FIS registers rise in revenues in Q2 2020 mainly due to Worldpay acquisition

On an organic basis, however, revenue decreased 7% compared to the prior year period, primarily due to reduced consumer spending trends.

Financial services technology provider FIS (NYSE:FIS) today reported its second quarter 2020 results.

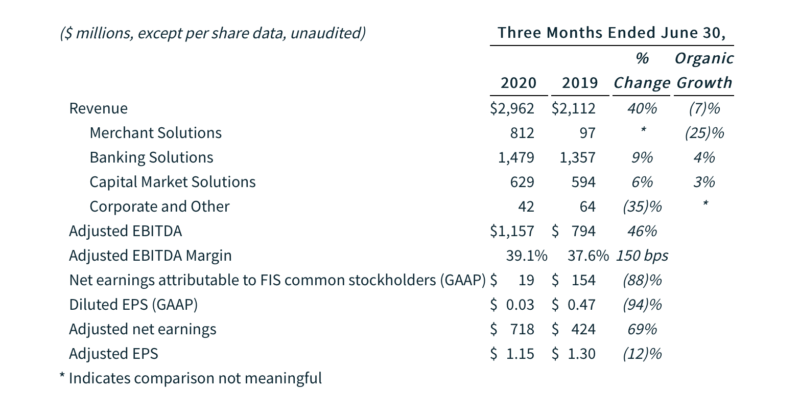

On a GAAP basis, revenue increased 40% to $2,962 million, primarily driven by the acquisition of Worldpay.

On an organic basis, revenue decreased 7% compared to the prior year period, primarily due to reduced consumer spending trends caused by shelter-in-place, lockdown orders and other impacts associated with the ongoing COVID-19 pandemic. Organic growth was also impacted by a headwind of approximately 2%, or $60 million, associated with the U.S. tax filing deadline transitioning from the second quarter to the third quarter of 2020.

Adjusted EBITDA margin expanded by 150 basis points (bps) over the prior year period to 39.1%, primarily driven by disciplined expense management as well as the acquisition of Worldpay and achievement of associated synergies.

Net earnings attributable to common stockholders amounted to $19 million, down 88% from a year earlier, or $0.03 per diluted share. Adjusted net earnings were $718 million or $1.15 per diluted share.

The company achieved annual run-rate synergies exiting the second quarter of 2020 as follows:

- Revenue synergies of approximately $115 million, including the origination of additional new bank referral agreements, debit routing benefits and Premium Payback product cross-selling wins during the second quarter.

- Expense synergies in excess of $700 million, including approximately $350 million of operational expense savings, approximately $275 million of interest expense savings and approximately $90 million of depreciation and amortization savings.

The integration of the Worldpay acquisition and achievement of associated synergies are progressing well ahead of schedule, FIS says. As a result, the company remains on track to meet or exceed its previously stated revenue and expense synergy targets for both year-end 2020 and 2022.

As of June 30, 2020, the company had $3,467 million of available liquidity, including $1,183 million of cash and cash equivalents and $2,284 million of capacity available under its revolving credit facility. Debt outstanding totaled $19,868 million with an effective weighted average interest rate of 1.7%.

Second quarter net cash provided by operating activities was $1,231 million, and free cash flow was $655 million. Additionally, FIS paid dividends of $217 million during the quarter.