

Quite…..

Ms Kalogerou then proceeded to read verbatim some of the directives issued by ESMA. These were pertinent to many classes, and different industry sectors and were presented in a very generic manner, as read from the exact same manual that can be viewed on ESMA’s website. Her allusion to pension funds during her reading, and then a swift realization “oh, this doesn’t apply to you” is testimony to this.

Some of the key matters of importance included that ESMA will insist that competent authorities will have to assess the aptitude of board members of firms, as well as the CFOs, which are often not board directors, and that key compliance officers, auditors and risk management officials will be subject to continual assessment under ESMA’s remit as of June 2018, hence a greater emphasis on corporate governance is coming.

In terms of clearing obligations, Ms Kalogerou did not explain how retail FX firms in Cyprus have to report this, but instead read verbatim the EMIR document on it, and referred delegates to circulars on connecting to a CCP to clear derivatives. In May this year, FinanceFeeds detailed exactly how this must be carried out.

CySec has confirmed that it has outsourced two projects to ESMA, those being the accessibility of trade reporting data, and financial industry reference data. Ms Kalogerou explained that, along with most EU member states, these have been delegated to ESMA as a huge amount of resources are required to gather, validate and make an assessment of the data that is coming from firms across Europe.

CySec will continue to work on MiFIR. Will store quantitative and qualitative information, done via reporting mechanism that gets your trsnasacitons and transfers them to ESMA.

LEIs, and the need for them to be obtained was covered in very scant detail, as well as spread betting being a new trading type that has been added to the repporting requirements for derivatives, before Ms Kalogerou handed over to Alexandros Constantinou, Director of Compliance at MAP S Platis, who really went into great detail with regard to what exactly needs to be done.

Mr Constantinou took a look at the revised technical standards that will be enforced, and the European Commission’s propopsal which was dated May 4 this year, to include certain instruments on exchange.

MiFIR directive

“Although EMIR has been around since 2012, and reporting started in 2014, we haven’t seen the regualtors taking serious actions against entities but yesteday we saw the first fine, but have seen CySec doing inspections on companies, as to whether companies do report, do not report and whether they comply with EMIR” said Mr Constantinou.

“With respect to MiFID and requirements on transactions reporting, we have experienced a greater emphasis on it by competent authorities” he said.

“However, the objective of EMIR is to increase transpaency and reduce systemic and counterparty risk in the OTC derivatives market” explained Mr Constantinou.

“The main obligations are to report to trade repositories, ensure that clearing obligations are met, and a considerable focus on risk mitigation for uncleared trades and requirements for centralized counterparties and trade repositories” he said.

Challenges

Mr Constantinou then explained the challenges that face companies, which is really the most important facet that needs imparting, and a facet that was not covered by any regulator thus far, including Ms Kalogerou this morning.

Mr Constantinou described in great detail how to select a trade repository or third party from which to report trades to a repository, and advised firms to look closely at fee structure and integration of trade repository services when budgeting for MiFID II compliance.

Very valuable information indeed. He then explained “Collecting and interpreting certain EMIR data fields is very much a point that needs covering by firms. Some of the trade data was not captured at all by companies before EMIR was introduced. To collect and store the data, technology and underlying processes in firms will need to be changed or upgraded.”

Mr Constantinou explained how to generate a Unique Transaction Identifier, which is a globally unique identifier for individual transactions in financial markets. USIs were introduced in late 2012 in the U.S. in the context of Dodd-Frank regulation, where reporting of transactions to Trade Repositories first became mandatory.

European financial market regulations followed suit, with reporting to Trade Repositories under EMIR requiring UTIs from February 2014 on. The use of the UTI is also mandatory for regulatory reporting under REMIT. Strictly speaking, the term USI is specific to the U.S. regulation, while UTI is specific to EU regulations. In practice, both terms are used interchangeable, in particular within large trading firms reporting under both regimes.

Mr Constantinou’s perspective is that when generating a unique UTI, where multiple parties are involved in one trade, the reporting should be delegated to another party so that the reconciliation wouldn’t be an issue. If firms tried to reconcile on their own, they may breach the EMIR regulation by generating incorrect or duplicate UTIs.

Additionally, he explained that counterparty data reporting is now far more comprehensive and under MiFID II and EMIR, it needs to include received collateral for open exposures which is broken down into to initial, variation and margin and excess collateral.

In terms of looking back at prior transactions, Mr Constantinou stated that an extension of time limit for reporting historic transactions has now been made, so that firms can report their historic transactions to a trade repository within a 5 year time frame, which is is an increase over the previous 3 year period that was allowed. These are transactions opened after August 16 2012 and closed before Feb 12 2014.

