FinanceFeeds hosts FX industry’s first ever London MiFID II Symposium today – Live report and full montage

The very first MIFID II symposium for the OTC FX industry took place today in London, hosted by FinanceFeeds and TRAction FinTech. Here is a comprehensive insight into what was discussed, and a full montage.

This morning, at EIGHT MOORGATE private members club in Central London, FinanceFeeds, along with TRAction FinTech, hosted a breakfast symposium, beginning at 8.30am until 10.30am, which presented the absolute intricacies of compliance with MiFID II, what will need to be done, and how to most effectively achieve it.

In attendance were a series of very senior FX and multi-asset electronic trading executives and leaders from across the entire spectrum of the business, from the interbank sector, through to the institutional technology division as well as retail FX brokerage and their respective service providers.

Organized by FinanceFeeds and hosted in conjunction with Australian OTC trade repository reporting service provider TRAction FinTech, the symposium sought to address a matter that is not often clarified and yet is extremely important in the advent of the impending MiFID II regulatory infrastructure directive which is schedule to be invoked across the European Union in January 2017, that being how every company in the entire business will prepare its technological infrastructure and what the guidelines are in order that they do not fall foul of the increasingly technology-led regulatory authorities.

In Europe, preparation for MiFID II is a major milestone that all FX brokerages, executing venues and electronic trading firms will have to pass, requiring substantial preparation and keeping abreast with technological change.

Introduced by FinanceFeeds CEO Andrew Saks-McLeod, Quinn Perrott, a highly experienced senior FX industry executive and director and co-founder of TRAction FinTech commenced with the first subject to be covered by the symposium, that being

to analyze the current situation that the OTC derivatives sector is experiencing, and the size of the industry which at $639 trillion per year in notional volume, overshadows absolutely every other form of electronic trading, and has become the bete noire of the regulators.

Mr. Perrott began by setting the scene for an in-depth dialog, within which the attendees participated actively, looking at arbitrage opportunities among regulators, multi-licensing strategies which use top tier and bottom tier countries in a group, and product intervention risks, BREXIT implications in an enviroment in which regulation will continue to advance as deregulation is very unlikely – Even Donald Trump has been met with a metaphorical brick wall in that respect!

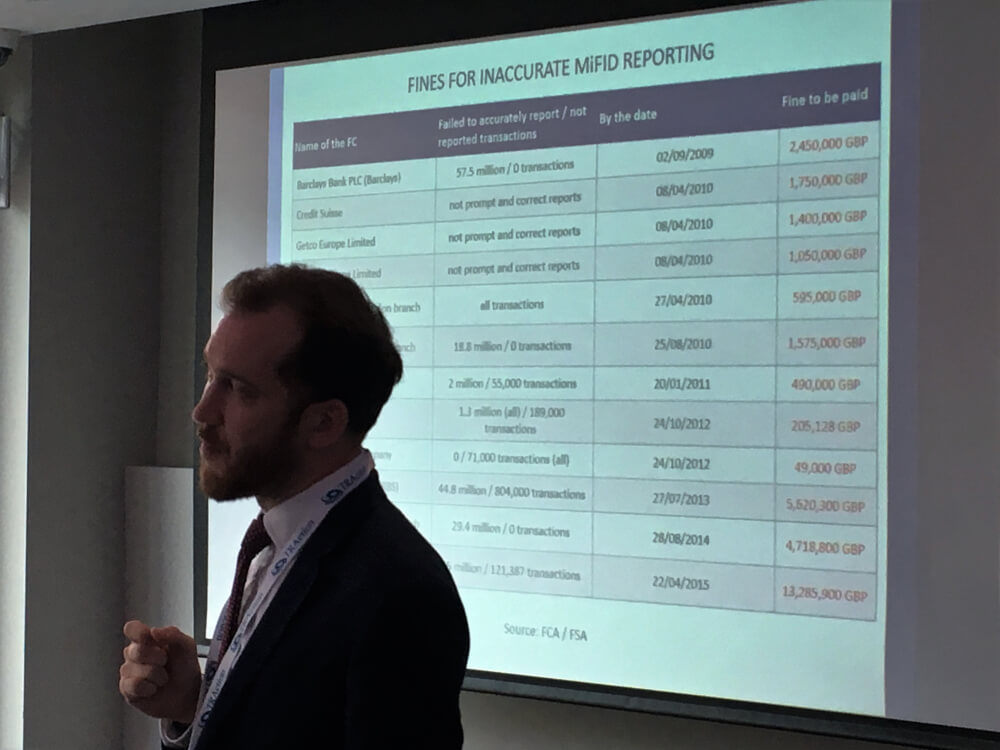

Going into great detail, James Cole, Trade Reporting Officer at TRAction FinTech elaborated for over an hour with regard to how the regulatory environment has become so infused with technological stipulations as far as brokerage infrastructure is concerned.

