Forex.com Japan starts offering trading on MT4 Web

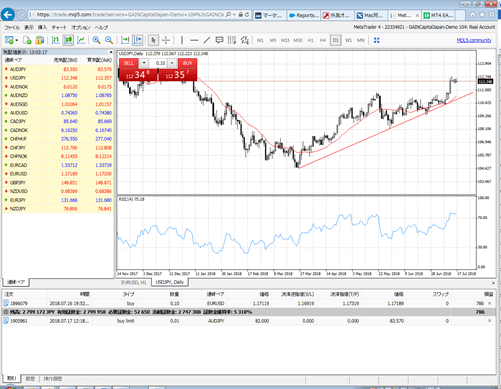

Clients of the Japanese broker can now make use of the web version of MetaTrader 4.

Clients of the Japanese business of Forex.com, the retail FX brand of Gain Capital Holdings Inc (NYSE:GCAP), now have access to MT4 Web, the company announced today.

The move apparently aims to attract larger clientele as the platform is suitable for FX beginners and experts alike. Plus, the trading system is familiar. Adding to the list of benefits is, of course, the fact that no download is necessary and that the platform is available directly from a browser.

Although there are some differences in the range of functionalities available to users of the desktop version of the platform and the users of the web version, let’s note that MT4 Web allows one-click trading, and gives access to more than 30 types of indicators. Various analytical functionalities are available too.

Although there are some differences in the range of functionalities available to users of the desktop version of the platform and the users of the web version, let’s note that MT4 Web allows one-click trading, and gives access to more than 30 types of indicators. Various analytical functionalities are available too.

FOREX.com MT4 Web does not permit the use of EAs (expert advisors). Let’s recall that in September last year, the broker sought to distance itself from EA sellers. Back then, Forex.com Japan noted that it is not responsible for any losses suffered due to the deployment of such products by its clients and that it will not respond to any complaints with relation to these products.

Forex.com Japan continues to be one of the handful of Forex brokers that offer trading on MT4 in Japan, in the face of the fact that a number of other retail FX brokers have dropped offering the platform. The most recent example in this respect comes from ArenaFX (now known as Excite One Inc), which in August last year unveiled its plans to stop offering MT4 to its clients.

Several Japanese Forex brokers, including Japan’s retail FX giant Monex Group, Inc. (TYO:8698) and YJFX, which is owned by Yahoo Japan Corporation (TYO:4689), have halted the offering of MetaTrader 4 earlier. YJFX admitted back in the fall of 2014, when it announced its plans to terminate the offer of MT4, that its decision was sudden and provided no specific reasons for the move. After abandoning MT4 in the autumn of 2014, Monex focused on the development of its proprietary platform TradeStation.