Best Execution and price ambiguity.

In London recently, FinanceFeeds discussed how pricing should be considered to be ‘Best Execution’ by regulators under MiFID II. It could, for example, be in the customer’s interest to execute internally, or to send trades to a specific liquidity provider if they have multiple relationships, and if doing so, how this can be viewed as in the customer’s interest, or the brokers interest with so many factors that are not displayed to the regulator, for example, favorable deals given to brokers by liqudity providers that would encourage the broker to execute there, even if another provider with which the broker has a relationship is giving a better execution for the customer.

This was not touched on at all by CySec this morning, however Mr Constantinou did throw some degree of light on it.

“Firms that are now required to use a centralized counterparty must use the settlement price for cleared trades for valuation and pricing. This way, the regulator can see via an impartial body what the price was, and match it accordingly.”

Quite simply, for those wishing to future proof their business, as well as take their part in ensuring that the Cyprus based retail FX industry’s bona fide entities – who have a great deal to be proud of – continue to uphold a high standard, then regulatory technology firms such as MAP S Platis, Point Nine, Cappitech or TRAction FinTech are the right ports of call, because quite clearly, we as an industry cannot rely on the regulatory chiefs to impart this knowledge.

If it were not for the industry-grown experts, it would be a case of EU government fines and difficult PR wranglings.

November 2017

For retail brokerages, being able to provide a full and genuine multi-asset solution to their increasingly demanding traders, portfolio managers and strategic partners is absolutely paramount.

For many reasons, gone are the days of simply providing a white label MetaTrader 4 spot FX platform at an initial cost of $5000 to a small brokerage that then subscribes to a $1750 support package and allows another small retail brokerage to provide a price feed that originates from, and processes orders to, its internal dealing desk.

The continual evolution relating to the provision of multi-asset liquidity via familiar and ubiquitous retail trading platforms as well as proprietary trading solutions offered by some of the largest retail electronic trading companies in the entire business has resulted in the need to form important relationships between the buy and sell side, along with providers and integration specialists alike.

The advent of regulatory mandates that require retail brokerages to publish their entire order flow and prove ‘best execution’ on a case by case basis such as MiFID II is congruent to the demand from the retail marketplace itself, and last week, PrimeXM entered into a strategic partnership with Swissquote (SWX:SQN) in order to provide liquidity into PrimeXM’s XCore solution, creating an enhancement of execution for brokerages, with the addition of one of the most renowned prime brokerages in the world.

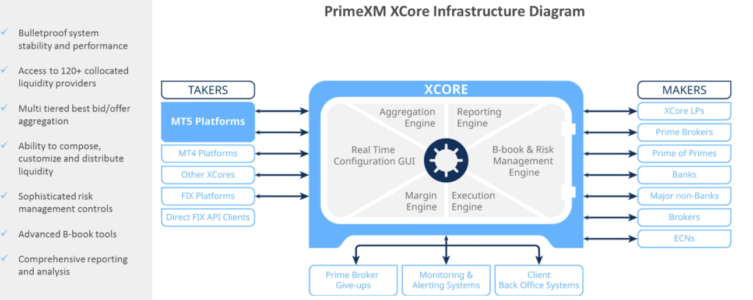

PrimeXM, being one of the industry benchmarks for liquidity integration alongside oneZero, Gold-i and Fortex, has been engaged in a proactive expansion of multi-asset connectivity recently.

Speaking to the company’s Global Head of Sales Richard Bartlett recently, FinanceFeeds looked at the importance of such development closely.

Mr Bartlett expanded on this, explaining PrimeXM’s raison d’etre as an FX connectivity and hosting provider. “It is important to note that we are not just a bridge or gateway firm. We offer hosting to companies which operate across global markets and our XCore product is an end to end smart order routing system.”

“Additionally, an important factor is that we have established our own global infrastructure with 120 connections to banks, ECNs, liquidity providers and datacenters, those being NY4, LD4, TY3, which are the geographically important locations, therefore we made dedicated connections to these areas” continued Mr Bartlett.

“Companies can pick and choose the liquidity providers and add as many to the same system as required. Similarly, brokers have strict cotnrol over their liquidity via the front end graphical user interface and different types of liquidity streams that can be channeled into MetaTrader 5. Brokers can also manage white labels this way if they are a MetaTrader 5 server owner.”

Essentially, any liquidity provider in the world can be added.

Mr Bartlett was very keen to highlight an important factor, that being that PrimeXM does not charge maker fees. “This allows firms to negotiate the best commissions” he said. “On the same lines, we can offer a centralized location as well which allows for the scalability to offer liquidity to any type of client from institutions to retail brokers.”