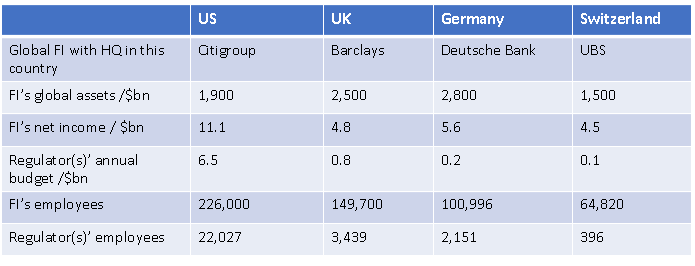

Mr Cole pointed out that the comprehension of regulations is subject to a vast differential, that being the gulf between the assets, income and human resources of regulatory authorities globally, compared with that of the institutions which absolutely dwarf those which oversee their activities.

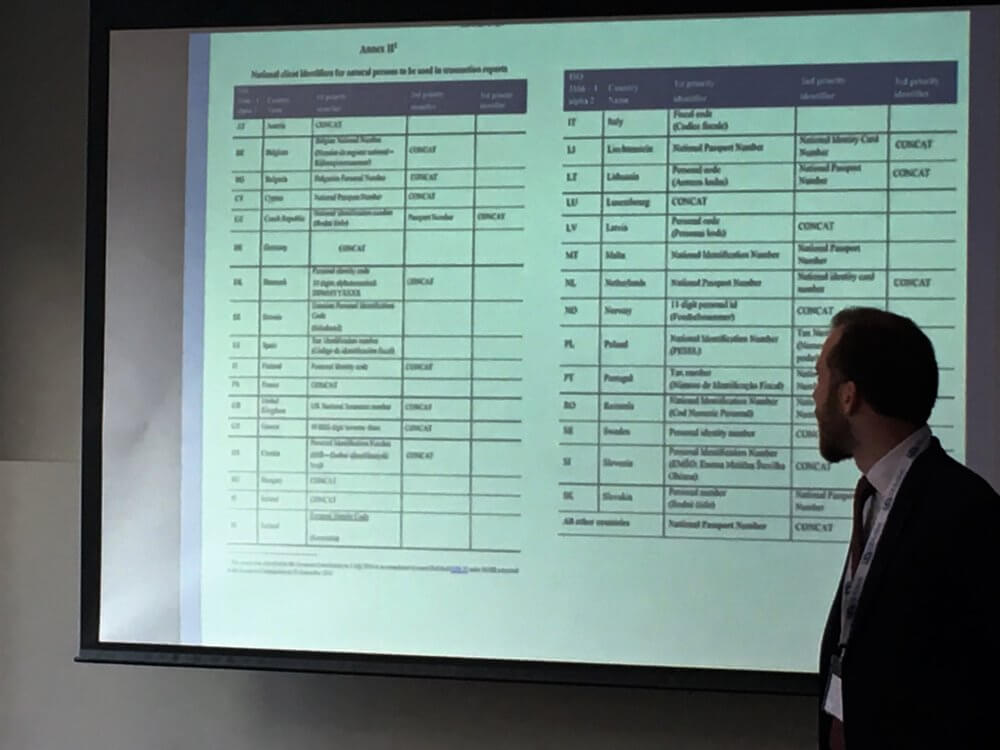

Mr Cole provided a very comprehensive insight on how trade reporting solutions must be in place in preparation for MiFID II, one of the factors covered in great detail being the need for the use of a Legal Entity Identifier (LEI).

From 3 January 2018 firms subject to MiFID II transaction reporting obligations will not be able to execute a trade on behalf of a client who is eligible for a Legal Entity Identifier (LEI) and does not have one.

An LEI is a unique identifier for persons that are legal entities or structures including companies, charities and trusts. The obligation for legal entities or structures to obtain an LEI was endorsed by the G20 countries.

An LEI is a code unique to that legal entity or structure. When an LEI code is allocated to companies subject to MiFID II, the code is included in a global data system. This enables every legal entity or structure that is a party to a relevant financial transaction to be identified in any jurisdiction.

Mr Cole explained that there are currently 520,000 LEIs on issue, and that this number is expected to increase by at least 50% post January 2018.

Mr Cole also explored why brokers have to report to MiFID & MiFIR, and what the difference is between trade reporting and transaction reporting. Interestingly, there will be no grace period following the introduction of MiFID II, meaning that the onus is on companies that report to European authorities will have to have understood and provided for the entire range of stipulations, thus avoiding ‘back loading’, which is a practice in which the regulators would reserve the authority to insist on a brokerage having to go through its entire trading history and report it to trade repositories.

Concluding, Sophie Gerber, Director and Co-founder of TRAction FinTech explained the current methodologies that must be adopted and in very charismatic fashion concluded the event, which heralded the first in a series, the next being in Sydney, Australia in November this year, focusing on Australian regulatory infrastructure and trade reporting.

Meanwhile, here is a full montage from today’s event.