Financial services companies most advanced in digital transformation, Fujitsu survey shows

Fujitsu’s survey of 900 business leaders shows 47% of financial services companies have implemented and seen outcomes of digital transformation activities over the last three years.

Fujitsu has released its Fujitsu Future Insights Global Digital Transformation Survey Report 2019, which highlights the results of its survey conducted among 900 CxOs and decision-makers at large and mid-sized companies spread across different industries in nine countries – the US, the UK, Spain, France, Germany, China, Singapore, Australia, and Japan.

The survey, conducted in February 2019, aims to evaluate the progress in digital transformation and to clarify how business leaders around the world perceive “trust”. The survey focused on topics such as progress in digital transformation, trust in online data and decisions made by AI and those by a person.

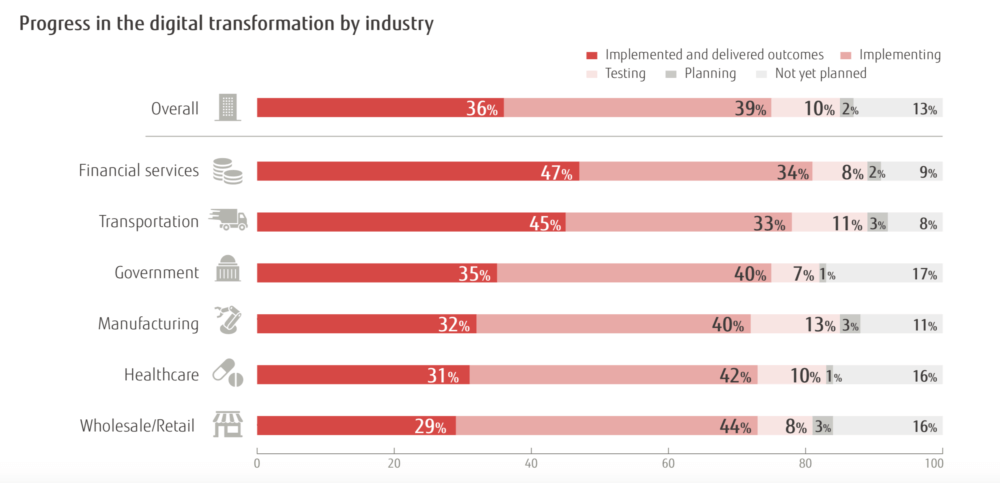

The survey indicates that financial services and transportation companies are leading digital transformation. Of the 900 respondents in 9 countries, 87% indicated that they have planned, tested, or implemented digital transformation in the last three years. By industry, financial services and transportation companies are the most advanced, with 47% of financial services companies and 45% of transportation companies responding that they have implemented and delivered outcomes. Only 13% of respondents said their companies are yet to explore digital transformation across all industries, supporting the notion that all industries are embracing digital transformation.

As one might expect, online companies have made more progress in digital transformation than non-online companies. Of the respondents from online companies, 91% are implementing digital transformation, with more than half achieving positive outcomes.

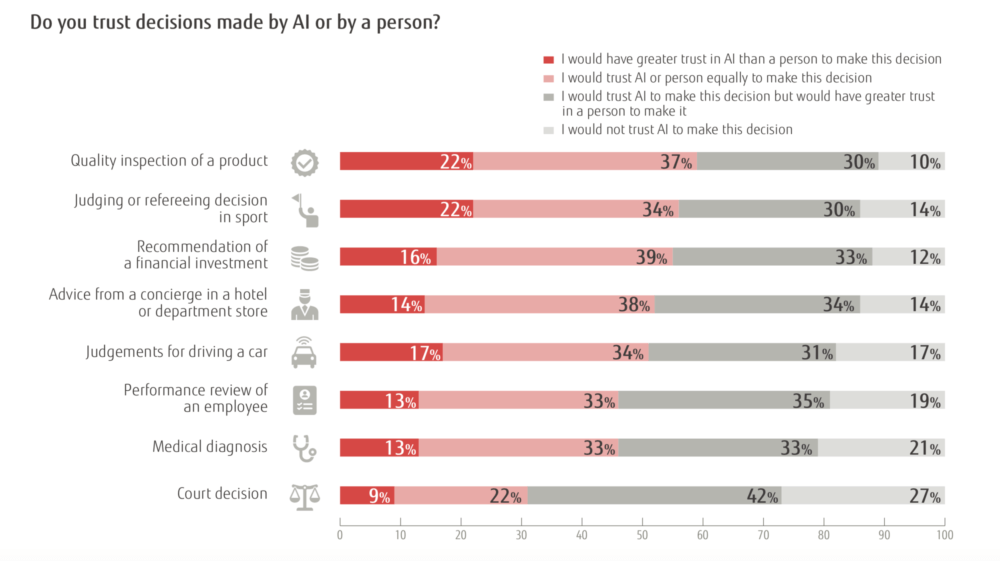

Respondents have not quite made up their mind whether they trust decisions made by AI. 60% thought that decisions made by AI are fairer than those made by people because people are subject to bias. However, 52% said they could not trust AI because the data used may be incorrect or biased. Similarly, 60% could not trust decisions made by AI on its own and preferred that the final decision be made by a person. Respondents were negative toward decisions made solely using AI.

Trusting decisions made by AI or by a person differs depending on the scenario. In the survey, Fujitsu presented eight specific scenarios and asked respondents about decisions made by AI and those made by a person. Of these scenarios, respondents had the greatest trust in AI used for a quality assessment of a product (22%) and for judging or refereeing in sport (22%).

Interestingly, 16% of the respondents would trust AI rather than a human being to recommend a financial investment, whereas 12% would not trust AI to make this decision.