FinanceFeeds spoke today to Ryan Nettles, Director and Head of FX Trading & Market Strategy at Swissquote, in order to gain the company’s perspective on the integration.

In recent years, we have observed institutions making the switch from sourcing liquidity from single dealer to multi-dealer platforms. For this reason, we have been investing in our technology and infrastructure to improve our distribution capabilities and have selected various trading venues to distribute our liquidity in order to meet the needs of institutional traders” – Ryan Nettles, Director, Head of FX Trading & Market Strategy, Swissquote

“We have observed noticeable growth among FX brokers utilizing PrimeXM’s XCore system therefore we have established a relationship with PrimeXM to be included as a disclosed liquidity provider within their XCore trading venue. We are excited about this new relationship with PrimeXM and we are pleased to add them among our other select trading venues including Integral, OneZero, and Goldi for institutions to take our liquidity across our FX, Precious Metals and CFD products” explained Mr Nettles.

PrimeXM explained to FinanceFeeds that Swissquote’s newly acquired instance of PrimeXM’s XCore will allow the company to offer its clients enhanced execution capabilities via the provision of Swissquote’s liquidity to PrimeXM’s broker clients. PrimeXM’s smart order management and aggregation engine has been developed to cater to the ultra-low latency demands of the market and the new partnership will further improve Swissquote’s advanced distribution abilities.

Through this new partnership, PrimeXM clients will gain access to a source of top-tier co-located liquidity and benefit from competitive discounted fees.

“”We are particularly proud of this new partnership with Swissquote as they are a reputable liquidity provider and through this partnership we will be able to offer our clients another source of top-tier liquidity. Our XCore has been customised to meet the needs of Swissquote and are very happy with the integrated solution we have created together with Swissquote.” Cristian Vlasceanu, PrimeXM CEO

Swissquote’s ethos is one which continues to assess and research sophisticated methods of providing a retail trading environment.

During a meeting with FinanceFeeds at Swissquote’s head office in Gland, Switzerland, Mr. Nettles explained this in detail, focusing on how the bank built its own proprietary systems which efficiently sources and distributes liquidity as well as their risk management system which automatically manages a portfolio of different currencies, precious metals and CFDs.

With regard to the partnership, Kseniya Zubkova, Head of Institutional Forex at Swissquote explained to FinanceFeeds “We are very proud to begin such a promising partnership. The true fusion of FinTech and Banking is invaluable in providing brokers both best execution and the tools essential for successful growth.”

Waving goodbye to a longstanding stablemate

A quarter of a century is a lifetime in the ultra-modern electronic trading industry, especially when referring to the retail sector which, compared to the long established institutional trading desks of Chicago, New York and London that have their origins in pre-industrial commodities trading, is a very new phenomenon indeed.

To have been a reporting and editorial mainstay for what is pretty much the entirety of the lifespan of today’s FX industry is a remarkable achievement.

This achievement can be reflected upon by industry news and editorial source FX-MM, which is a quarter of a century old, yet is closing down within a month from now.

Peter Garnham, FX-MM

The publication, which is an online resource that began with a magazine that eventually ran congruently to the website, is owned by Russell Publishing and has its editorial overseen by institutional and retail FX trading veteran Peter Garnham, its focus being to provide important news and information to bankers, corporate treasurers, fund managers, traders, brokers and technology vendors in the international financial markets.

On November 22, Mr Garnham has announced the end of the road for FX-MM, which, according to his memorandum to readers today, will cease to operate by the end of 2017.

“It is with sadness that I have to announce the closure of FX-MM. Over the years, FX-MM has strived to provide an essential resource for the trading, treasury and financial technology sectors” stated Mr Garnham in his correspondence today.

One of the main reasons cited for the firm’s imminent closure is that the delivery of media in this space has radically changed.

Mr Garnham wrote “Despite our many efforts to develop new products and services, the saturation of the market with alternative sources of data has become too great an obstacle.”

“Founded 25 years ago as a monthly magazine focused on the FX industry, the magazine expanded its remit to encompass all aspects of trading, treasury, financial technology and, in recent years, the constant flurry of new regulation affecting the financial sector” he stated.

Looking back on an illustrious 25 years that Mr Garnham can genuinely be proud of, he concluded “Personally I have edited FX-MM for four years, and would like to take the opportunity to thank the dedicated team that have made that possible, from our talented team of writers and editors to the wider support staff here at Russell Publishing. I would also like to thank the array of contributors and supporters from across the financial sector that have made the journey so stimulating over the past few years, and, of course, the readers, whose feedback and generosity have been so vital.”

