FinanceFeeds and Shift Forex set to bring China’s FX all important big players to the FX brokerages at FXIC Shanghai

China. The all important golden egg of the FX industry, which every brokerage worldwide has focused its attentions on for a number of years. With the lucrative opportunity which is undoubted, comes a unique business environment which requires FX brokerages from around the world to engage with Chinese partners and build long standing relationships, which […]

China. The all important golden egg of the FX industry, which every brokerage worldwide has focused its attentions on for a number of years.

With the lucrative opportunity which is undoubted, comes a unique business environment which requires FX brokerages from around the world to engage with Chinese partners and build long standing relationships, which often bear far more fruit than those in any other region worldwide if conducted properly.

On December 8 this year, Shift Forex is hosting the annual FXIC Shanghai event, at the prestigious Waldorf Astoria Hotel on the Bund, which will host senior FX industry professionals and China’s finest and most important retail FX business leaders.

Unlike events in many regions, FXIC Shanghai will provide a direct opportunity for western brokerages in that China’s entire FX business is based on IB networks, therefore instead of having a situation in which vendors are pitching to vendors, brokers will be able to establish relationships with IBs, making the audience from west and east very relevant to each other as future trade partners.

FinanceFeeds, the official media partner of FXIC Shanghai, is highly experienced in what matters in China, having conducted extensive research within companies operating in the region, and having the exclusive knowledge of which company does what, and where it does so.

Let’s face it, China is where it’s at

Banks, liquidity providers, regulators, fund managers and brokers will attend from across the globe, and IBs from all across China will be present.

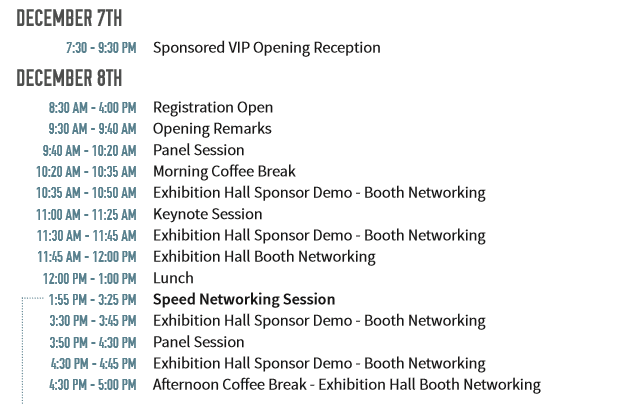

The event will be preceded by a welcome party which will take place during the evening of December 7, leading to an 8.00am registration for the event itself on December 8.

FinanceFeeds CEO Andrew Saks-McLeod will present to the audience on what is critical in order to succeed in business via relationships with Chinese IBs, and will explain in detail what they require from Western vendors, software firms and brokers in order to remain loyal and provide large volumes, his research being based on specific research conducted over a period of time across all of China’s major centers for FX.

During the course of the day, FinanceFeeds will report directly from the conference, with live reports covering the panel discussions and in depth interviews with industry leaders and Chinese IBs, which will be in written and televised format.

Aside from numerous networking opportunities, speakers at the event include Cosmo Zhu, Managing Partner at FX Dynasty, Kevin Wang, General Manager for China at GKFX (a company which FinanceFeeds can confirm is massive in China), Lance Liu, Director of PingAn Ventures, Tim Brankin, Managing Director at TradeToolsFX, and the senior management team of Shift Forex.

In China, relationships and physical presence is everything. IBs handling 90,000 lots per month and up to $200 million in assets under management are thriving. We have met them and know them all, therefore the ability to meet the leaders of the industry in person is a major lead for FX businesses wanting to do business in China.

See you there !