FinanceFeeds Sydney Cup: CME Group and Cappitech engage Australia’s brokerage executives in retail FX’s number one region

From publicly listed electronic trading giants to the major interbank dealers, and from board level executives from the world’s prime of prime brokerages along with institutional technology leaders, the FinanceFeeds sixth Sydney Cup brought together the very leaders which preside over the most important components of the global business.

Modernity, fastidious business ethics, and a finely honed understanding of the entire spectrum that the electronic trading sector of the financial services business encompasses, Australia’s senior level talent is a fine example indeed.

On Thursday, February 21, in Sydney, Australia’s financial and technological capital, FinanceFeeds hosted over 60 senior executives from across the institutional, technological and retail brokerage industry at the sixth FinanceFeeds Sydney Cup FX industry networking event.

The entire structure of our industry continues to represent the leading edge of development in the financial markets sector worldwide, and therefore in one of the world’s most advanced regions for retail FX, the Sydney Cup event was hosted and sponsored by exactly the caliber of companies that assist brokerages to maintain the highly advanced standard, including Cappitech, a leading Fintech provider focused on compliance and regulation technology for banks, brokers and asset managers to solve their reporting needs, and CME Group’s Global Repository Services division which provides a multi-asset class reporting solution for regions, with specific support for the growth of the APAC region.

Attending the event is one aspect of importance, as such a platform for the high quality firms that are very well established in Sydney and form the very well organized electronic financial markets sector in Australia, however the combination of Australia’s position as a very highly respected business center between the all-important Asia Pacific region and the West stands it out as the most important retail FX center in the world.

Represented were senior executives from CMC Markets, oneZero, TRAction FinTech, ISPrime, easyMarkets, Fair Markets, FP Markets, Chi-X, XTX Markets, Fifth Logic, Gold-i, USGFX, Cardiff Capital, Royal Financial Trading, Thomson Reuters, CQG, IG Group, OANDA Corporation, Charter Prime, Rakuten Securities, FXCM Pro, along with some of the ancillary service providers that have a majority market share in Australia and the APAC region including licensing consultancies and boutique financial technology service providers.

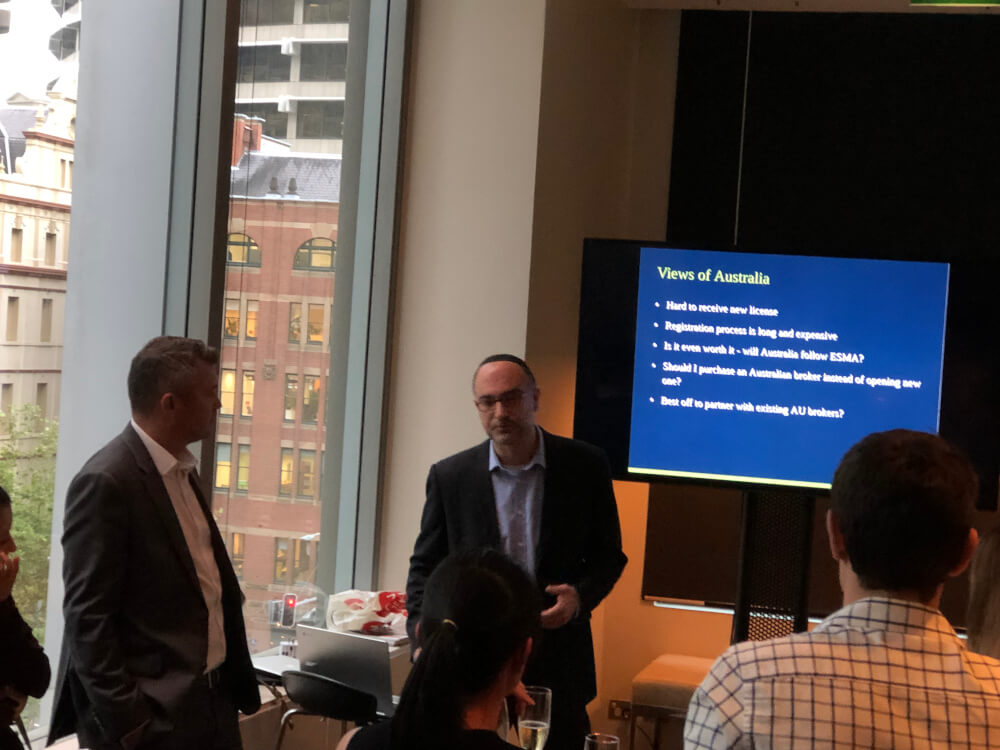

In keeping with FinanceFeeds’ ideology of linking the very senior level executives with each other and ensuring that absolutely relevant business can be conducted in a charismatic and corporate community style environment, following a welcome address by FinanceFeeds CEO Andrew Saks-McLeod, the Sydney Cup event was preceded by a highly informative and entertaining keynote speech delivered by Ron Finberg of Cappitech, who explained in great detail how specifically designed technologically advanced reporting systems that cover the entire spectrum of stipulations that are now de facto among international governing bodies, that also integrate into the structure of the electronic trading systems used by modern financial markets entities.

With regard to Australia, one of the most sophisticated regulatory environments in the world, and one of only two global financial markets centers in which the regulator – in this case the Australian Securities and Investments Commission (ASIC) – actually understands the full components of the FX and CFD business to the extent of using advanced surveillance systems to conduct real time compliance monitoring, Mr Finberg, a senior electronic trading industry executive with an extensive career history, looked at the challenges associated with obtaining an AFS license from ASIC, how long and expensive the regulation process is, and if Australia will follow the European Union’s direction in terms of leverage and trading terms restrictions.

Mr Finberg delved into the very interesting subject of how to establish in Australia’s high quality retail environment, and debated whether it is worth buying an existing brokerage as a means of entering the market instead of establishing a new one, and whether to partner with existing Australian brokerages.

Joined by CME Group’s Global Repository Services division’s Head of APAC region, Struan Lloyd, Mr Finberg looked at solutions that brokerages can use to streamline their reporting, especially when considering the business from a cross-border point of view, and how the new GDPR rules can be adhered to for companies with multiple offices in various jurisdictions that need to pass customer data on an inter-departmental basis.

Mr Lloyd touched on how trade reporting and repository services are now a vital component of the retail FX sector, and with Cappitech’s partnership with CME Group in order to provide a holistic solution, Australia’s highly technological environment is an ideal development ground for brokers to move toward utilizing the same structure for their trade reporting as large institutions.

Sydney is a very important region for the FX industry. It is the high quality bridge between the APAC region and the West, and embodies some of the most well organized and knowledgeable companies in the world.

FinanceFeeds will see you all again in November 2019 for the next Sydney Cup FX Industry Networking Event at The Establishment.

Meanwhile, here is a full montage of this evening’s event. See you all again next year in Sydney!