FinanceFeeds applauds the journalistic and research orientated effort made over the course of this period by FX-MM, and wishes Mr Garnham every success in his next endeavor.

The importance of genuine and well researched reporting is critical to the advancement of the electronic trading industry, especially from sources that make the effort to research and report from within the companies in the business, and alongside the industry’s leaders and senior executives.

This, after all is how progress is made.

December 2017

For the refined and knowledgeable FX industry executives in London, it did not take long before those who joined LCG (formerly London Capital Group) shortly after its 2014 acquisition to either realize that there are far better names to be associated with and places to apply their abilities, thus moving on of their own accord, or for them to be part of the rash decisions that have become an LCG trademark, one particular example being the mass hiring and then mass redundancies.

LCG’s controversial and high profile ‘revolving door’ dynamic following its acquisition by GLIO Holdings led by Charles-Henri Sabet in 2014 had been a very poignant matter for discussion among senior FX industry executives in London, considering that LCG, a publicly listed company on the London Stock Exchange’s Alternative Investment Market (AIM), has been in existence for three decades and has had every possible opportunity to be part of the top quality electronic trading sector that has flourished and in many cases led the way in the world’s most highly respected and advanced financial markets capital.

Management woes, organizational struggles and lack of commercial direction have plagued LCG for several years.

Under its previous leadership, the firm, then operating under the moniker London Capital Group, became the target of acquisition largely due to its balance sheet having been in the red for some time. In early 2013, several companies examined the possibility of purchasing the company, however GAIN Capital and Cantor Fitzgerald (Europe) soon dropped their interest. By that time, the company’s share values dropped by 20% to 34.50p, with further decreases in value occurring throughout the ensuing five years.

Two other suitors had pulled out, leaving London Capital Group to struggle on independently until its purchase by Charles-Henri Sabet and his consortium in 2014.

Today, the company has announced its intention to list its stock on the NEX Growth Market. This signifies a substantial likelihood of an imminent de-listing from the London Stock Exchange’s AIM, as dual listings, whilst are legitimate, are very very unusual indeed, especially under circumstances such as this.

Trading of LCG shares on NEX Growth Market starts today at 8,00am GMT. Watch out for imminent LSE delisting

If it chooses to do so, a company can list its shares on more than one exchange, which is referred to as dual listing – although few companies do. However, there are some companies that are listed on both the NYSE and Nasdaq. Charles Schwab, Hewlett-Packard and Walgreens, for instance, all have dual listings on both exchanges.

One reason for listing on several exchanges is that it increases a stock’s liquidity, allowing investors to choose from several different markets in which to buy or sell shares of the company. Along with the increased liquidity and choice, the bid-ask spread on the stock tends to decrease, which makes it easier for investors to buy and sell the security in the market at any time.

Multinational corporations also tend to list on more than one exchange. They will list their shares on both their domestic exchange and the major ones in other countries. For example, the multinational British Petroleum trades on the London Stock Exchange as well as the NYSE.

None of these factors apply to LCG, especially when considering who actually owns the shares. Unlike the successful companies in London, which have vast market capitalization figures and whose shares are genuinely in the hands of the public, percentage of LCG securities in public hands (as defined in the NEX Exchange Growth Market Rules for Issuers) is 18.56 per cent. The percentage of securities not in public hands is 81.43 per cent – ie, the vast majority of shares are owned by the directors of the company, a status quo that has applied since its purchase in 2014, and prior to that with its previous management structure.

Ergo, it may well be a publicly listed firm on paper, but its shares are not traded, there is no liquidity and as over 81% of them are in the hands of just a few board members, it does not behave as a publicly listed firm.

Speaking on December 13 to a mergers and acquisitions litigation specialist in London, FinanceFeeds gleaned that “it can be considered very unlikely that this will be a dual listing, in fact it appears to be a move which will be followed by a removal of listing from the London Stock Exchange. The company’s ordinary Shares will remain admitted to trading on AIM following admission, however I suspect that will be reversed” said the litigation specialist.

FinanceFeeds was correct, and the advice given was accurate. Just a few days later, LCG began its preparations to de-list.

Controversy continued to surround LCG’s operations during the period post-acquistion.

On April 7 last year, retail FX brokerage ACFX, an acronym for Atlas Capital, was the subject of a license suspension by Cypriot financial markets regulatory authority CySec. A generic rationale was provided in a public report by the regulator as to why this action was taken.

A litany of complaints surrounding this matter now adorn public forums, indicating that the tardiness with regard to withdrawal requests made by customers of ACFX is no longer limited to Chinese introducing brokers and their clients, but is now widespread across many region in which ACFX conducted its business.

