Forex Financial Services and USGFX top AFCA’s complaints list

The two firms topped the list of Forex dealers with most complaints during the period from July 1, 2019 to June 30, 2020.

The Australian Financial Complaints Authority (AFCA) has updated its Datacube which provides information about complaints received regarding members of the dispute resolution body. The latest information is for the period from July 1, 2019 to June 30, 2020.

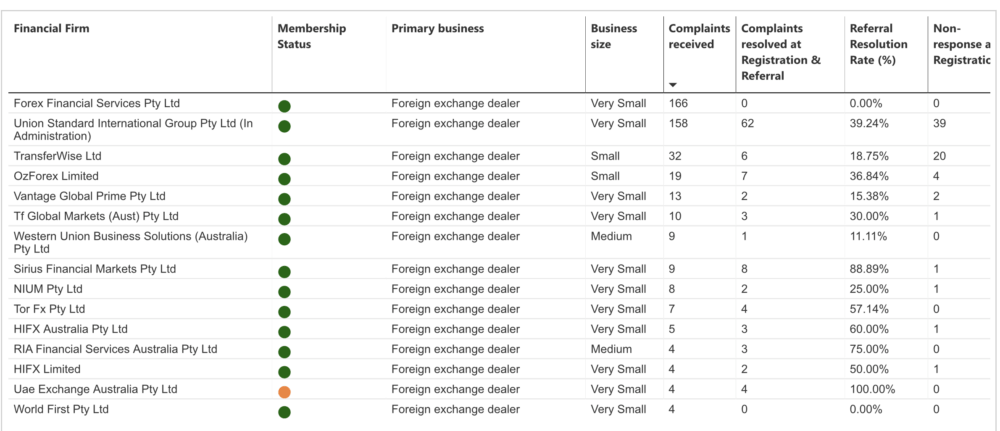

The body got a decent number of complaints regarding foreign exchange dealers, with Forex Financial Services Pty Ltd and Union Standard International Group Pty Ltd, also known as USGFX, being the two firms that triggered most of the complains. AFCA received a total of 166 complaints about Forex Financial Services Pty Ltd, and 158 about USGX.

Let’s recall that, for the period from July 1, 2019 to December 31, 2019, Forex Financial Services was at the lead among FX dealers about whom clients submitted most complaints.

Regarding USGFX, let’s note that the Australian Securities & Investments Commission (ASIC) cancelled the Australian Financial Services (AFS) licence of USGFX earlier in September. The licence was cancelled on under section 915B of the Corporations Act 2001 (Cth) (Corporations Act), the regulator explains. The cancellation was announced a couple of months after ASIC suspended the license of the broker.

Although the licence is cancelled, ASIC has used its power under section 915H of the Corporations Act to allow the liquidators to conduct certain necessary activities under the licence until 18 December 2020, including to have in place a dispute resolution scheme and arrangements for compensating retail clients, to hold professional indemnity insurance, and to allow the termination of existing arrangements with current Union Standard clients.