The vast majority of the company’s senior management subsequently left the firm. FinanceFeeds recently interviewed staff, former employees, and clients with balances ranging from $1,500 to over $80,000 as withdrawals remain outstanding following the mass exodus from the firm by its management.

At that time, FinanceFeeds made contact with sources close to the matter to establish the whereabouts of certain members of the senior management who were at ACFX, as they have, according to our sources, been hired by LCG, a company which, as previously mentioned has had a revolving door approach to senior management recruitment since it was acquired by GLIO led by Charles-Henri Sabet in 2014.

LCG hired former ACFX management as yet more LCG officials leave

In April last year, one source very close to the matter explained to FinanceFeeds “LCG has recently hired the management that lead ACFX to bankruptcy. This will be the final blow for LCG.”

LCG placed over 20 professionals on gardening leave in one fell swoop in 2015, most of whom had joined the company just a matter of months earlier from senior positions within some of London’s top level firms that they had excelled in and had been highly respected by firms of far greater standing.

This occured following our report earlier that year that a further exodus from LCG of senior management had taken place, with Legal Counsel Kate Valdar having gone on gardening leave recently, Peter Wells, who spent 28 years at British interdealer broker ICAP before joining LCG post-acquisition having left LCG to take time out from the city, Nicola Penn, the Executive Assistant to the Directors having moved on, and the firm shutting its LCG digital operations in Tel Aviv just 6 months after establishment.

One particular senior ACFX executive explained to FinanceFeeds:

“Please do continue your investigation and I hope you will do your job to the best standards and you will reveal who hurt ACFX and why those who did all went there (LCG). For now that’s it from my side.” [sic]

At the time, FinanceFeeds contacted Andreas Michaelides, former Head of Investment Research at ACFS (Atlas Capital Financial Services division of ACFX) for his comments on the hiring of certain key ACFX staff by LCG, who said “I have nothing to add.”

FinanceFeeds has reached out to LCG’s legal department by telephone during several days in April last year in order to clarify this matter, however the firm did not provide comment, saying that they were not able to make any statement one way or another.

When contacting ACFX’s head office in Cyprus, a spokesperson explained “We are under license suspension at the moment and therefore I cannot answer any questions of this nature.”

The company also went through a very rash period of expensive new directions, only to can them soon afterwards.

The company established a digital marketing entity in 2015, which went West (literally) very soon afterwards.

Setting up an entirely new entity, in a different country to the main operations of a loss-making company whilst its balance sheet has been in the red since 2011 and then canning it just six months later could be construed as a very unusual step to take.

In the beginning of 2015, LCG’s losses ran at approximately £7 million for the first quarter, by the end of the year, the hole in the bucket had increased so much that the firm had made a £13.9 million loss for 2015.

In spite of such losses, LCG moved its operations from Devonshire Square in the heart of the City of London’s financial district to the highly exclusive 1 Knightsbridge in London’s West End, and underwent a rebrand, part of which involved the purchase of the LCG.com domain for $175,000.

In June 2016, FinanceFeeds made contact with Amedeus Muscato, who left his position as CEO of LCG Digital to pursue his business, Soho Media which provides boutique traffic to firms across web, video and mobile advertising, however no comment on the matter was provided.

With almost every key hire having left the firm after a very short time, when peers in London with equal length of time in establishment are renowned worldwide for high quality, have long standing client bases and executives who are wholly committed to their cause, often remaining in their position for between 15 and 25 years, there is a clear disparity between LCG and the stalwarts that maintain London’s excellent reputation as the leading and most respected FX industry center in the world.

As the adage goes, “A wise man once said, when you come to the last page, close the book”. And rightly so.

Despite that fly in the otherwise exemplary ointment, London remains the pinnacle of professionalism, and on that note, we went ‘around the world in 30 minutes’ to detail what is good, bad and ugly as 2017 draws to a close.

FinanceFeeds CEO Andrew Saks-McLeod unleashed what you need to know about the upcoming MiFID 2 (Markets in Financial Instruments Directive) rules for the New Year with Tom Constable at TwoBlokesTrading.com

as well as lambasted ICOs and crypto currency schemes, and looked at where the good quality and upper end of this industry will expand next, growing its success and banishing the lower echelons to oblivion via a quality and impunity vs lack of acumen situation.

Meanwhile, FinanceFeeds remains committed to serving the very upper end and leaders of this industry, assisting in the development of quality business relationships globally and providing accurate and detailed research and reporting from within the offices of brokerages, regulators, technology providers and institutional companies alike.

We wish you all a very happy and prosperous new year, and look forward to being an integral part of your business activities in 2018 and beyond!

Here is the podcast: